I hope you enjoy this blog post.

If you want us to appraise your luxury watch, painting, classic car or jewellery for a loan, click here.

The Market for Fine Watches in 2024 – Have Luxury Watches Lost Their Shine?

The last five years in the luxury watch market have been a rollercoaster ride. In early 2022, the market hit record highs. However, by the end of that same year, it hit a slump from which it has yet to recover.

So, what does the future hold for investors and collectors of fine watches? Is it time to buy the dip or dip out of the market altogether?

Market for watches : Snapshot

According to market analysis, the global luxury watch market is worth around $50 billion. It has a healthy CAGR of almost 5%, leading experts to predict a market size of almost $75 billion by 2032.

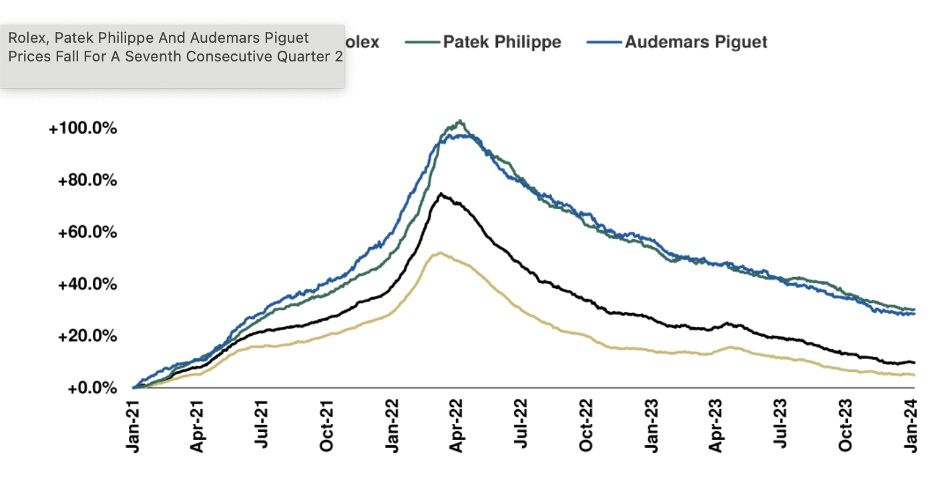

The secondary luxury watch market, where buyers and sellers trade rare and vintage timepieces, is currently about half the size of the regular market. However, it’s growing in stature.

LuxeConsult, a Swiss advisory firm specializing in the watch market, released an industry report suggesting the pre-owned market is closing the gap fast. They predict that by 2033, the secondary market will be worth almost $80 billion.

Source: LuxeConsult (2023)

The same report suggests that growth would be sluggish throughout 2023 before leaping to 10% during 2024. But what is driving these predictions? Let’s take a further look.

Fine watch market analysis for 2024

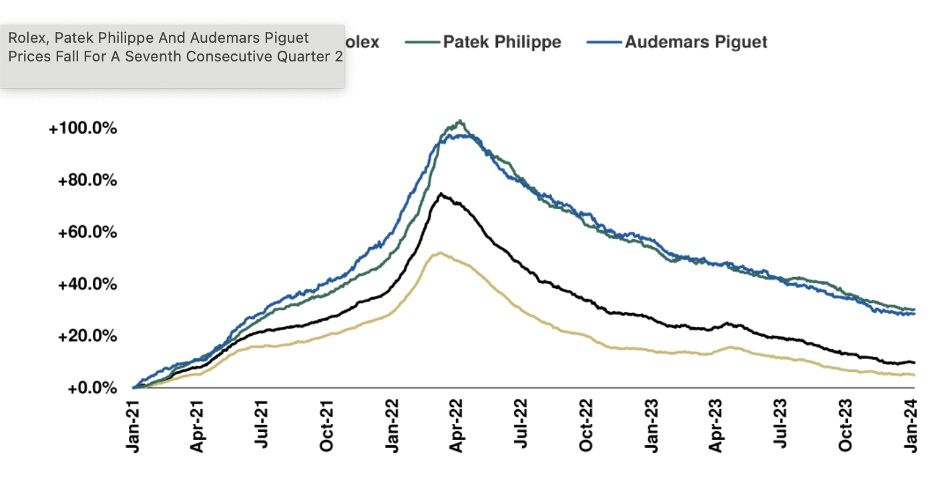

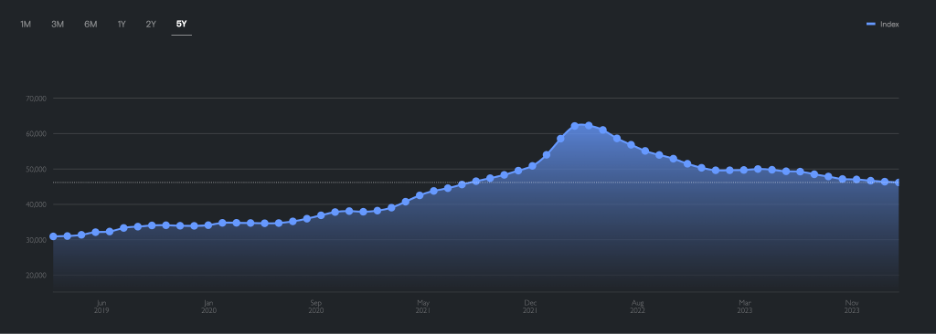

Late last year, Joseph Wilkens stated in Business Insider that “The great Rolex recession is here.” Citing the WatchCharts market index, he noted that the market had declined 37% since its March 2022 peak. Wilkens also noted a sharp decline of 31% for Rolex watches over the same period.

However, since the “Rolex recession” was called, the market has stabilized.

Going into 2024, the market is on a knife-edge. The big question on investors’ lips is, have we found the bottom? So, let’s explore what factors will affect the market.

# Driving forces behind the luxury watch market in 2024

Let’s examine some factors affecting the fine watch market in 2024 and beyond.

1. Interest rate rises

Perhaps the biggest force behind the decline of the luxury watch market has been the attempts by central banks across the Western world to dampen inflation. As the Bank of England and the Fed introduced a series of interest rate hikes, analysts worried that their approach lacked finesse.

While these monetary policy maneuvers have yet to really hurt the broader economy or stock market, they have had an effect on pre-owned luxury watches. Accessing credit has become harder and costlier, which has hit demand for luxury timepieces.

2. Crypto collapse

Cryptocurrencies were one market sector that was hit hard by rate rises. The famously volatile industry has had a tough few years, with many of its leading lights finding themselves behind bars due to widespread corruption, market manipulation, insider trading, and more.

The Terra Luna collapse caused a ripple effect across the industry. Major players collapsed amid a level of contagion and fraudulent accounting that made the 2008 financial crisis look sane.

However, in the lead-up to these events, cryptocurrency had risen dramatically, and some long-term holders became new luxury investors.

As Chrono24 reported shortly after the dramatic collapse in various digital currencies, the luxury watch market was flooded with rare and expensive timepieces as investors sought to liquidate assets to cover their losses.

However, in the last six months, crypto has rebounded. At the time of writing, the market is close to its November 2021 record peak of $64,000. Investors who have been through the “crypto winter” of the last few years might well feel that they have something to celebrate. The return of crypto fortunes could see the supply side of pre-owned luxury watches get a little lighter.

3. Supply

Another thing we have to talk about is supply. During COVID-19, the supply of new watches contracted. Stay-at-home orders saw factory output restricted, while supply-chain problems hurt the flow of raw materials. As investors’ appetite for luxury goods shot up due to stimulus payments and savings from travel restrictions, luxury watches became a viable asset class.

The production slowdowns have been felt on the market. In turn, they have led to waiting lists getting longer, with prospective buyers being required to jump through more hoops to secure a coveted piece from their local authorized dealer (AD).

So, while the overall markets — both primary and secondary — have been hit by a decline in recent years, pre-owned luxury pieces are still going for well in excess of retail price. This fact can tell us a lot about the solid demand that exists for luxury watches despite the bleak headlines for 2023.

4. Market expansion from big players

Another sign of the overall sentiment in the secondary market is the establishment of the 1916 Group. WatchBox, a US retailer backed by Micheal Jordan and Bill Ackerman, announced sales of around $400 million in 2022. Late last year, they purchased Govberg, Hyde Park Jewelers, and Radcliffe Jewelers and announced they would become part of the Rolex Certified Pre-Owned watches program.

Clearly, the 1916 Group sees great value in the pre-owned space to commit to this deal during a time of uncertainty in the secondary market and the broader economy.

It’s not the only big announcement from a secondary retailer. In July last year, Chrono 24, which is a market for luxury watches, announced that football icon Cristiano Ronaldo had invested in their business.

The Portuguese star is one of the world’s highest-paid and most recognizable athletes. While the exact amount that he put into Chrono24 is unknown, it’s thought to be a significant sum that represents his interest in luxury timepieces, of which it is said he has a collection worth over $10 million.

Both these investments point to long-term confidence about the future of the industry.

5. Shifting buyer demographics

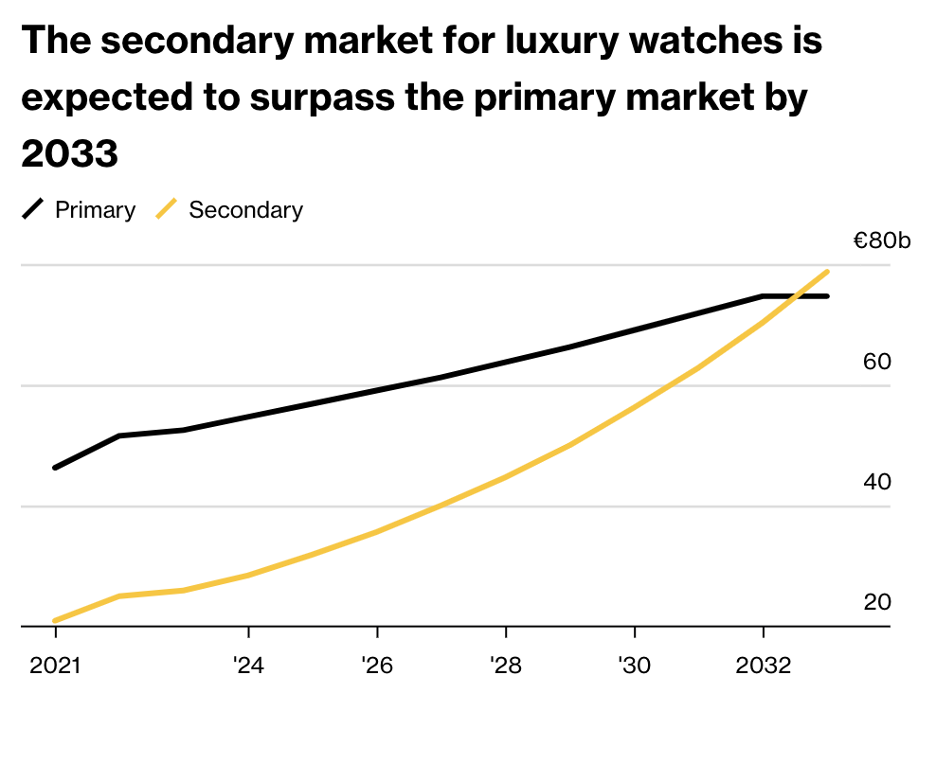

While Deloitte may not be as bullish as LuxeConsult about the future of the secondary luxury watch market, they’re not too far off. In a wide-ranging report, the professional service firm suggests they see the market growing by around 75% by 2030, fuelled by a shift in both buyer behavior and demographics.

These shifting demographics are one of the surest signs of a rosy future for the secondary market. However, there is a bit to unpack here.

Firstly, we have to acknowledge that there is a broader market appeal towards sustainability from younger generations. Topics like the Circular Economy and ethical manufacturing are big topics for Millennials and Generation Z, which has stiffened the market for pre-owned goods of every kind.

Now, a big part of the boom of pre-loved goods comes down to affordability. However, that dynamic is not explicitly present in the luxury watch market. Yes, the price points that collectors were prepared to meet during the heady days of 2022 may have dropped, but we are still talking about an asset that has had a huge five-year return of over 40%.

When it comes to luxury watches, these generations are driven by something a little different. In their increasingly digital world and the modulating values that entail, younger generations are attracted to the authenticity, history, and permanence of luxury watches.

Source: Deloitte research

Per Deloitte data above, Millennials and Gen Z are much more likely to buy a pre-owned watch than previous generations. In fact, Millennials are a staggering four times more likely to buy a watch on the secondary market than the Baby Boomer generation.

Of course, we should note that while willingness to engage with the pre-owned market is a bullish sign for watch investors, not all products available on the secondary market are pre-owned. Many pieces on the secondary market are new watches that are flipped after purchase from an authorized dealer. Many more are held in their original box, unworn, so that prices can steadily climb.

Finally, data from Phillips Auctioneers backs up this thesis. Between 2019 and 2023, registered paddles at watch auctions grew 70 percent. What’s more, the average age of buyers dropped in that period from 57 to 50 years of age. The market is changing.

6. New classics

Another luxury watch trend that has been observed over the last few years and is set to make a big impact is the general broadening of the market. For years, sports watches from big brands like Rolex were seen as the be-all and end-all of the market. However, as different people and communities are entering the luxury watch market, that diversity is being reflected in taste.

While historic performers like a Patek Philippe or limited-run Rolex will always hold their value, smaller watches, Art Deco-inspired pieces, and even some non-Swiss brands are gaining a foothold in the market. Rarity, provenance, and watches with a history and a great story will be big through 2024.

7. Muted primary market

Loupe This founder, Eric Ku, spoke to Robb Report and suggested that 2024 would be “a muted year for new releases.” He cited the current economic situation and cautioned against seeing anything too revolutionary. Ku suggests that new releases will involve slight modulations on classics, including new dials and cases or some interesting materials.

If Ku is correct in his theory that premium watchmakers are set to use 2024 to catch their collective breath, this could create an opportunity for rare, innovative, or unusually designed watches on the secondary market. If the new watch market doesn’t provide a steady stream of standout pieces, collectors will need to dig into the past to slake their thirst for remarkable watches.

8. Value retention despite slower inventory

During 2021, a flipper market took hold in the watch industry. The growing interest in luxury watches during a time when supply was tight and inventory was lean led to astronomical prices. That market is all but over, except in instances when consumers get a watch on a waitlist and flip to another consumer.

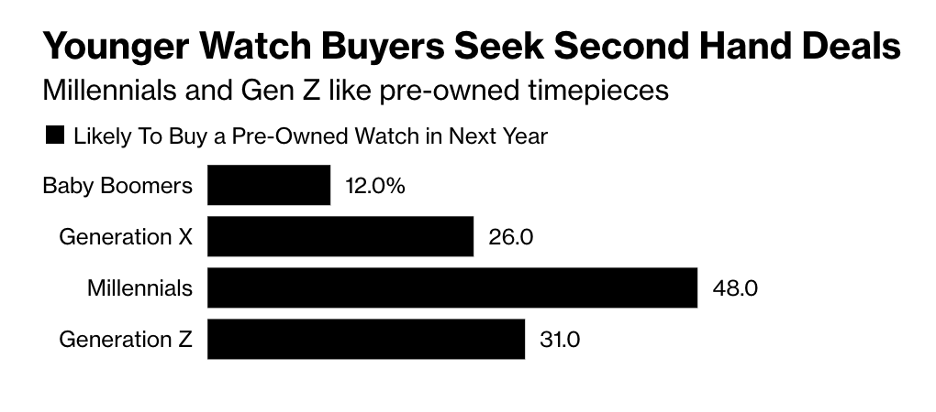

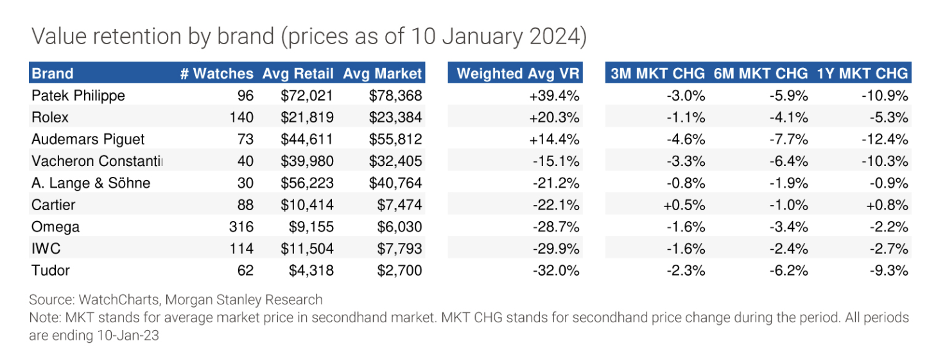

Here is the decline in prices seen for these big brands.

However, what is interesting to note from the report is that the majority of these brand’s watches are still selling for over retail prices. If you go by models, Rolex (68%), Audemars Piguet (66%), and Patek Philippe (48%) are still commanding a profit.

More intriguingly, value retention is still a feature of the market despite price declines.

Remember, this resilience is happening in what is definitely a bear market. Despite high inventory levels, investors who are stuck with pieces aren’t getting desperate and selling at giveaway prices.

While the broader market has declined, it’s still up from 2021 levels. However, when it comes to selling a watch, you’ll still need to be patient. But judging from this data, people know what they have and understand its value. The market could represent a good opportunity for new investors to enter at a bargain price.

9. China

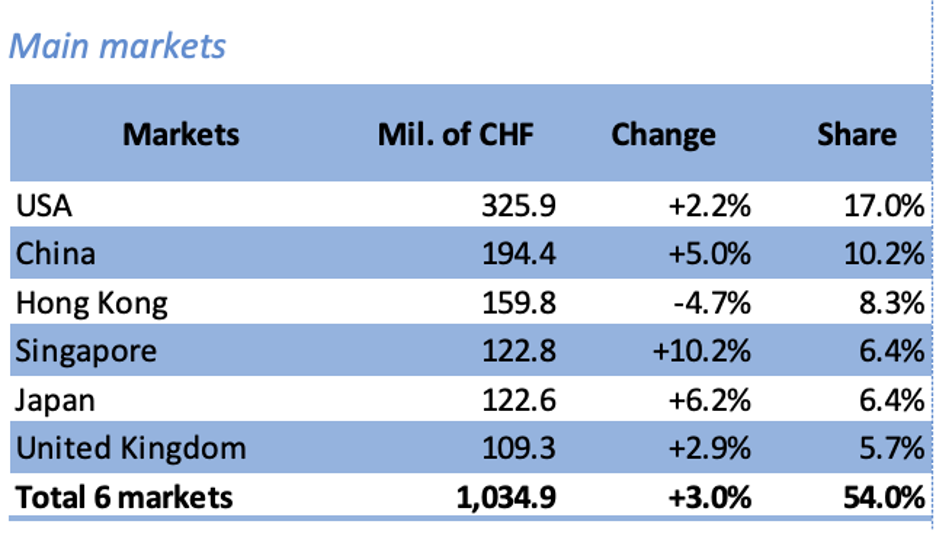

Source: Federation of the Swiss Watch Industry (FH)

The Federation of the Swiss Watch Industry’s statistics for January 2024 make for some interesting reading. While the US is the biggest individual market for Swiss watch exports, when China and Hong Kong are combined, they account for a bigger share of imports.

Considering the sheer size of the market, investors will be keeping an eye on the Red Dragon’s economic recovery throughout 2024.

While China’s Swiss watch imports grew 5% this January, it’s hard to argue that the country has recovered from its economic turmoil. A large reason for sluggish growth in China is Beijing’s “zero-COVID” policy that kept the country in three years of on-off lockdowns. During 2023 – a year that the IMF said the Chinese economy would grow by 5% — the property market collapsed, unemployment grew, and internal demand for goods declined.

An excellent article by the economist Adrian Blundell-Wignall in the Financial Review makes a compelling argument that we should temper our hopes about a Chinese bounceback. If he’s correct, the global watch market, both primary and secondary, will lose out on a key component of demand.

Despite pessimistic news about growth in China, other Asian markets are bouncing back. APAC darling Singapore has grown by +1, and a growing middle class in India is fuelling interest in watches, with brands like Omega and Breitling seeing a 20% to 30% boost in the South Asian powerhouse.

In short, while China is a hugely significant market, it won’t need to do all the heavy lifting in 2024 and beyond.

A great watch market recession or just a normal correction?

Many people will look at market data and despair at the loss of value over the last five years. However, zoom out, and you see a different picture of the pre and post-COVID luxury watch market.

This dynamic is easily demonstrated by looking at the five-year average price of the Rolex 50 from Wrist Check data.

As we’ve highlighted in an earlier section, between half and two-thirds of models from Patek Philippe, Rolex, and Audemars Piguet are holding firm, which is especially true for older vintage timepieces from these legendary brands.

COVID was a perfect storm. Watch production dropped, people had spare income because they couldn’t go on holidays or to restaurants, and a bigger portion of the public woke up to watches as an investment class. As lockdown measures and supply chain problems hit production, these rare watches became even rarer.

The big takeaway here is that the market is moving from a “recession” into a period of low growth or stagnation. While the highs of early 2022 might not be on the table across the board, there are plenty of reasons to hold on to these wonderful assets.

Why you should pawn rather than

sell your watch in 2024

David Sonnenthal – Director Of New Bond Street Pawnbrokers

Owning a vintage Patek Phillipe or a limited edition Rolex Daytona has many perks. They’re stylish, timeless, and a powerful status symbol. However, luxury timepieces are also more than just a watch. They are a financial asset and, in many cases, legitimate artworks on both a mechanical and aesthetic level. However, more than that, a luxury watch is a piece of history.

A big reason why vintage watches hold or increase in value is because they tell a story. The story is about craftsmanship, the timepiece’s previous owners, and the history of horology. As things change and evolve around us, fine watches stay the same. Many pieces are handed down through generations and serve as a reminder of the past just as much as a technology that helps us tell the time.

In light of this, it can sometimes seem a little pointless to fret about how macroeconomic conditions affect the price of a watch. Many of these pieces have been around longer than we all have. They’ve been through wars, recessions, and seismic social events, weathering them all and maintaining or rising in price.

We all experience times in our lives when we need a cash injection. If you own a luxury watch, liquidating it can help you free up some capital. However, when we look at the current financial climate and the market for luxury watches in particular, selling might not be the optimal situation.

Here is why pawning your watch beats selling it in 2024.

1. The suppressed luxury watch market of 2024

As we’ve demonstrated above, the secondary watch market is in a very particular place. Prices have declined significantly since the 2022 peak, but the market has somewhat stabilized since then.

In the view of many experts, we may have found the bottom of the market. The big question for people holding a fine watch is whether this is the optimal time to sell.

Now, there are a few ways we can look at this. If you’re under pressure to liquidate an asset, you don’t get to choose what market you are selling into. Timing is everything, after all.

However, now that the market has stabilized, 2024 could be a good year. Anyone holding a luxury watch that sells in this market might look back on their decision in a few years’ time with major regret. Of course, that regret won’t just be limited to the prospect of lost gains. It could also be sadness about selling an asset that isn’t easily replaced on an emotional level.

Pawning your luxury watch offers a credible alternative. History tells us that luxury watches will hold or increase in value. Pawning your watch means that you can still ride the wave of appreciating value and get maximum returns if you do eventually decide to sell.

2. Retain your asset

Pawning your watch means you get to retain your asset. This advantage is particularly pertinent if your watch holds great sentimental value. Selling a watch that was a gift from a partner, an inheritance, or something you bought to celebrate some milestone is not easy.

Leveraging a loan against a valuable item doesn’t need to involve losing ownership. It also keeps you in the game for when your asset appreciates, allowing you to think about the future.

3. Seamless process

Selling a luxury watch in the current market is a long process. You could put your watch up for sale, but finding a buyer at a good price could take weeks, months, or even longer in a market with reduced liquidity.

Of course, if you’re selling a luxury watch, there are many avenues you can consider. For example, there are lots of dealers who operate on consignment. The issue here is that you eat into your sale price at a time when the market is already a bit cold.

These issues and more are part of the reason that many people prefer to use a pawnbroker when they want to leverage their luxury watch for cash.

The process is discrete and painless, and if you use a high-end shop like New Bond Street Pawnbrokers, you’ll get a quick decision and transfer of funds. Then, when your finances improve, you can come and get your watch, which may have appreciated in value by the time you collect.

Final thoughts

Luxury watches are a durable asset, even in challenging market conditions. While the headlines might suggest a market in decline, what is really happening is a correction from the frothy heights of 2022.

The interest, allure, and history are still there, and models that encapsulate those qualities aren’t going anywhere. Selling could be a mistake, especially when you can instead take a loan against your timepiece if needed and sit back while it appreciates.

Pawn or sell?

Some of the big questions we put under the microscope include:

- Will the latest crypto bull run inflate the market?

- Is the luxury watch market’s fate tied to China’s economic recovery?

- Will the forecasted interest rate cuts for 2024 lead to a rise in luxury watch prices?

This post is also available in:

Français (French)

Deutsch (German)

Italiano (Italian)

Português (Portuguese (Portugal))

Español (Spanish)

Български (Bulgarian)

简体中文 (Chinese (Simplified))

繁體中文 (Chinese (Traditional))

hrvatski (Croatian)

Čeština (Czech)

Dansk (Danish)

Nederlands (Dutch)

हिन्दी (Hindi)

Magyar (Hungarian)

Latviešu (Latvian)

polski (Polish)

Português (Portuguese (Brazil))

Română (Romanian)

Русский (Russian)

Slovenčina (Slovak)

Slovenščina (Slovenian)

Svenska (Swedish)

Türkçe (Turkish)

Українська (Ukrainian)

Albanian

Հայերեն (Armenian)

Eesti (Estonian)

Suomi (Finnish)

Ελληνικά (Greek)

Íslenska (Icelandic)

Indonesia (Indonesian)

日本語 (Japanese)

한국어 (Korean)

Lietuvių (Lithuanian)

Norsk bokmål (Norwegian Bokmål)

српски (Serbian)

Tamil

Be the first to add a comment!