I hope you enjoy this blog post.

If you want us to appraise your luxury watch, painting, classic car or jewellery for a loan, click here.

Fine Watches – Top 13 Brands You Should Consider Investing in 2024

Ever wondered what are the Best Investment Watches in 2024?

There is nothing quite like the quality and craftsmanship of a luxury mechanical watch, as our watch experts at New Bond Street Pawnbrokers well know. Wearing a brand such as Audemars Piguet or Patek Philippe makes a statement about who you are. But while many people view luxury watches as expensive accessories, the smart buyer knows that the right watch can also serve as a lucrative investment.

Many limited-edition or specialty watches can double or even treble in value once production ceases, making them some of the best watches to collect for investment in 2024. The trick is knowing which of the thousands of quality timepieces produced each year are the ones most likely to increase in value.

In this blog, we’ll take a look at the manufacturers and models which represent the best investment opportunity going forward.

THE LUXURY WATCH INVESTMENT MARKET IN 2024

Luxury watch investment is both a passion and a hobby. Most of the world’s collectors have a deep appreciation for the intricate craftsmanship, style, and, in many cases, the history of luxury watches.

Wristwatch investment requires knowledge of a few different things. For starters, you need to know the watch brands that hold value. Secondly, you must understand which specific models can bring returns. Finally, you need to stay on top of the market trends that drive prices.

So, before we share the watches that are good investments, we must explore the market in 2024 so you can time your entry and exit for maximum profit.

Wristwatch investment market analysis

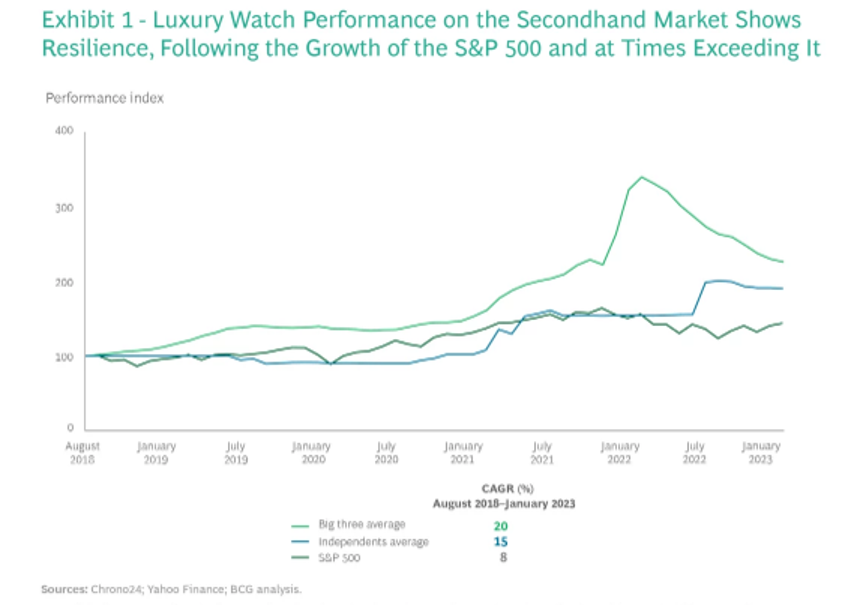

The global luxury watch market is worth almost $50 billion. With a healthy CAGR of around 5%, business analysts suggest that the market could be worth around $75 billion by 2032.

However, 2023 was a tough year, with only some watches appreciating in value and many more dropping in price. However, these declines are the result of a market correction rather than an indication that people are falling out of love with luxury timepieces.

Prices escalated during COVID-19 for a number of reasons, including access to bountiful amounts of capital, lockdowns that curtailed discretionary spending, and demand for luxury watches that far outstripped demand and pushed prices to incredible levels.

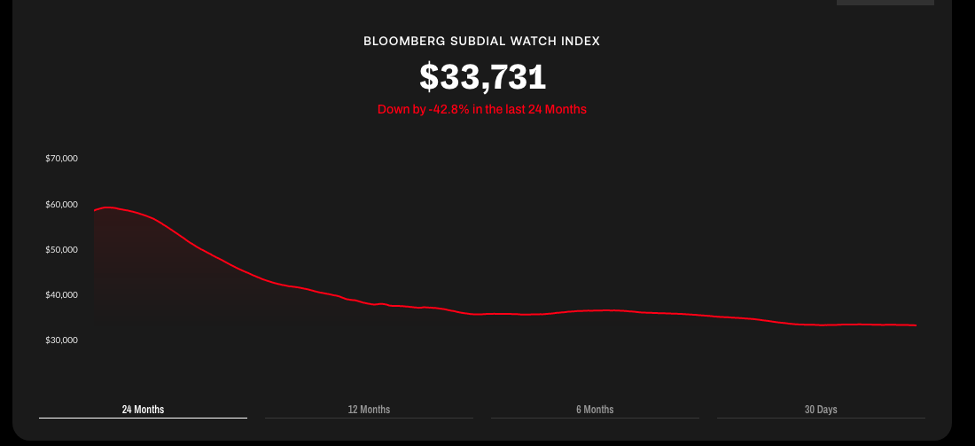

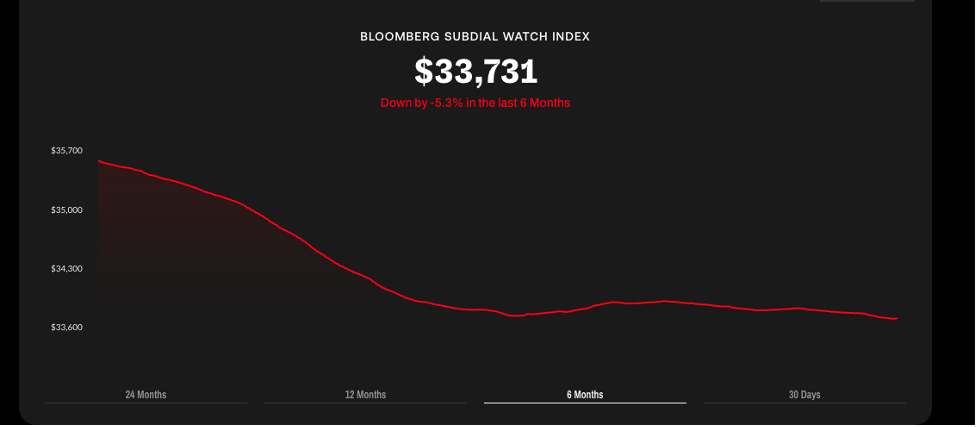

The ascent was unprecedented. So, too, was the correction. According to the Bloomberg Subial Market Index, which tracks “the 50 most traded luxury watches on the secondary market by transaction value,” the market declined by 48% in 24 months.

However, between February 2023 and February 2024, those losses were about 7% and have been slowing down since. It seems that the market has bottomed out, which is good news for anyone considering investing in wristwatches in 2024.

Of course, investors must consider the bounce back between all watch brands has not occurred at the same rate. Succes in 2024 requires riguring out the best watches to buy for investment requires diving deep into individual brands and particular models.

INVESTING IN WRISTWATCHES: THREE REASONS

TO BE CHEERFUL IN 2024

After a chilly 2023 market where many investors who were overexposed to luxury watches went to the wall, there are genuine signs of positivity in the market. Let’s take a look at the reasons to be positive in 2024.

1. SENTIMENT ABOUT THE BEST WATCHES TO INVEST IN IS EVOLVING

In a fascinating interview in the New Yorker Magazine, Austen Chu, founder and chief executive of Wristcheck, suggests that:

“The shift in sentiment has been very clear in terms of what people want to buy. Last year, we were basically just selling Rolex, Audemars Piguet (A.P.), Patek Philippe. And out of those brands, it was just the hot models — the Submariners, the Daytonas, the Royal Oaks, the Nautiluses, the Aquanauts — as well as Richard Milles and hot F.P. Journes.”

Chu points out that Omega and Cartier watches are now doing well, redefining the watch brands that hold value in 2024.

2. ASIA WILL BE A MAJOR PLAYER IN 2024

The Evergrande collapse and property crisis in China in 2023 caused alarm for the broader market. Watch investors must monitor the situation carefully because Mainland China and Hong Kong have become the world’s biggest importers of Swiss watches, buying in well over $5 billion in timepieces from the region last year.

While the US is not too far behind, Mainland China and Hong Kong combined have exhibited growth of around 25%. However, Deloittes Karine Szegedi posits that market turmoil could increase luxury watch investments in the region as high-net-worth investors look for alternative portfolio assets.

The Deloitte Swiss Watch Industry Study surveyed 75 senior executives in the watch industry. Opinion on China is on a knife edge, with 50% of executives suggesting it will be a positive year in the region. Much will depend on the broader macroeconomic situation in the area.

Interestingly, the same report suggests India will be a major player, with three in four executives suggesting strong growth. Asia could be the savior of the watch market.

3. INTEREST RATE DROPS COULD REIGNITE THE MARKET

Rising interest rates have been an endless point of discussion across investment circles in the last 18 months. Central banks have been cutting rates. However, in the Bank of England’s latest Monetary Report, they suggest that rates could stay at around 5.25% until autumn 2024. In the US, the Federal Reserve is doing a better job at dampening inflation, and with three rate cuts forecast for 2024, things are looking positive.

Watch investors should look at this situation with great interest. While borrowing won’t be as cheap as it was during the last watch “bull run,” luxury watch purchases will increase with a more accommodative monetary policy.

For investors, the prospect of an upcoming boom means current prices present a significant opportunity to buy watches at a discount. For collectors underwater on purchases they made over the last few years, a market bounce back could be a chance to take some profits.

OK, with that out of the way, it’s time to look at the brands and particular watches that are good investments in 2024.

Top investment watch

brands for 2024

1. Patek Philippe – unquestionably one of the top 3 best watches to invest in 2024

When brainstorming the best watches to invest in 2024, Patek Philippe is one of the most popular brands for watch connoisseurs and collectors. Famous for their understated style, exquisite design, and unmatched quality. Every component of a Patek Philippe watch from the case to the hands is hand-made and finished ensuring production numbers are limited.

Looking for more hints on why Patek Phillipe is one of the best watches to collect for investment in 2024?

Patek Philippe currently holds the record for the most expensive watch sold at auction as of 2024: $24 million was offered for a Henry Graves Supercomplication, one of the most complicated watches ever created. But you don’t have to spend that much to add one of these magnificent timepieces to your collection.

With such a venerable brand and reputation, you won’t go far wrong with any of the standard watches. Some models will appreciate more than others, however, making them better watches to invest in in 2024.

The Calatrava, for example, is always popular, but, as a vintage watch, it is small by today’s standards which may put some buyers off. For a more sound investment in watches, look for one of the post-1998 chronographs.

One of the most sought-after by collectors is the 5070 chronograph, released in 1998. This watch contains the renowned Calibre CH 27-70 movement which is regarded as one of the most beautifully designed chronograph movements available on the market and is popular with both connoisseurs and collectors alike.

One final thing to mention about Patek Philippe is that each watch has its history recorded in the brand’s archives. A quick search can tell you the exact date of manufacture and where it was sold.

Further investigation can reveal the names of buyers of vintage watches. You never know, you may find out the watch you want to purchase was once owned by a famous person, which will greatly enhance its value, adding it to your list of the best watches to invest 2024.

Simmilarly, The Nautilus Ref. 5711 has become the luxury watch to own after being discontinued in 2021, with a 61% value increase. In December 2021, the first of Patek Philippe’s limited-edition Tiffany & Co. Nautilus watches sold at auction for around £4.87 million.

.

In yet another example, Patek Philippe’s remade rose gold 5204R is a rattrapante perpetual calendar chronograph with a launch price of £232,103.

Moreover, their 5905/1A is a flyback chronograph with an annual calendar and is appearing in steel for the first time with a price tag of £44,295.

And, finally, the newer 5930P is a self-winding world-time flyback chronograph in white gold, starting at $106, 450.

PATEK PHILIPPE MARKET ANALYSIS FOR 2024

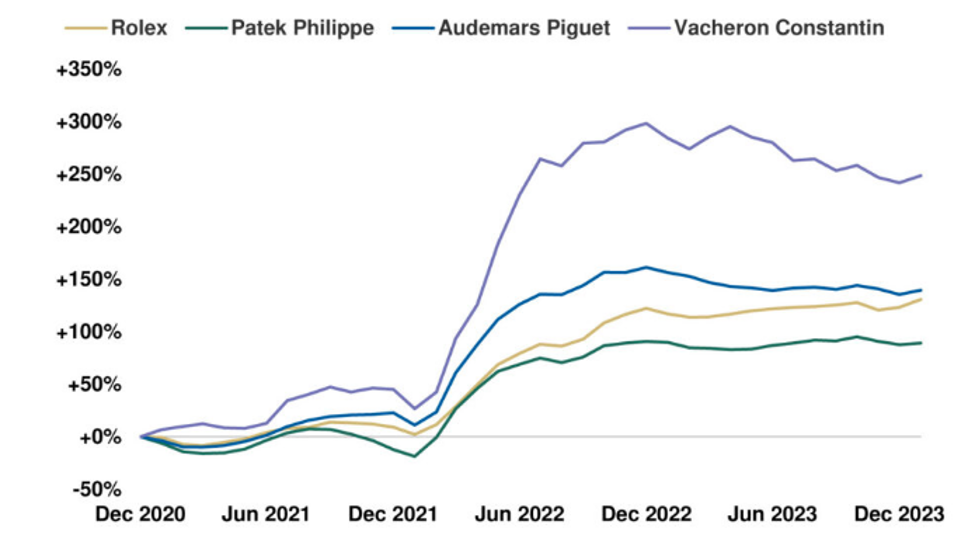

The average price for a Patek Philippe watch on the secondary market fell from $170,000 to $145,000 during the start and end of 2023. The decline of almost 14% was devastating news for watch collectors.

The big losers in 2023 were all Nautilus models, with the 5711/1R (-14.8%), the 5980/1A (-14.5%), and the 5711/1A (11.3%) all dropping in value in just the last six months. However, the legendary brand has stemmed the losses during the start of 2024, with the Nautilus 5711/1R already bouncing back with a 10% new year price rise.

Source: Morgan Stanley/Watch Charts

Available inventory will remain a big factor here. While Patek Philippe watches are rare, there are a lot on the second-hand market. The chart above shows the rise of supply for luxury watches in the secondary market in the last few years. Until demand increases and eats into that supply, prices will remain suppressed throughout 2024.

2. Rolex

Rolex is a timeless, luxury brand and will likely always be one of the safest and best brands in which to invest. They have addressed the recent high demand and low production trend. It is expected that Rolex will introduce new watches to the market this upcoming year. The price is expected to increase as it has been, deeming it a solid investment for 2024.

The value of the Rolex Daytona has increased by 37% and continues to be one of the most challenging models to find in the primary market, which has driven demand. Their stainless steel version is one of the most scarce and one of the top investment picks for 2024.

Of course, a timeless, elegant Swiss brand classic such as Rolex is a household famous name when it comes to the best luxury watch brands. Rolex continues to provide luxury watch owners with exquisite pieces and some of the best 2024 investment opportunities for watches.

These watches can appreciate significantly in value and are certainly a smart luxury watch investment for 2024 and beyond. In a recent 2021 New York Watch Auction, a circa 1971 Cosmograph Daytona “Paul Newman ” model Rolex luxury watch sold for $321,300.

Some examples of the best Rolex models to invest in :

1. Rolex Deepsea

Even within the category of diving watches, there are many different types you can get for numerous applications. The Rolex Deepsea is the watch you want if you’re going to dive using scuba equipment, and another “best watch to buy for investment in 2024“.

It is pressure tested, and guaranteed to be waterproof to 1.2km below the surface. The watch also includes a helium escape valve, which allows the timepiece to decompress before returning to the surface. This allows the watch to be brought back to the surface safely after deep sea diving.

This watch’s incredible resistance to water at great depths does nothing to compromise on luxury; to the naked eye it looks like a classic Rolex design that wouldn’t look out of place on the red carpet.

If you’re a scuba diver, and you’re looking for a luxury timepiece that won’t let you down at any depth, the Deepsea is the watch for you.

2. Rolex Submariner

The Submariner is known by many as the quintessential James Bond watch, after Sean Connery, Roger Moore, George Lazenby, and Timothy Dalton’s Bond’s all wore one. However, as the name of the watch suggests, it is also an extremely capable diving watch, able to be submerged safely at depths of up to 1,000 feet.

Its unidirectional rotatable bezel allows divers to safely and accurately monitor diving time and compression stops.

Despite all of its spectacular diving features, the luxury of the Submariner is such that many users will never take it diving. They just like the watch. And can you really blame them?

ROLEX MARKET ANALYSIS FOR 2024

Rolex watches also took a big hit in 2023, with average prices dropping from 28,500 to around 26,000, a decline of almost 8%.

After years of speculation and rampant price increases, demand has topped out. Experts predict a period of stability for the iconic brand on the secondary market.

In the last six months, two GMT Masters have been the worst performers in the Rolex secondary market. The 126720 has declined by 11%, while the 126715 has lost about 3% in value. However, it’s not all bad news for GMT Master owners. The 126710 BLRO, affectionately known as the “Pepsi,” is up by around 5% over the last six months, suggesting it could be one of the best watches to invest in this year.

3. Audemars Piguet

Founded by Jules Louis Audemars and Edward Auguste Piguet in 1875, Audemars Piguet is one of the most innovative watchmakers in the world, and one of the best watches to collect for investment in and beyond 2024.

Highlights include the introduction of the minute repeater in 1892, and the world’s first skeleton watch in 1934. Today, the brand is highly regarded by collectors who love its distinctive styling, unmatched quality, and reliability.

As with Rolex, it is rare for any Audemars Piguet to be worth less than its retail value after five years. But there is one AP watch that is sure to increase in value more than any other (definitely one of the best watches to add to your investment portfolio in 2024). The Royal Oak Automatic. Manufactured from 280 components and 40 jewels, the Royal Oak’s 3120 calibre movement is renowned as one of the most reliable movements ever created.

But it is the timeless octagonal case and integrated bracelet, which have remained virtually unchanged since its inception in 1972, that ensures the Royal Oak will remain a favorite for collectors. Once again, the more limited pieces are the ones to go for, a rare 2005 semi-skeletonized tourbillon Royal Oak recently sold for $137,500 at auction.

Audemars Piguet discontinued their iconic Royal Oak 15202ST Jumbo in 2022, so watch for this model to start skyrocketing in cost, while their upcoming 50th-anniversary edition will become the watch to own. Christie’s sold a retiring version for over £2.523 million in November 2021.

Moreover, Audemars Piguet continued to sell some of the most expensive watches in the world, with their extremely rare circa 2009 Royal Oak Grande Complication model recently sold at the December 2020 Racing Pulse New York Auction for $504,000

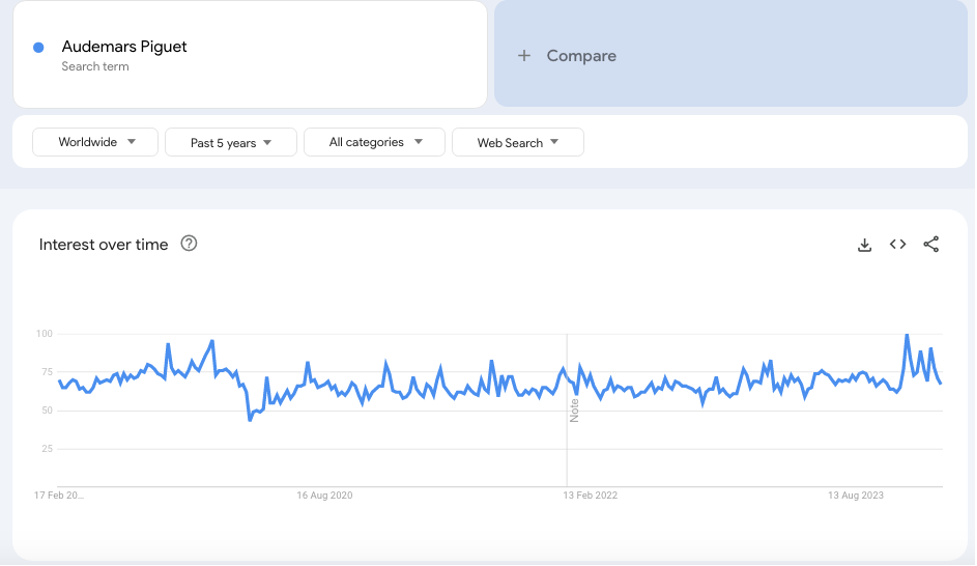

AUDEMARS PIGUET MARKET ANALYSIS FOR 2024

Audemars Piguet watches felt the brunt of a cooling 2023 market, with average prices dropping from around $82,000 to around $68,000 between the start and end of the year. These figures constitute a decline of around 15%, undermining Audemars Piguet’s reputation as one of the best watch brands that hold value.

However, while the recent picture may be concerning, quality brands like AP have been around for a long time. They’ve been through the ups and downs, but demand always holds steady.

If we look at Google searches for the legendary Swiss watchmaker, it’s clear that interest in the brand is firm.

According to WatchCharts.com, ten different versions of the classic Royal Oak have declined by more than 10% in the last six months. The 26240OR was the worst performer, with a sharp decline of more than 17%. However, the market stabilized during the first month of 2024, suggesting that economic recovery and lower interest rates could result in normal order being resumed.

4. Richard Mille

Most of the watch brands featured here are traditional watchmakers with hundreds of years of lineage, but Richard Mille is the exception and another fascinating entry on our list of best watches to buy for investment in 2024.

Founded in 1999, in just 20 years, Richard Mille has become legendary for its unique and innovative watches. The brand can be found on the wrist of many famous sports stars and celebrities including; Rafael Nadal, Jackie Chan, and Natalie Portman.

The reason for this success lies behind the distinctive and innovative style of the cases, combined with the exceptional engineering of the movements. Richard Mille watches are instantly recognizable due to their tonneau-shaped cases, which are often skeletonized to show off the exquisite detail of the movement encased inside.

From an investor’s perspective, the best thing about Richard Mille watches is that every single timepiece forms part of a limited collection. The more limited the number, the more valuable the watch.

One of the rarest models, the RM52 Tourbillon Skull Asia Edition, of which only six were made, sold at auction for HKD 3,460,000 (£346,000) in 2015. If that same watch were to come on the market today it would be worth over £500,000.

But Richard Mille’s Swiss watches continue to push the limit on luxury watch innovations. In December 2021, one of their 2012 Tourbilon watches sold for a whopping £883,384.

In yet another example of investment opportunity, Richard Mille racing fans have been scrambling in 2022 for one of 150 limited-edition racing watches celebrating the return of the Le Mans automotive competition. Richard Mille sponsored this event at the Bugatti Circuit and is dedicating its eighth limited-edition model to the July 2022 return.

This sporty green, black, white, and red limited edition watch will retail for £131,810 and be a rare sighting indeed.

RICHARD MILLE MARKET ANALYSIS FOR 2024

The average price of a Richard Mille watch is about $200,000. This figure puts these luxury watches above Patek Philippe and makes Richard Mille the most expensive Swiss watch on average. However, they are also one of the best watches to hold value in recent years, even during the widespread watch market correction.

For example, in 2022, the average price of an RM55 went over $300,000. Browse through a secondary watch market like Chrono24.co.uk, and you’ll see similar models holding or exceeding that price.

One of the reasons that premier brands like Rolex, Audemars Piguet, and even Patek Philippe lost value in recent years is that there was a lot of supply to go around. Richard Mille only produces about 5,000 watches per year, while other luxury brands like PP or AP produce more than ten times this amount. As such, Richard Mille will remain one of the best watches to hold value based on scarcity alone.

5. Vacheron Constantin

Vacheron Constantin was founded by Jean-Marc Vacheron in 1755, making it the world’s oldest watch manufacturer in continuous production, and another of the best brand watches to invest in 2024.

Francoise Constantin joined the firm in 1819 as an associate director, after which the firm was renamed Vacheron Constantin. The brand is renowned for its design, workmanship, and heritage with vintage examples regularly demanding high prices.

Vacheron Constantin is comparable in both design and quality with Patek Phillippe, but the brand is often overlooked by new collectors who favor the better-known Patek watches. This means prices for vintage examples are often less than half the price of a similar quality Patek Phillippe, making them excellent watches for investment in 2024.

However, the demand for these quality timepieces is sure to increase in the future, as more collectors realise the benefits of this quality brand….you should really add this to your list of best watches to collect for investment in 2024.

If you can find one, look for the vintage 4621, which is a classic watch much sought after by collectors. What is believed to be the first 4621 ever made sold at Christie’s in 2016 for a record $605,000.

As another example, at the November 2019 Geneva Watch Auction, a striking 1946 Indian Summer model Vacheron Constantin wristwatch sold for $64,800.

VACHERON CONSTANTIN MARKET ANALYSIS FOR 2024

2023 was a tough year for Vacheron Constantin, with an average market decline of 7%. The legendary Swiss watchmaker saw secondary market prices fall from about $55,000 to $47,000 from the start to the end of the year.

Some models experienced huge drops over the last six months, with the Overseas 6000V/110A-B544 losing over 20%. However, more affordable models like the Fifty-Six 4600E/000A-B487 have bucked the trend and grown by about 4% over the same time frame.

Historically, Vacheron Constantin has been one of the best watch brands that hold value over the last few decades. The brand is very prestigious and desirable, and with only 20,000 produced each year, prices will bounce back once interest rates drop.

You may also like :

6. Breguet – another great yet often overlooked candidate for the “Best Investment Watches 2024 Award”

Founded by Abraham-Louis Breguet in Paris 1775, the firm quickly established itself as a watchmaker of some repute. Within five years, the brand’s customers included Louis XVI and Queen Marie Antoinette.

Today, Breguet is part of the Swatch family but remains true to the founder’s principles of design excellence and innovation. Breguet watches are instantly recognizable with their pomme hands and guilloché dials.

As with Vacheron Constantin, the brand is often overlooked by newer collectors who favour the better-known brands, and yet you can release great value of these watches by pawning against their value.

But Breguet watches hold a special cache with connoisseurs who are willing to pay high prices for rare or interesting examples. As a result, any vintage or limited edition Breguet represents an excellent watch to collect for an investment opportunity and will give you the opportunity to own a true piece of horological art in the process.

BREGUET MARKET ANALYSIS FOR 2024

While Breguet watches did take a hit during 2023, the average prices only dropped about 2%, declining from $23,300 to $22,700. Comparing their market performance against Rolex and the other big players, this French brand has emerged as the maker of some of the best watches that retain value in the modern era.

Indeed, two Tradition models (the 5057BB and the 7097BB) have gone up in price by 8% in the last six months, while the Classique 5717BR has returned 11%. Investors should not sleep on this brand.

7. Jaeger-LeCoultre

Founded by Antoine LeCoultre in 1833, Jaeger-LeCoultre was regarded as the most innovative watchmaker of the 19th century. The brand holds hundreds of patents, including the world’s smallest calibre and a near-perpetual movement.

Today the brand is regarded as a top-tier watchmaker alongside luminaries such as Patek Philippe, Audemars Piguet, and Breguet. Definitely one of our choice of best watches to buy for investment in 2024.

There are many popular Jaeger-LeCoultre models such as the Reverso, Memovox, and Ultra-thin moon watch. As with the other top-tier brands, you should stick to one of the classic models, or try and find a limited edition to guarantee your investment. Limited edition Reverso watches are always popular and regularly beat auction estimates.

One rare pink gold example recently sold for HK$118,750 ($15,150) more than twice its estimate.

JAEGER-LECOULTRE MARKET ANALYSIS FOR 2024

Jaeger-LeCoultre has weathered the market turbulence over the 12 months to become that rarest of things: a luxury watch brand that increased in price during 2023. In large part, that success is due to increasing interest in two Jaeger-LeCoultre models, the Master and the Reverso.

While average prices for the watches have only gone up by 1%, when placed against the context of a market in freefall, things are looking good. Indeed, over the last five years, Jaeger-LeCoultre has experienced average price rises of 20%. Considering the brands’ resilience and historical performance, collectors are starting to realize they’re good watches to invest in over the long term.

8. A. Lange & Sohne

Founded in 1845 by Ferdinand Adolph Lange, A. Lange & Sohne is regarded as one of the finest watchmakers in the world, and another favorite of ours for the best watches to invest in 2024.

As a German company, their watches differ in style from most Swiss manufacturers, with the brand favoring a more traditional Glashütte style which is similar to classic British watches. This understated look is what makes A. Lange & Sohne watches appealing to collectors.

When choosing an A. Lange & Sohne, it is best to stay away from the classic pieces and go for one of the limited edition Chronographs. One of the most desirable watches is the Dataograph Up/Down Lumen which was limited to 200 units and is sought-after by both connoisseurs and collectors alike.

The best price that was achieved at auction for an A. Lange & Sohne was $825,525 for an elegant 1815 “Homage to Walter Lange”, which was a single watch created to celebrate the life of Walter Lange who died in 2017.

A. LANGE & SOHNE MARKET ANALYSIS FOR 2024

The venerable German watchmaker had a mixed 2023. Average prices fell from around $55,000 to $52,000, constituting a drop of just over 4%. When set against big Swiss brands, that decline isn’t the end of the world for collectors holding some of these exclusive pieces.

The Zeitwerk, one of A. Lange & Sohne’s most popular models have experienced a topsy-turvy six months. The 140.029 model lost its footing during the period and dropped 12%, a decline that was only matched by the Odysseus 363.179’s correction of 11%.

However, two other Zeitwerk models (the 148.038 and the 144.028) have both shot up over 10% over the last six months on the secondary market. Saxonia and Lange 1 model watches are also rising, so there are profits there if you get the right A. Lange & Sohne, regardless of current market dynamics.

9. IWC

The International Watch Company (IWC) is a Swiss brand founded by American engineer Florentine Ariosto Jones in 1868. The brand was founded with the aim of combining advanced American manufacturing techniques with traditional Swiss craftsmanship. The watches were to be assembled in a factory which was groundbreaking at a time when most watch components were being assembled in people’s homes.

Today, the brand is focused on producing high-quality mechanical timepieces and chronographs. IWC do not have the same following as the more famous brands such as Rolex or Patek Philippe watches, but that does not mean they do not make good investment consideration for 2024.

In fact, you can pick up an IWC watch for a fraction of the price of a similar quality Patek. One piece to look out for is the Ingenieur 3227 which has an unusual hexagonal case. This watch was recently discontinued and prices are starting to firm, but it still remains accessible to most buyers.

IWC MARKET ANALYSIS FOR 2024

The average price for an IWC watch dropped from $9,700 to just over $9,000 over the last year. That suggests a decline of around 6%, but the correction has slowed in line with the broader secondary watch market, and prices are close to stabilizing at some stage during 2024.

Unlike other watch brands on our list, IWC’s five-year returns have been -2%. So, while they’re one of the watch brands that hold value, they have been surpassed by some of their fellow Swiss competitors in recent years.

Some IWC watches, like the Portugieser 371611 (up 14.5%) and 371446 (up 11.9%), have performed really well over the last six months. IWC has good watches to invest in for smart investors who stay on top of trending models.

10. Panerai

Another candidate for the best watches to invest in 2024 list is the Italian manufacturer, Panerai.

Named after founder Giovanni Panerai who opened his first watch shop in Florence, Italy in 1860. Panerai watches have become increasingly collectible in recent years, thanks to their unusual cushion-shaped cases and quality movements.

All Panerai watches are limited edition, albeit the differences between them are slight. This means every Panerai watch will become collectible at some point, with rarer editions being the most sought-after.

If you are just starting your watch investment portfolio, the Panerai Luminor Base is a great place to start. Introduced in 1950, the Luminor is a dive watch containing an ETA 6497 hand-wound movement. This movement was replaced by Panerai’s own movement in 2017 which bumped up the price by more than £1000. This makes the original ETA 6497 based Luminor a bargain, and it’s sure to increase in value as new models become more expensive.

PANERAI MARKET ANALYSIS FOR 2024

Investing in the luxury Italian watch brand hasn’t been straightforward over the last five years. Indeed, the average price of a Panerai watch has declined about 10% on the secondary market since 2019. Preferences change, and hype watches move in and out of fashion, but there are reasons to be cheerful for Panerai owners, such as the PAM 90’s 22% price increase over the last six months.

The PAM 1616 has also increased in price over the last half-year, with a 10% rise, while the PAM 111 and the PAM671 have shot up by 6%. Panerai could be making a comeback in 2024.

11. TAG HEUER

Founded in 1860, the Heuer luxury watch brand is known for its extreme precision and easy-to-read timepieces. A circa 1962 Autavia “Full Lume” model Heuer wristwatch displaying Heuer’s signature large registers and full lume hands was recently sold at the December 2021 New York Watch Auction for $163,800.

In 1985, Techniques d’Avant Garde (TAG) bought the company, and it became TAG Heuer.

TAG HEUER MARKET ANALYSIS FOR 2024

The average Tag Heuer watch price declined in 2023, dropping from $3,870 to $3,700. While a sub 4% drop is minor compared to Rolex et al., it broke a steady five-year climb for the legendary Swiss watchmaker.

The Carrera is one of the most iconic Tag Heuer models. Their performance over the last six months on the secondary market sums up the mixed bag for the Swiss brand. The CBN2AF1 has dropped by 12%, while the CV2A10 has lost 11%. On the other hand, the CAR5A8Y and the CV2010 are up 7.3% and 5.4%, respectively.

Tag Heuer is still one of the best watches that retain value on the market today. Buy the right model and sit tight for a few years, and it will typically increase in price.

12. De Bethune

Founded in 2002, this luxury Swiss watch brand has quickly become known for its high-tech materials and design. If you’re interested in acquiring cutting-edge, technical watches from a high-end luxury watch brand, then De Bethune is one to consider. A stunning circa 2007 white gold Avante-Garde De Bethune wristwatch featuring a night sky display recently sold at the December 2021 New York Auction for $176,400.

DE BETHUNE MARKET ANALYSIS FOR 2024

De Bethune is one of the hottest independent Swiss watchmakers. They produce between 150 and 300 watches each year. As such, collectors constantly compete over these rare and extremely expensive pieces, and the market is not saturated. De Bethune are good watches to invest in because they are always scarce. Popular models like the DB28 have not acted in correlation to the broader market and are on the rise, increasing from around $40,000 to $50,000 in the last few years.

13. OMEGA

OMEGA is not always considered as a best watch investment but you may want to re-consider your options. Omega Seamaster is one example that comes to mind when thinking about investing in watches that could appreciate in value beyond 2024.

From one James Bond watch to another – the Submariner has been the official watch of 007 since Pierce Brosnan took up the role in the 1990s, and one of our favorites for the best watches to invest in 2023 list.

Like the Submariner, the Omega Seamaster can also reach depths of 1,000 feet, and is a direct competitor to Rolex’s premier diving watch in every sense. Again, many users of the Seamaster will not choose to take it diving, content that it’s a luxury watch that looks great on their wrist.

OMEGA MARKET ANALYSIS FOR 2024

Over the last five years, Omega has been one of the best watches that retain value, shooting up in price by 13.2%. However, just like the rest of the market, they felt the chill of the post-2020 peak and saw average prices go from $9,300 to $8,900.

The sharpest declines were in the Speedmaster and Seamaster models, some of which dropped by between 7% and 10%. However, other versions of the same models have had 3% price rises. Overall, Omega still has big brand recognition and plenty of celebrity endorsements to ensure a strong 2024.

How to value the best watches to invest in 2024

Fine watches are a popular luxury investment asset all around the world, with many top brands being synonymous with prestige, class, and style. Whether you’re thinking about loaning against fine watches or selling them, the first thing you need to consider is their value.

At New Bond Street Pawnbrokers, we have arranged many loans against fine watches over a period of decades, and our team of timepiece appraisers has become unrivaled experts at determining the value of collectible watches in the process.

Like so many assets, the popularity (and, accordingly, the value) of fine watches can fluctuate over time, and what might be highly collectible today may prove a difficult sell in a few months’ time. On the flip side, a watch deemed unfashionable that does not sell well can become a rare piece in years to come, increasing its value.

Here at New Bond Street Pawnbrokers, we offer loans against fine watches regularly, and there are certain principles that will stand you in good stead when you wish to buy your fine watch for investment purposes.

Here are the main valuation factors to look out for when seeking loans against fine watches.

Manufacturer and model

When considering what is the best watch to buy for investment in 2024, the obvious starting point is the manufacturer of the watch and the specific model.

Certain names automatically translate to market-value in a timepiece.

Loans against Patek Philippe watches, for instance, tend to attract a higher value since this particular brand of wristwatch regularly appreciates in value by a significant amount from its original purchase price.

Loans against Rolex watches, on the other hand, whilst more plentiful, and by no means less beautiful, rarely attract the same % increase in value. That is not to say that your Rolex is not valuable, however. Certain models of Rolex (the Rolex Red Submariner, for example) have appreciated by a considerable margin since their original release and might be a worthwhile deposit if you were thinking of pawning your Rolex.

And even if your Rolex hasn’t significantly increased in value it’s likely that it will have at least held the original value you bought it for.

Condition

When considering investing in fine watches, the condition is everything.

Generally speaking, people are looking to buy fine timepieces in as near-to-mint condition as they can. This means that any restoration work done to a watch is very likely to negatively affect its value. Anyone looking to take out loans against Vacheron Constantin, for example, would be hard-pressed to strike a good deal if parts have been noticeably replaced, or if the face is clouded over with dents, scratches, or other cosmetic blemishes.

However, it is worth noting that there is a growing school of thought among watch collectors that a watch having scratches and other imperfections is not necessarily always a bad thing. If the imperfections tell a story and add to the character of a watch, they could help to make it more valuable.

Paul Newman’s Rolex Daytona was scratched and damaged, but this did not affect its value; it actually became the most expensive watch of all time when it went up for auction. These are all factors you must consider when taking out loans against fine watches, hence you should really consider these factors when placing your 2024 investment in luxury watches.

Age

Whilst some models of luxury watches hold their value for years after production, many do not. If the timepiece in question was being worn, rather than on display, or in a collection, then the odds are good that it has undergone some damage, simply by being exposed to the elements during day-to-day usage.

That said, certain models are considered vintage, and so their condition must be balanced up against their rarity in the marketplace.

The fine Swiss watch manufacturer, Audemars Piguet, has been producing wristwatches since 1875. Should one of their original repeater wristwatches ever show up, any superficial damage would be outweighed by the historical nature of the watch itself. This is not to say that Audemars Piguet investment prices automatically attract a higher value, merely to illustrate that condition, age, and rarity must all be considered when assessing the worth of a fine watch.

Provenance

The best watches to buy for investment in 2024 and beyond are luxury items and, being so, often come in handsomely appointed presentation boxes. Those boxes, in mint condition, add value to the watch itself, as does the original bill of sale, confirming the original cost of the item.

Servicing papers can add further value to the piece, confirming that any repairs to the watch were conducted by a trained and certified professional.

Indeed, any of the original materials or paperwork that came with the watch are worth keeping hold of, as they can do nothing but boost the value when trying to pawn or resell. This can include (depending on make and model) warranty cards, warranty booklets, serial number tags, and polishing cloths.

Materials

While most of the value in your luxury watch is invested in the brand name, the specific model and the condition of the piece itself, the material the watch is made from can also determine its worth.

Many precious metals go into the manufacture of luxury watches – gold and platinum being the most popular – and these have an inherent value beyond the function and design of the watch itself.

Certain high-end watches also include precious gems like rubies, diamonds, and sapphires, which again have an appreciable value of their own.

You should expect any embellishments like this to enhance the value of your watch.

Salvage

It may be that your fine watch has seen better days, and that’s a shame.

However, whilst the watch itself might not fetch much either on the open market or as the basis of a loan, the internal parts or materials might still be of interest if they remain in good condition. Watch repair and maintenance is a highly skilled profession, and original parts are often at a premium in this industry.

So even if the outside of your watch is scuffed and dented through decades of regular use, it’s entirely possible that its internal workings still hold some value.

Is it genuine?

It is a sad fact that in any arena where high-value goods are sold there are always disreputable people looking to make a profit from unwary consumers.

As such, fake and duplicate timepieces are rife in the luxury watch trade, many of them looking extremely convincing to the untrained eye. Fortunately, our team of assessors brings years of experience to the table, and can quickly identify fraudulent items, and the best watches to invest in 2024 and beyond.

Impact of The Russia-Ukraine War On Luxury Watches Investment

Forecasts put the global luxury watch market’s CAGR at 3.25 percent from 2022–2027. With sanctions against Russia causing the ruble to drop significantly and stock markets to remain closed, wealthy Russians are investing in luxury watches to protect the value of their savings.

In March 2022, sales in Russian luxury watch stores spiked following the international response to the country’s invasion of Ukraine, which heavily limited cash movement.

The trend gave the industry a short-term boost, but it was hard to predict how long that boost would last, given that the full implementation of the SWIFT policies was expected to make exporting to Russia challenging, if not impossible.

Putin announced a ban on depositing cash in foreign accounts to prevent money, particularly those held by wealthy Russians, from leaving the country and further destabilizing the economy. Luxury watches provided a haven and an investment during economic uncertainty.

However, Russia’s invasion effect on the price of luxury goods was a potential public relations nightmare. As of March 1, 2022, high-end companies such as Apple stopped selling in Russia. Reasonably, this is a cost for them, which might be offset by the positive communication image they enjoy in other market segments.

Bulgari has remained in Russia and seen an increase in sales. Meanwhile, the luxury watchmaker Watches of Switzerland has stepped down from the Responsible Jewellery Council (RJC) after they failed to sever ties with Russia.

Watches of Switzerland’s exit from RJC means that watch brands like Rolex, Patek Philippe, Cartier, Grand Seiko, Tudor, Omega, Breitling, Tag Heuer, and Hublot are no longer available for firsthand sales in Russia. They’re among the best watches for investment in 2023.

Luxury Watches Market Trends During Russia-Ukraine War

Since so many watch brands have pulled out of Russia, the majority of luxury watches still available are by independent and privately-owned retailers who still have inventory left from before Russia’s invasion of Ukraine.

Since Bulgari watches are still available, their sales are on the rise as Russia’s wealthy are using them as the best investment watches.

Meanwhile, on the secondary market in Russia, well-known watches are fetching three times or more than their original price.

Some Russians have tried buying luxury watches outside of Russia. However, stores like Harrod’s have responded by limiting Russians from spending more than £300 in their stores, eliminating Russians’ ability to buy luxury watches there for sale on the black market.

Interestingly, the theft of luxury watches is on the rise in Europe, and some of the big buyers of these stolen watches are Russians.

Luxury Watches Competition Landscape During Russia-Ukraine War

Watches of Switzerland has increased in-store and online sales by 48% in the US during the 2022 fiscal year. Its revenue increased 36% in its home market, the UK. At the same time, the average firsthand luxury watch price has increased by 4%-5% in 2022.

Demand for luxury watches during the Russia-Ukraine war has far outstripped supply. Shortages were originally within brands like Rolex, Audemars Piguet, and Patek Philippe. However, the shortage has spread to other luxury, high-end brands like Zenith, Omega, and IWC, making all of these brands excellent options for investment.

Stores can’t get enough of the newest products, like Zenith chronographs, IWC pilots, and Omega’s James Bond Seamaster and Speedmaster models. They’re flying off the shelves, making them some of the best watches to invest in 2023.

Three-fourths of current luxury watch sales are waitlist sales for watches that aren’t yet in stock. Watches of Switzerland is putting more people on waitlists than they are taking off waitlists. So, they still have financial insulation from the current economic slowdown.

The index for luxury watches is up 32% in the last year. And investment in luxury watches is still ahead of other alternative asset investments like vintage cars, gold, and cryptocurrencies.

Now that cryptocurrency values are down, some of the early-pandemic luxury watch investors are starting to sell their watches.

However, as equities and cryptocurrency valuations have tumbled, secondary market prices for luxury watches have started to fall. Without Russian and Chinese buyers, the prices have dropped an estimated 25%.

To summarize, the top 5 watches to invest in 2024, and beyond are:

Some of the many watch brands we loan against include: A. Lange & Sohne, Breguet, Breitling, Bulgari, Cartier, Chopard, Harry Winston, Hublot, IWC, Jaeger LeCoultre, Omega, Panerai, Piaget, Richard Mille, Roger Dubuis, Tiffany, Ulysse Nardin, Urwerk, Vacheron Constantin, Van Cleef & Arpels, Audemars Piguet, Graff, Patek Philippe, and Rolex

This post is also available in:

Français (French)

Deutsch (German)

Italiano (Italian)

Português (Portuguese (Portugal))

Español (Spanish)

Български (Bulgarian)

简体中文 (Chinese (Simplified))

繁體中文 (Chinese (Traditional))

hrvatski (Croatian)

Čeština (Czech)

Dansk (Danish)

Nederlands (Dutch)

हिन्दी (Hindi)

Magyar (Hungarian)

Latviešu (Latvian)

polski (Polish)

Português (Portuguese (Brazil))

Română (Romanian)

Русский (Russian)

Slovenčina (Slovak)

Slovenščina (Slovenian)

Svenska (Swedish)

Türkçe (Turkish)

Українська (Ukrainian)

Albanian

Հայերեն (Armenian)

Eesti (Estonian)

Suomi (Finnish)

Ελληνικά (Greek)

Íslenska (Icelandic)

Indonesia (Indonesian)

日本語 (Japanese)

한국어 (Korean)

Lietuvių (Lithuanian)

Norsk bokmål (Norwegian Bokmål)

српски (Serbian)

Tamil

Be the first to add a comment!