I hope you enjoy this blog post.

If you want us to appraise your luxury watch, painting, classic car or jewellery for a loan, click here.

Top 14 Best Classic Car Investments in 2024 (+ 4 Classic cars of the future)

Stubborn inflation, macroeconomic problems, and an underperforming stock market have left many people looking for less traditional investment opportunities. Antique car investment can provide that alternative, alongside some attractive returns.

According to the most recent Frank Knight Wealth Report, vintage cars have grown in value by a stunning 185% over the last 10 years. It’s worth noting that the S&P 500 has lower returns over the same period. Indeed, according to the Frank Knight Report, vintage cars have also outperformed art, wine, and watches since 2014.

In recent years, the market has moved from being a small group of hardcore collectors to a worldwide phenomenon. Research suggests that the value of the global classic car market will be around $44 million in 2024, up from just below $40 million in 2024.

One compelling reason why people buy classic cars that will increase in value is that their prices are not correlated to traditional assets. This fact helps investors diversify their assets and make gains even when the stock market is sluggish. So, it’s no surprise that people are looking for the best classic cars for investment in 2024.

One of the biggest appeals of antique car investments is that it’s a tangible asset that you can enjoy. While many people invest in cars and keep them in storage, others maintain their vehicles and take them out on the road. When coupled with the potential high returns, this makes investing in antique cars very appealing.

What’s more, you don’t even need to have huge sums of capital to get involved in the market. Some investment cars can be purchased for sums in the low thousands, making the pursuit open to everyone.

If you want to know what the best classic car to buy as an investment in 2024 is, this article is for you. We’ll look at some of the best historical investments alongside the most promising cars to buy for the future.

Here are the best classic cars to buy for investment in 2024

1. Mercedes SL

Price: $12,000-$13,000

Years Produced: 1980-2001

Moving into 2024, The Mercedes SL cars in the 1980-2001 time range are one of the best classic cars to buy as an investment.

As sports cars, these are hot in demand, super comfortable to drive, and a vintage classic. Mercedes is a big brand name, and in terms of classic cars with the best investment potential, the Mercedes SL is hard to beat.

This car has been on the market for over 60 years, making it one of the oldest loved classics on the market. Prices for this investment classic car have been on the rise for a while and will likely continue to spike as time goes on beyond 2024.

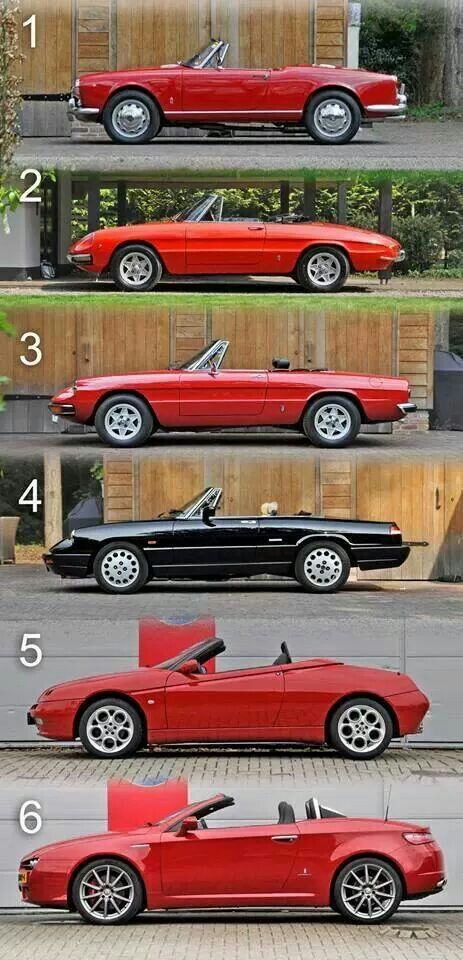

2. Alfa Romeo Spider

Price: $16,653

Years Produced: 1966-1982

One classic car that has been tipped by many experts in the industry as one of the best 2024 investment cars to buy is the Alfa Romeo Spider.

A successor to Giulia and Giulietta, the Spider first reached production lines from 1966 through to 1982. With a sleek Italian style and chassis that handles like a dream, the Spider is one of the classic cars that will appreciate over the years.

It is also a great buy if you are looking for something which you can drive and enjoy, which, as we said, is an added benefit of investing in classic cars.

The car has a sleek vintage style with Italian influence and is truly enjoyable to drive and own. The 1970 and 1973 versions of this car currently sell from $17,000 to $37,000, making them a couple of the most popular and best classic cars to buy for investment in 2024.

The 1973 Alfa Romeo Spider is especially promising, with a massive spike in sales in the last five years.

3. Toyota MR2

Price: $4,000-$14,000

Years Produced: 1984-1989

With an affordable investment price tag and sleek styling, the Toyota MR2 sports car encompasses everything we loved about 80s cars, making it an instant classic.

Manufactured from 1984 – 1989, the MR2 was extremely popular due to Toyota’s excellent reliability and engineering record.

With independent front and rear suspension, a twin-cam engine, and five-speed transmission, the sports car was a smooth ride and handled beautifully.

This Toyota model has been one of our favorites for a while, with independent front and rear suspension, a five-speed transmission, and smooth driving abilities.

With the iconic pop-up headlights, the Toyota MR2 has made the 2024 list of the best classic cars to invest in due to its dedicated following, which makes it one of the few collector cars that are sure to get snatched up as soon as it hits the market.

A rust-free 125bhp AW11 model looks to be one of the most appreciating cars in the range. Due to its low investment cost and increasing price trends, you can put a small amount of money down and rake in the big bucks later.

4. Porsche 911 and 924

Price: $97,666

Years Produced: 1965-2021

The Porsche 911 was the highest-selling classic Porsche of December 2021, and it’s only rising into 2024. Car gurus have seen this car’s price rising steadily throughout the years. It was especially one of the best investment cars in 2024.

Not only that but, as of 2024, most classic Porsche models make for the best classic car investments due to the mark’s wide range of Porsche models on the market.

Similarly, you can’t go far wrong with the iconic Porsche 924. Rolling off the production line from 1975 onwards, the 924 was always considered one of the lower-quality Porsches.

However, in recent years it has become the unsung hero in the illustrious history of the manufacturer, and the 924 is rapidly becoming one of the classic cars that will increase in investment value the most out of the Porsche portfolio.

Despite early criticism of the 924, by 1988 some 150,000 were built. They are currently relatively cheap to get hold of due to the higher number still in circulation. However, prices are steadily rising, making it an ideal investment car to buy in 2024.

The more powerful Turbo or S models are the more expensive cars from the range, but are also two of the best investment cars as prices look set to continue to rise going into 2024.

The classic Porsche 924 is also one of our favorite cars that appreciate in value due to its lower investment price, around $10,000.

If you’re looking to invest in vintage cars, we suggest the Porsche 911 from 1965-1980 or the Porsche 924 from 1975-1988. Both make excellent investment classic vehicles for 2024.

Now, let’s talk a bit more about Porsche 911 Turbo (930 Generation)

First introduced to the market in 1975, and discontinued in 1989, it was the fastest German road car of its era. No mean feat, considering the considerable automotive expertise to be found in Germany.

Prices vary wildly, not least because there are numerous different iterations of these cars that were sold during its 14 year run, but you should expect to pay at least £20,000, and even then you’re looking at a model to fix up.

This was an expensive car when it was new, and in 2024, its growing status as a classic car is driving prices up for investment purpuses; you could be facing prices upwards of £80,000 to get hold of one.

However, good condition Porsche 930s are almost certain to be going under the hammer at high-end auctions in two or three decades’ time. You also get a beautiful Porsche to ride around in while you wait for its value to increase. It’s a win-win.

5. Jaguar XJ-S

Although the Jaguar XJ-S never really lived up to its E-Type cousin – with comparisons being made from the moment it drove off the production line – people are now cottoning on to the fact that this is an extremely desirable tourer and one of the best classic cars for investment in 2024.

Manufactured from 1975 to 1996, the XJ-S is available as a coupe or convertible. Every bit of the luxury cruiser and powered by a smooth V12 engine, a well-serviced XJ-S is expected to be one of the best vintage cars and will likely increase in value over the coming years.

6. Triumph Stag

The Triumph Stag (1970 – 1977) was originally best known for its appalling reliability reputation.

However, the reliability problems are relatively easily fixed nowadays and by now most of the initial problems with the engine – cracked gaskets and poor cooling – have already been resolved on the models currently in circulation.

Being the car of choice for James Bond in ‘Diamonds are Forever’, less than 26,000 Stags were built. Powered by a powerful 3-litre V8 engine, the four-seat convertible model is bound to increase in value and has been tipped as one of the best vintage classic cars to buy as an investment in 2024.

As well as being an excellent classic car investment, you also get the joy of driving the Michelotti styled classic, feeling like Bond himself as you feel the wind in your hair.

7. BMW E24 6 Series

The BMW E24 (1976 – 1989) was the first generation of BMW’s series 6 tourers. With excellent performance, keen dynamics, and sharp steering, the luxury saloon was both stylish and brilliant to drive.

With a selection of six-cylinder engines, the BMW E24 is a great purchase if you are looking for a trustworthy workhorse to drive on a daily basis with the added benefit of being a sound investment in 2024 and beyond.

Parts should be easy to come by for the E24 should they be needed. You can enjoy the appreciating value of your investment while relishing the reliability and great build you would expect from BMW.

8. Ford Escort RS2000

Forget investing in gold or property. Ford cars are rapidly becoming the vintage car investment of choice when looking for a decent return on your money beyond 2024.

When considering which classic car to invest in, a Ford should feature high on your 2024 shortlist. Immensely fun to drive and instantly recognizable, the Ford Escort RS2000 Mk1 (1971 – 1973) tends to be rarer due to its age, but it is the Mk2 that seems to be the most appreciating car from the RS2000 range.

Not so long ago, Mk2 Escorts were two-a-penny. Rust and low values took a heavy toll on the number of cars in circulation. However, in a very short space of time, the Ford Escort RS2000 Mk2 investment in these classic cars has soared exponentially, with demand far outstripping supply.

Any car with the famous Cosworth engine is predicted to be one of the most appreciating cars in the coming years. With 10,000 punchy two-door saloons manufactured, they are not the rarest of cars, which makes picking one up slightly easier.

Be sure to choose one that has its original RS parts, making the Ford Escort RS2000 one of the best cars to buy for investment in 2024.

9. Volvo 1800 ES

Although the Volvo brand may not initially strike you as a brand that produced classic cars to invest in 2024, the 1800 ES is no ordinary Volvo.

After shooting to fame as Roger Moore’s car in ‘The Saint’, the 1800 ES is an evocative and attractive 60s sports car.

With all the reliability you would expect from Volvo, the classic coupe is currently one of the best-kept investment secrets in the classic car world. With its light controls, torquey engine, and good safety rating, the 1800 ES is great for day-to-day use as well as being one of the best classic cars to buy for investment.

As you would expect from Volvo, the car just runs and runs with little need in the way of replacement parts in comparison to other cars on the list.

10. Ford Capri

Another Ford to make the list of the top 10 classic cars to buy as an investment in 2024 is the Mk1 Ford Capri. Instantly recognizable, the punchy coupe was always destined to become a desirable classic car.

Introduced in the late 60s, and phased out in the late 80s, the Ford Capri was one of the American car manufacturer’s most desirable cars.

In 2024, the Ford Capri is a pretty appealing prospect for dealers and investors in cars; it’s already regarded as a classic car by many, but the sale price of it hasn’t been driven through the roof just yet. Don’t expect it to remain in this sweet spot for too long though, prices have risen noticeably in the past 18 months.

You should be able to pick one up for £10,000 or less but keep it in good condition and you could benefit in the future.

As one of the most appreciating cars at the moment, get in quick if you are looking to buy one of these as investment. Particularly desirable models are the 280 Brooklands and the 2.8i Special, both of which are expected to be the classic cars that will increase in value the most in the coming years, well beyond 2024.

The Mk2 Capris are also highly desirable. If you can get your hands on the Mk2 1300, you are sure to have one of the best classic car investments on the market at the moment.

However, with only eight 1.3L models on the road (as of 2017), they have become so rare you would have to be extremely lucky to get your hands on one.

11. MG MGA

Another vintage car you may want to invest in 2024 is the MG MGA, which rolled off the production line between 1955 and 1962. At its peak in 2017, this was one of the most appreciating cars, with the value of some models jumping by a staggering 47% that year.

Over 101,000 of these English classics had rolled off the production line by 1962. However, most were exported, leaving just 5,900 on the market in the UK.

Both the convertible and coupe versions of the car have proven to be excellent cars to buy for investment in 2024, steadily increasing in value over the past decade.

Although the MGA is not one of the fastest classic sports cars released, its light steering, lively performance, and sleek, beautiful appearance make it a joy to own and drive in addition to being an excellent investment.

12. Mk1 Volkswagen Golf GTI

One of the cheaper options on this list, unlikely to set you back more than £6,000, this is a bit of a no-brainer.

The Golf GTI was the second model in the popular VW Golf range, introduced as a ‘sport’ version of the highly practical Golf Mk1. First released in 1975, it was one of the first cars to successfully blend fun and practicality, and was regarded by many as the ultimate hot hatch.

At the current market rate, this slice of automobile history is a snip and will only increase in value. A must-buy car for investment and a very likely classic in the future.

13. Mk 1 Audi TT

A relatively recent car introduced to the market in 1998, and becoming a ubiquitous sight on the roads of North America and Europe in the early noughties, the Audi TT is an investment for 2024, with a sight on ROI for the future.

Unlike many of the other entries on this list, the TT is not regarded as a classic car just yet. However, its unique design aesthetic is sure to be of interest to collectors in decades to come, once it becomes a less common sight on the roads.

Typically priced between £2,000 and £8,000, this car won’t break the bank, but be prepared to hold onto it for a few years before reaping the rewards of your investment.

14. DeLorean DMC-12

If you grew up in the 80s, chances are you remember this car as the speedy time machine from the hit movie series Back to the Future. It’s this association with the wildly popular film franchise more than anything else that makes DeLorean such a classic.

If you want to add one of these cars to your investment collection, you’re going to have to pay upwards of £15,000, possibly as much as £60,000.

Beyond 2024, this car investment will be worth it though; less than 10,000 units were ever made, and production was halted in 1983. These cars are becoming harder and harder to find, at an ever-increasing cost. Get your hands on one now, and who knows how much it could be worth in 20 years.

CLASSIC CARS OF THE FUTURE

If you live long enough, you’ll see the cars of your youth become classics. As 80s and 90s models are moving into classic car territory, it’s time to ask which cars will be the antiques of the future. Some of the best cars to invest in 2024 were also made this century. While their prices are currently low, some of these vehicles could become big players in the antique game over the long term. So, what’s the best classic car to buy as an investment in 2024 with a long investment horizon?

#1. AUDI R8

The Audi R8 caused quite a stir when it was released in 2006. Between that year and 2015, about 40,000 of these beasts were released. However, if you can get your hand on one of the only 5,000 manual versions in circulation, you could multiply your investment as these durable and hardwearing supercars become classics of the future.

#2. FERRARI GTO 599

The stunning front-engine Ferrari GTO 599 came out between 2010 and 2011. It has incredible performance and comes with lots of different manufacturing options.

The Ferrari GTO 250 sold for around $70 million at auction in 2018. While the 599 is not as rare or cherished, things could change as the years pass by. As a result, we recommend the 599 as a potential future classic that could fetch incredible returns in the right condition.

#3. MERCEDES SLS AMG BLACK SERIES

Released between 2013 and 2015, the Mercedes SLS AMG Black Series has a lot going for it as an investment. Inspired by the 300 SL Gullwing and boasting a 6.2-liter V8 engine, the Black Series had a run of less than 1,000 vehicles. The sheer exclusivity of the vehicle makes it one the best investment cars in 2024 and beyond.

#4. MERCEDES G65 AMG V12

For something a bit out of the box, you should consider this limited edition SUV as a potential future classic car. With a power V12 engine and a sleek exterior, these vehicles were only on the market between 2012 and 2015. With only around 1,000 Mercedes G65 AMGs released, they will become a highly coveted vehicle in the future, which could make investing in them in 2024 a smart move.

Which vintage cars hold their value best

for investment purpuses?

The words “vintage car” and “investment” are creeping up more and more often in the classic car world, as our team of London pawnbrokers can testify.

As 2024 modern cars get bigger, uglier, and more complex, the relative simplicity and undeniable beauty of classics become even more appealing to buy for investment. But, money spent on the purchase price is never guaranteed when you decide you want to sell – so which classic cars will keep your investment money the safest?

The old standards

There are certain classics that have always been desirable.

In the world of classic Jaguar, for example, you have the venerable E-Type. The very earliest E-Types, the S1, especially with the flat floor, have always been the most desirable to collectors and investors. As such, prices vary anywhere from £130,000 for higher mileage models, to upwards of £250,000 for low-mile cars and concourse restorations. Take this example from August, 2018.

Jaguar XKSS

Classic Porsches too offer reliable car investments in 2024 – any Porsches that can draw a connection to motorsport always command a considerable premium.

For example, the 1971 Porsche Carrera RS recently began to nudge 7 figures in value. Though Porsche isn’t just about the 911; the 356 is another iconic model that rarely lowers in price.

Classic Ferraris vary dramatically in price, but the sheer name recognition of the brand means they’re almost always going to be desirable to buy for investment.

Good condition Testarossas, for example, average anywhere from £110,000 to £160,000 in right-hand drive.

The 512M, which followed the Testarossa and improved on many aspects, often reaches over £200,000. True classic Ferrari cars, however, continue to be expensive investments going into 2024 – bargain on £250,000 at least for a 250 GT in reasonable condition, and upwards of £1.5 million for a 275 GTS.

The world of classic Mercedes shows a similar disparity, with certain models showing consistency in their pricing, while others keep growing.

Many argue the 300SL is the quintessential classic car to invest in, and still fast to this day – prices reflect this, seeming stable around the £900,000 – £1.3 million mark.

Mercedes-Benz cars from their “pre-War” period, when many truly beautiful cars were made, are also consistently desirable.

On the other hand, the R107 SL series has seen marked growth over the last several years as its subtle styling and reliable mechanics become more widely appreciated.

What keeps car investment value stable?

Certain classic cars enjoy a period of rapid growth in value, followed by a comparative dip in investment value and interest. Others seem to have always been held at a certain value, and while they haven’t necessarily appreciated they haven’t lost money either.

The classic Aston Martin DB5 is an example of a car gradually losing investment value as of 2024. The DB5 enjoyed a period of consistent appreciation over a number of years. But, values have begun to fluctuate gradually. The DB5 was regularly for sale for £750,000 and above, however, a browse of a classifieds website has shown several examples closer to £500,000.

To continue with Aston Martin as an example of a car that has consistently remained around the same investment value, take the V8 Vantage. Values of the V8 Vantage have regularly remained around the £200,000 to £300,000 mark, with a special exception of the last-of-the-line “X-Pack” models commanding more of a premium. The prices rarely seem to climb, but they haven’t fallen either.

There are many things that affect the value of a car for investment on a long-term basis. One of which is how culturally relevant it is. The Aston Martin DB5, for example, will always be thought of as the James Bond car (even though in the books Bond favored a Bentley).

If you considered investing in vintage and classic cars in 2024, The Lamborghini Muira is another example – the first ten minutes of the Italian Job cemented the Muira’s place in cultural history. Combine that with it being arguably the first ‘supercar’, and in 2024, the investment value of Muiras is reliably in the £1 – £1.5 million region, rising even more for particularly rare examples.

It follows, then, that when a car becomes culturally significant, such as a classic Bugatti, its value is often far more secure than other cars which rise and fall in investment value as fashions change.

When you’re choosing the vintage car to invest in, it’s a good idea to choose a car you’re fairly confident a lot of people will recognize. This broadens the appeal when it comes time to sell.

The Allure of a Classic Sports Car

The allure of the classic sports car is a truism that seemingly goes unspoken, it is just obvious. It is often said by motoring aficionados that automobiles designed during racings ‘golden age’ – the 1930’s and 60’s, represent the absolute embodiment of speed, style, elegance and design. The golden era of automobile perfection, influenced by contemporary art, architecture, fashion and design gave us such classics as the DB5’s, MK’s as well as the 250 GT. These remain timeless artefacts of an era of splendour and luxury, even if the most customised of all was only reserved for the privileged few; your Gable’s and McQueen’s. However the spread of this market during that period has left some collectors with some now valuable vehicles.

Classic car culture is well and truly alive up and down the country as well as the capital. From Firle Vintage Summer Fair to Southbank’s Classic Car Boot Sale the love for the classic car, like anything vintage, and removed from contemporary mass production, is blooming and beloved.

Restauration of Classic cars plays a

part in investment decisions

Dealerships worldwide boast an impressive range of serviced cars brought back to their former glory. Here is a selection of our personal favourites:

Ferrari 355 F1 Spider

Austin Healey 3000 MK111

Alfa Romeo Giulia Super

Mercedes 190SL

But when it comes to influential classics, iconic models resonate with people and that was certainly the case when the Telegraph decided to find out which vehicles resonated with famous faces from the big and small screens, titled ‘Stars and Classic Cars’. Top Gear presenter at the time, James May, awarded the tribute to The Corgi Aston Martin DB5 as a car that inspired him – and numerous others – when they were youngsters.

The allure of a classic sports car seams to never fade we think as we browse a 1935 Aston Martin MK2 with a long chassis – coming from Landmark Cars – being renewed with a fierce red lacquer bringing them into the modern age as seen below.

The Jaguar XKSS

(Picture Jeremy Selwyn)

There are many examples of classic cars rising exponentially in value and this is exactly what’s happened to the exceptionally rare Jaguar XKSS, only one of 16 ever made.

The XKSS was made in Coventry during 1957 and unfortunately spent a large portion of its life rusting away in a Cuban pound after an accident during a supercar race on the island. It miraculously survived the whole of the Castro regime before JD Classics bought the vehicle in 2010. Four years later and the results of labouring over its restoration are clear to see.

The car is said to reach a top speed of 180mp. Some famous drivers have included Steve McQueen and Ralph Lauren. Apparently 16 were finished before an infamous fire at the plant in 1957, destroying the remaining 9, one of the many reasons for this car being so rare.

The restoration of classic cars sourced from the rarest of locations is still a process of careful sourcing. But this market that can be hugely satisfying as well as lucrative, and will have a large weighting in teh investment value of your classic car.

The War in Ukraine and Its Impact on the Classic Car Market

2024 continues to be a year of significant upheaval. What should have been 12 months dedicated to recovering from what may have been the worst of the pandemic has birthed an unprecedented tragedy.

On February 24th, 2022, Russia invaded Ukraine at the cusp of its admittance into the North American Treaty Organisation (NATO). This was a major escalation in the Russo-Ukrainian War that has been ongoing since 2014.

Global efforts to de-escalate the situation in Ukraine have not been much of a deterrence to Russia’s invading army. Despite the unpopularity of the move among UN members, Russian president Vladimir Putin has mandated the nation’s military forces continue their advance on Ukraine.

Ukrainians have doubled down on their opposition, and thanks to assistance from its allies, they have been able to hold their own and even push back against Russian invaders.

It should be noted that this blog does not hope to predict what may come of the conflict. We are discussing the best classic cars for investment in 2024 and only cars, bearing in mind that whatever economic downturn the industry suffers pales in comparison to the loss of human life on the ground in Ukraine.

With this established, let us delve into what the Russo-Ukrainian War means for classic car investments in 2024.

Predictions for Classic Car Investments During Wartime

Since you are reading this blog, you are likely curious. Some predictions made by Hagerty Insider, a company that specializes in covering car collector’s analytics, were sourced to help elucidate what issues investors and collectors of classic cars are up against as a result of the fighting.

The broad scale of economic slowdowns has significantly contributed to rising gas prices. This spike is due to the sanctions put in place upon various Russian imports, including oil, by many countries such as the United States.

Inflation, as a direct result of these economic sanctions, is soaring, according to experts on the subject. Moreover, it is unlikely this trend will cease any time soon, either.

Additionally, international transportation, which the pandemic had already strained, has not had enough time to recuperate its losses and may not yet find a reprieve.

As Western European nations gear up for what could become a widespread conflict, shipping vintage cars falls to the wayside in terms of priority. At this time, people may even feel guilty about ordering or investing in vintage cars.

Best Classic Car Values in 2024 (Russo-Ukrainian War Era)

Be aware that most people, both in the US and UK, favour the economic sanctions placed on Russia despite the inflated gas prices.

Your vintage investment vehicles may be more expensive to drive this summer. Still, it is generally agreed upon that this is preferable to the active support of a return to the conqueror’s agenda showcased by the Russian government.

While it may hinder collectors from purchasing classic German Porsches and Mercedes, brands like Cadillac and Tesla will see a surge of interest from their American connoisseurs. Therefore, local buying, selling, and trading may take the spotlight for 2024.

If you are a fan of classic cars like ‘66-’67 Pontiac GTO (retailing at $74,000) or the ‘65-’70 Cadillac DeVille Convertible (priced around $35,200), then 2024 may very well be your year!

Check out online sales, attend some silent auctions, or ride the wave of the contactless era that has transformed the market following the pandemic. Remember to stay safe and adhere to CDC guidelines as news about the BA.5 variant breaks, and be on the lookout for information regarding the Ukrainian front.

Being knowledgeable at a time like this is the best thing you can do to be both a responsible investor and a responsible human when looking for the best classic cars to buy in 2024.

How do you keep a car valuable?

Whether you are a classic car owner or investor, there’s no doubt you’re subject to market whim when it comes to the value of your pride and joy – sometimes values slip for seemingly no reason.

That doesn’t mean, however, that you’re completely out of control when it comes to keeping your car as valuable as possible…there are several things you may do to protect your classic car investment.

The best thing you can do for your car’s value is to keep it in the best possible condition you can. Apply the same stringent standards you used when buying the car, and put yourself in the place of a potential buyer. Would you have paid your asking price for your car, in its current condition? If the answer is no, you can’t reasonably expect to sell your car for a profit, or to at least break even.

Excellent mechanical condition is essential if you’re going to get the best ROI on your classic car. Your car needs to be able to start “on the button” unless you intend specifically to sell it as a project.

As time goes on, consider sympathetic mechanical upgrades to keep the vehicle working as reliably as possible. This may include an upgraded radiator, cooling, and depending on the car, maybe an electronic ignition system. Money spent on improving your brakes is also never wasted.

Exterior and interior condition are also highly important, but a bit more complex to get right.

The factor that drives the highest investment prices on the collector market is originality. It stands to reason that cars are only original once, and the more time and owners that pass, the greater the odds of somebody making major alterations that can’t be reversed. Adding seatbelts and subtle air-conditioning isn’t likely to deter most buyers, but there is certainly a market appeal for the most originality possible.

As a quick sum up of some of the best investment cars in 2024, you can also watch our video below:

Be realistic when considering your choice of the best classic car to buy for investment in 2024

It’s important that you invest in the right vintage car for you. Before investing in classic cars, spend some time thinking about how you’re going to use the vehicle, aside from the obvious considerations about your budget and storage options.

If, for example, you want a car to drive regularly, you should avoid low-mileage cars. Low-mileage cars are worth more, and every mile you put on them is money you’re taking off the asking price at the other end of your ownership.

Also, keep in mind that money spent on your classic car purchase is just the beginning of your 2024 investment. Cars take maintenance to keep running, and this is certainly true of classics. The rarer and more exotic the classic, the higher your maintenance bills are going to be, which you’ll have to factor into your ultimate asking price to determine any profit.

It’s a sound strategy when you’ve decided on the car you want to buy as an investment to do some homework. See what the maintenance is actually going to be like, and make contact with the owners if you can. See if there are any common problem points you might have to be aware of.

New Bond Street Pawnbrokers offer loans against the following classic cars: Aston Martin, Bugatti, Ferrari, Jaguar, Mercedes, and Porsche

This post is also available in:

Français (French)

Deutsch (German)

Italiano (Italian)

Português (Portuguese (Portugal))

Español (Spanish)

Български (Bulgarian)

简体中文 (Chinese (Simplified))

繁體中文 (Chinese (Traditional))

hrvatski (Croatian)

Čeština (Czech)

Dansk (Danish)

Nederlands (Dutch)

हिन्दी (Hindi)

Magyar (Hungarian)

Latviešu (Latvian)

polski (Polish)

Português (Portuguese (Brazil))

Română (Romanian)

Русский (Russian)

Slovenčina (Slovak)

Slovenščina (Slovenian)

Svenska (Swedish)

Türkçe (Turkish)

Українська (Ukrainian)

Albanian

Հայերեն (Armenian)

Eesti (Estonian)

Suomi (Finnish)

Ελληνικά (Greek)

Íslenska (Icelandic)

Indonesia (Indonesian)

日本語 (Japanese)

한국어 (Korean)

Lietuvių (Lithuanian)

Norsk bokmål (Norwegian Bokmål)

српски (Serbian)

Tamil

The original Tesla Roadster (2008-2012) is likely going to be a very collectible car someday, especially if only electric cars are allowed on the road eventually.

A most informative article and – as an Xj-S owner / enthusiast, – just terrific to see this fine car receiving the praise it so deserves.

Long live the classic car market – a different and enjoyable financial recreation away from stocks and shares!

Kind regards.

Peter