Whether you’re a whiskey connoisseur, collector, or investor, you’ll probably have watched in awe at the emergence of a thriving fine whiskey market over the last few years.

The sale of a bottle of Macallan Valerio Adami 60-Year Old at the end of 2023 for a stunning $2.7 million underlined the continued growth of whiskey as an alternative asset. But behind the headlines and the eye-watering sums being spent on ultra-rare bottles, what does the fine whiskey market look like for 2025?

The good news is that collectible whisky is a strong investment. With some analysts suggesting that the S&P 500 is looking at around 2% to 6% growth during 2025, alternative and nontraditional asset classes are looking more attractive. The best whiskey investments will beat the 6% and even hit double figures over the following year. But unlocking that growth means understanding the best whisky to invest in.

So, if you want to invest in whiskey casks or bottles, you’ve come to the right place. This guide will give you the low down on whiskey barrel investment and some of the best whiskey to invest in during 2025. There will be tips and tricks for those who want to figure out the best whisky cask investment for them or explore other niches like bourbon investment..

Whisky investment 101

imager credit: https://www.flickr.com/photos/mikepmiller/4495383414/

Before we look at different whisky bottles or whiskey casks investment strategies, we need to get an overview of the market, including some terms and definitions to help you understand what the best whiskey investment is for you this year.

Is whisky casks investment the way to go?

If you’re thinking about making a whisky cask purchase, there is a lot of information you need to know. But perhaps one of the most important things is to consider the difference between whisky and whiskey.

The difference between whisky and whiskey

While the words whisky and whiskey are pronounced the same and often used interchangeably, they describe different products. As such, whisky cask investment and whiskey cask investment are somewhat different practices because they deal with different products from different countries of origin.

So, which is which?

Whisky describes products made in Scotland, Japan, and Canada. Whiskey describes products made in Ireland and the US, including variants like bourbon, Tennessee, and rye whiskeys.

If you look at the most expensive bottles ever sold, they tend to be from Scottish or Japanese distillers. However, that’s not to say that Irish and US manufacturers aren’t good whiskey for investment. A whiskey cask investment, i.e., a cask from Ireland or the US, can still produce good returns with the right market conditions.

Whisky casks investment vs whisky bottle investment?

Ultimately, it comes down to personal investment. However, there are some differences in the experience for both collectors and investors. While we we deal with the question later in the article, whisky cask investment is better for long-term investments, while bottles can provide short-term gains and a more liquid market.

Understanding the language of whisky

Like any niche interest, the fascinating world of whiskey comes with its own lexicon. Here are a few of the terms that you need to know when evaluating a whisky cask purchase.

- Cask: A cask is a wooden barrel that whisky is stored in to mature.

- Single malt: A single malt is a whiskey that is made from one malt, generally barely.

- Blended malt: Unlike a single malt, a blended malt whisky uses two or more grains

- Malt whisky: A whisky produced solely from malted barley, yeast, and water

- New make spirit: The clear pre-matured spirit that is put into a cask to mature

- Single cask malts: A malt that comes from a single cask.

Ok, now that you’re up to speed on the basics of fine whiskey investment, it’s time to dive into the market so you can understand how it all works.

The evolution of the single malt whiskey market

image credit: https://www.flickr.com/photos/mikepmiller/4494752309/

Before you invest in any market, it’s important to take some time to learn the ins and outs. Whiskey has been a collectible item for years. However, in the last few decades, the market has matured significantly.

A good investor is concerned with the past, the present, and the future. We can’t predict the future, but we can learn as much as possible about both the past and present of whisky investment. Armed with this knowledge, we can have a better understanding of how to contextualize present-day events and what they might mean for the future.

Let’s take a quick snapshot of the single malt whisky market from the 1960s onwards to help you understand 2025 and beyond.

The 1960s to 1980s

The 1960s to 1980s were something of a boom time for the single malt whisky industry. Glenfiddich and Macallan began the process of marketing whisky outside Scotland in the early 60s, and the quality of the product shone through. This led to a few major events in the world of whisky.

The popularity of Scottish whisky caused a surge in demand. Many new players opened distilleries to capitalize on this interest. However, two problems emerged: overall quality dropped, and supply was saturated, leading to a decline in demand.

The fallout of these events was significant, with many brands going out of business. Even major distilleries of today, such as Arbeg and Springbank closed shop temporarily.

Throughout the ’80s and early ’90s, the decline of interest in single malt whiskeys led to a glut of unsold products that would be allowed to age and eventually become the classics of the future.

The influence of Scottish whisky led to an interest in Japan, starting in the late 19th century. Japanese distilleries opened in the 1920s, but the economic growth in the area caused a whisky boom. Many new distilleries open in the county using innovative techniques to reproduce the quality of Scottish single malts. In time, these distilleries would emerge from the shadow to be considered some of the world’s best manufacturers.

The 1990s

The 1990s were tough times for the whisky markets. Oversupply hit the market, with many big players going out of business. Some manufacturers encouraged customers to invest in whisky casks because it was a way of generating capital. Indeed, a cask of Macallan could be purchased for as little as £3,000 at the time. Older casks of Macallan can fetch as much as £300,000 right now.

While these prices seem incredible right now, take-up was limited. A big part of the problem was that the market was very illiquid. Buying a cask for £3,000 didn’t turn out to be a great move for a number of years. This situation serves as a stark reminder that even the best whisky investments take time to mature.

The 2000s

The 2000s was a transitory time in the cask whiskey investment space. Many whisky companies embraced the internet, and single-cask malts became a big deal. Online retailers took off and people became more comfortable with buying on the internet.

The era saw a lot of brands that we know and love today change their marketing and emerge to serve a new audience. In 2002, Dalmore took the world record for the most expensive bottle of whisky ever sold when it fetched £25,000 at auction.

Other brands emerged, too, and the market started to heat up. While collecting and investing in casks was still not a mainstream practice, whiskey investment returns were slowly climbing, and anyone who bought the right casks was getting nicely set up for the next decade.

2010s

The 2010s saw the emergence of the collectible whisky market that we know today. Online auctions and marketplaces sprung up, and prices started to rise. Indeed, by now, many of the whisky casks investment plays that people made in the 80s and 90s were suddenly ready to be bottled as they hit the 20 and 25-year mark.

With whiskey investment returns hitting multiples of 30 to 40x in just a decade, people started paying attention to these emerging alternative investments. Macallan emerged during this time, as the single malt became the product of choice in the fine whisky investment market.

2018 to 2025

The last six years or so have seen the whisky market hit peak popularity. By 2018, whiskey investment returns were at around 30% to 40% for certain casks and bottles, as frenzied buying pumped prices. Pre-2018, no whisky had sold at auction for more than six figures. During 2018, records were broken on five separate occasions.

In 2019, a bottle of Macallan sold for £1.5 million at auction. That record for an individual bottle held up until a rare special edition Macallan sold for around $2.7 million near the end of 2023.

What can we learn from the collectible whisky market history?

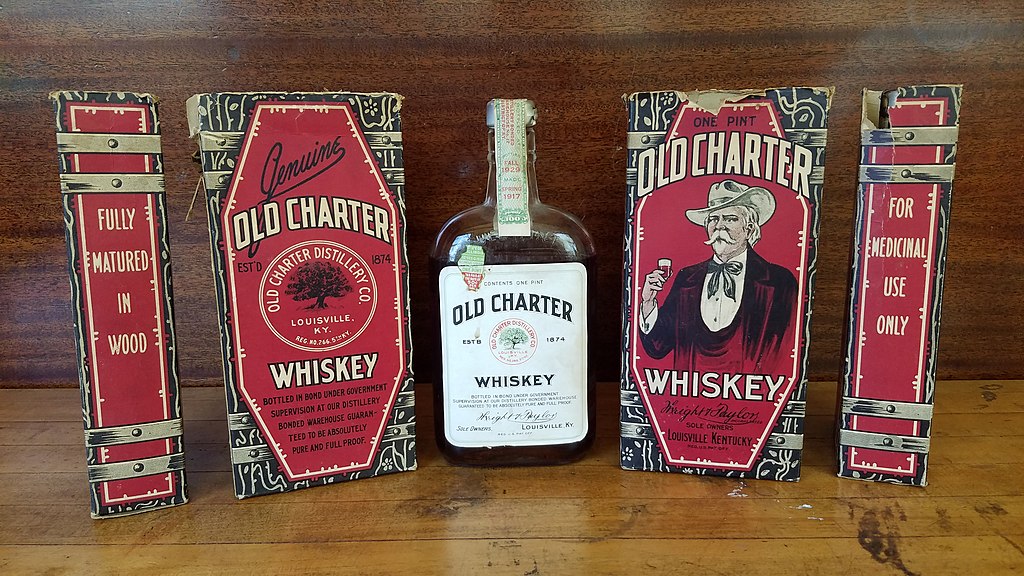

image credit: https://en.wikipedia.org/wiki/File:Old_Charter_Whiskey_bottled_1929.jpg

In the 60-odd years that whiskey for investment has emerged, the market has hit some serious peaks and troughs. But what are the big takeaways for investors? And what can understanding this period tell us about whisky investment for the future?

#1. New players can emerge in the market

For many years, Dalmore was the biggest name in the space. However, they were overtaken by Mccallum. What this tells us is that the industry is dynamic and that new players can emerge. The popularity of Japanese whisky across the globe also underlines that new brands can enter the public consciousness and capture market share.

While the nature of whisky production means that disruptive brands don’t exactly break into the rare collectibles market overnight, there are still some opportunities that emerge.

#2. The market is volatile

While the trends move more slowly than the S&P 500, the whisky investment market has exhibited some volatility in recent decades, particularly in relation to supply and demand. During the COVID-19 pandemic, a spike in interest and the rise of online auctions caused prices to peak considerably, making headlines around the world. However, there are no guarantees that the market will keep delivering in this way.

#3. Growth is baked into prices

The amazing growth in prices over the last year has attracted new investors who are looking to invest in products that are not correlated heavily with the stock market. However, this influx of interest has led the market to mature and be priced more efficiently.

Now, that’s not to say that bargain whisky investments do not exist out there or that the right bottles cannot achieve 12% to 15% annual growth. But investors need to understand that 400% to 500% historical returns could well be historical, so they should temper their expectations and consider that the prices that they pay could already have market growth baked in.

#4. Not all bottles can make huge multiples

Even within popular brands like Mccallun and Glenfiddich, there are bottles that perform better than others. Specific blends and years do well, and rare or limited runs are where the big money is. Researching particular series as well as distilleries is essential if you want to turn a profit.

What to look for in a high-potential brand?

The change in the market over the last 20 or more years has been nothing short of remarkable. Whisky has moved from something that people drink to a genuinely prized luxury collectible good. But what is it that causes one whisky cask purchase to turn into an incredible investment and another to stagnate?

The first thing that we need to explore is the most simple explanation: people enjoy the taste. Indeed, as a particular cask matures, the aging process improves the quality. And while there are undoubtedly differences in quality between particular brands, the question investors need to ask is whether that difference is reflected in price.

In many cases, the taste difference is not the most important factor in price. For example, some bottles of the same whisky can fetch completely different prices based on brand alone. Of course, this is a concept that many investors will understand instinctively. The best whiskey investment isn’t necessarily the bottle that you like the most; it’s the bottle that others perceive to be the best. Branding matters.

The emergence of Mccallan and Dalmore in the 2000s shows that targeted marketing campaigns and long histories can do a hell of a lot for public perception of a brand. However, it’s not quite as simple as taking a brand and marketing it with a huge budget. Plenty of distilleries have tried this approach, and their collectible bottles don’t make it big.

So, what are the factors that you should look out for when finding the best whisky investment for the future?

Here are some of the factors to consider.

#1. Perception of brand quality

#2. The year that the items were made and bottled.

#3. Limited editions or runs, or scarcity.

#4. The presence of a distiller visitor center seems to have an effect on the price and the public perception of the brand.

How do I know if a bottle of

whisky is collectible?

image credit: https://www.flickr.com/photos/mikepmiller/4495390666/in/photostream/

The short answer is by looking at the price. However, if you’re looking for whiskey for investment, you need to dig deeper and find bottles that have the potential to turn into future classics. We have gathered a few criteria to help you understand the best whiskey investment.

While ultra-rare bottles dating back to the 1920s and 1930s are what make the headlines, they aren’t the only good investment whisky out there. Indeed, there are plenty of vintage options that go for lower prices that are primed to make long-term profits.

Many of these whiskies were bottled during the 1980s and 1990s and are typically limited runs by vaulted manufacturers.

So, what are the characteristics of the best whisky investments? Here are a few commonalities to consider.

- The bottle comes from a much-loved distillery

- It’s a distillery release

- That distillery is no longer in operation / is the bottle from a discontinued series

- Is that statement over 12 years or more

- Is it a limited edition

So, as you can see, the market determines the collectability of the release through a mix of quality, rarity, and brand recognition.

What about modern scotch whisky investments

The thing that makes vintage bottles so expensive is what also stops many investors from getting a piece of the action: rarity. However, there are plenty of other options out there, some of which have increased in price over the last few years.

The modern whisky market, typically referred to as bottles that were released in the last 10 to 15 years or so, is a different prospect with its own rules and behaviors.

The first thing we need to make clear is that the vast majority of modern bottles are released for consumption. While there are collectibles and limited edition runs, the bulk of the market is not something that will mature into a six-figure bottle in 30 years’ time. And there is a reason for this.

The concept of collectible whisky is relatively new. In the past, when bottles were produced, people didn’t think of them as anything but an enjoyable evening tipple. As such, the stock was consumed, which led to eventual rarity, which pushed up the price.

Modern ideas about whisky mean that even limited edition runs have become a collectible. Again, because people have the perception of whisky as something that can increase its value, these bottles and casks are purchased and held. Without consumption, supply remains steady.

Secondly, whisky distilleries are also very aware of the secondary market. These brands tend to price their rare and limited runs appropriately, which, when paired with an abundant supply that is being collected and not consumed, means there are few opportunities for products to accelerate in price as they did during the 2010s.

However, there are some aspects of the modern whiskey for investment market that are quite appealing. For starters, new bottles have lower price points, so entering the market is far easier. Secondly, stock is more readily available.

However, we have seen a rise in what could be termed “Collector’s releases.” These premium offers are separate from drinking bottles and, as such, are some of the best whisky to collect. But the big question is, are they the best whisky to invest in?

Let’s explore some of the characteristics of these modern limited runs and see how they stack up against the idea of a product that will increase in price.

Here is what to look out for when evaluating a new release collectible whisky.

1. Initial outlay:

The distilleries price these limited runs at a high price point, which requires a relatively high outlay when compared to the quality of the product.

2. Accessibility:

Many of the top-selling vintage bottles featured very small runs. However, modern limited editions may not be so limited, especially in comparison.

3. Sourcing:

Some limited runs are available to buy, but many distilleries use a ballot system. As a result, you need luck to access some bottles. However, winning one of these ballots can offer an advantage if the goods are sold to an investor who has been locked out of the process.

4. Scarcity:

As mentioned earlier, because these bottles are being purchased as a collectible, they are not being removed from the market via consumption. As such, the lack of attrition means that there is a lot of supply on the secondary market as people try to flip their bottles for a quick profit.

Different ways to invest in collectible whisky

There are a number of different ways to access the best whisky bottles to invest in. Each process has its own advantages and disadvantages.

1. Retail

While auction houses are where the big deals are done, specialist whiskey retailers are a good place to find niche and rare collectible bottles. Most of these services have relationships with both distilleries and private individuals, which gives you a focal point to find whiskey for investment.

Each major whiskey retailer has its own business model. Some buy bulk items and sell them to consumers, while others work on consignment for clients.

The advantage of buying with a retailer is that the prices are fixed. There is no need to jostle with other collectors at auction, and if you see something for sale, the only obstacle in your way is having the capital to pull the trigger.

Other plus points are that retailers allow you to buy either in person or online. Overall, these transactions are smooth and official.

Another big benefit of buying through a specialist retailer is that it cuts out the ballot process. What’s more, these shops can be an excellent way of getting your hands on new releases thanks to their relationships with retailers. Buying a new bottle through an auction can be a frustrating experience, with limited edition whiskeys going for fair considerable sums if there is a lot of hype around a new release.

Of course, there are some drawbacks to purchasing a bottle through a retailer. For starters, retailers often lack the old and rare stock that you can find at auction.

But perhaps the biggest drawback is the price. Retailers are intermediaries between either the distillery or a private owner. While they can help connect you with products that are hard to find, you’ll pay a premium for that privilege. For starters, retailers will add VAT to the final prices in addition to the profit for providing their service. Sometimes, the overall markup can be as much as 200%.

From an investment perspective, paying that sort of markup puts you in a difficult spot. The more expensive your initial purchase, the longer you need to wait to turn a profit. Buying from a retailer violates the buy low, sell high maxim. That’s not to say that you can’t purchase a bottle from a retailer and realize a profit. It’s just that the horizon will most likely be much longer, which means you need to consider the opportunity costs.

2. Direct from the distillery

Collectable bottles of whisky are typically released in limited runs. These limitations are imposed by a distillery’s limited capacity, the rareness of a cask, or deliberate artificial scarcity.

When a run comes up for sale, distilleries often use a ballot to help determine who can actually get the bottle. The same principle applies to whiskey barrel investment.

Buying from distilleries has some big advantages. For starters, they can store the whisky for you in a perfect environment. What’s more, you can find some excellent prices through this method, especially from new distilleries who need capital inject early in the venture.

3. Auction house

Auction houses are the natural environment of eye-watering deals for incredibly rare whisky. However, all sorts of vintage and collectible bottles go through auction houses across the world, selling for relatively modest prices.

In recent years, dedicated online whiskey auction platforms have sprung up around the globe to challenge the hegemony of the likes of Christie’s and Sotheby’s. Depending on demand, auction houses can be a source of good investment whisky at bargain prices. However, anything you buy requires paying an additional auction fee, which can range from 10% for online markets to around 25% at Sotheby’s.

The pros of buying at an auction include having access to a diverse range of rare and obscure whiskeys. Indeed, it’s impossible for retailers to compete with the diversity of stock. What’s more, depending on the jurisdiction, you can add to your investment whisky collection without paying VAT, which means getting bottles at a reasonable price.

Of course, there are some negatives to contend with, too. For starters, auction prices are hard to predict. This can work to your advantage when you pick something up for cheaper than you expect. However, it might lead you to ask yourself the question of why the market values an item at a lower price than you.

Another downside is that auctions aren’t frequent. Some houses only dedicate a week or so to whisky, with bottles coming up sporadically throughout the year. You need to stay active and on top of auctions, which might not be a big issue if you’re a whisky nut.

Some auction houses attract a crowd that really likes to throw around the cash. So, you might face stiff competition, especially for rare or high-potential bottles.

But that’s not the only pricing excess to think about. As mentioned above, buying from an auction means paying a fee to the auction house, which can be as large as 25%. So, if you plan to resell for a profit, you need to wait until your investment matures by this auction fee and account for inflation.

4. Private sale

Buying whiskey for investment through private sales is another interesting option. However, while you might think that you can cut out the middleman, you can’t buy or sell alcohol without a license, which is why you need a whiskey broker to complete these deals. What are the fees that these brokers charge for this service? Typically, it’s about 10% to 15%.

Using a broker can give you access to the best whisky bottles to invest in because some of these items never make it to retailers or auction houses. This benefit is particularly attractive for collectors of ultra-rare or obscure items. Indeed, building a relationship with a broker could give you first refusal on the collectible whisky of your dreams because they can keep an eye on stock throughout their network.

Another plus is that you won’t have to pay VAT, which can save you 20% or thereabouts, depending on your jurisdiction.

Of course, private sales aren’t a perfect solution. For starters, you’re limited by your broker’s network. The other thing to remember is that private sellers are pretty savvy. They know the prices that similar bottles fetch at auction or at retail, so getting a bargain requires them to be in a situation where, for example, they want to liquidate their assets quickly. Otherwise, many of these sellers can ask for above auction price.

Of course, the issues of a rational and mature market affect investors with every purchase avenue and not just private sale.

5. Whiskey stocks

Another interesting way to invest in whiskey is to buy stocks from public companies. There is not much for the whiskey collector here, and this method lacks the prestige of scotch whisky investments or cask whisky investment, but it’s a way to bet on the popularity of the drink.

Here are a few publicly floated whiskey stocks to consider:

- Diageo: Lagavulin, Laphroaig, and Oban

- Pernod Ricard: Chivas Regal, Jameson, and Glenlivet

- Brown-Forman: Jack Daniel’s, Woodford Reserve, and Old Forester Bourbons

It’s worth noting that each of these companies has had a rough 2023, in stark contrast to the S&P 500. So caution is advised.

6. Whisky investment funds

Whisky investment funds popped up in response to the public’s growing appetite for whiskey speculation. They give you a chance to gain exposure to the whisky for investment market, but without needing to own bottles or casks. They work like an ETF or mutual fund and are managed by experienced experts. Quality varies considerably, so thorough research is essential.

Should you enter whisky stock ballots?

Ballots were set up as a way to handle sales of products when demand outstripped supply. In theory, they democratize the process of buying whisky from distilleries. However, it’s not a perfect solution.

The biggest issue, from an investment standpoint, is that ballots are a form of marketing. While not all distilleries are guilty of this practice, it can be a way to imply that whisky is far more in demand than it really is.

What’s more, the suspicion remains that the manufacturers can impose a hard cap on production rather than it being something that is limited in rarity. For example, a distillery could have good data on the expected demand for their product. In almost all other areas of business, they would ramp up products to meet or even saturate that demand. However, in the world of collectibles, this would perhaps suppress the price and affect the perceived scarcity of the product.

So, we can see that the advantages of the ballot for distillers are threefold:

- They allow whisky distilleries to, in effect, pre-sell their products

- They satisfy the demand of those who buy the bottles while leaving others without a bottle

- They imply that the demand and exclusivity of the bottle is increased.

There are some things that you should be careful about when evaluating a bottle on the basis of a ballot. For example, the fact that there is a ballot for a particular bottle does not mean that it will automatically sell out. Plenty of investors have found that demand was softer than expected after the won at a ballot.

However, this is not the only thing that you need to worry about. You also need to think about bots.

How do bots affect online whisky ballots?

Software robots, also called bots, are used across a wide range of items on the internet. People use them for concert tickets, sneaker releases, and for whisky ballots. In essence, these automated programs can rapidly purchase an item far quicker than a human.

Two situations can happen here:

- Bots can snap up all the available bottles

- Bots can enter the ballot multiple times, increasing the programmer’s likelihood of winning the ballot.

The consequence of this is that many bottles hit the secondary market. What’s more, it makes the demand seem higher than it actually is. So, when you go to sell on the secondary market, the prices will be softer because there is more supply than you suspected because the people running bots bought with the idea of flipping on the market.

Is flipping whisky a legitimate strategy?

While many distilleries and collectors frown on flipping, there is no point in pretending that the process doesn’t hold attraction for investors. The primary difference is that the cashing-out horizon is much shorter than that of long-term investors.

But let’s think about how this strategy can affect the long-term situation of the market with a creative case study.

A distiller releases 100 bottles of a limited whisky. There is high demand, and the bottles sell out. Soon after, a few of the bottles go to auction and private sale, thus roughly satisfying the demand.

If you attempt to sell your bottle after the demand has been sated, you might miss out on this initial spike. Therefore, flippers are incentivized to sell quickly while the price is high.

Of course, in many ways, the above is the best-case scenario. If you buy one of the 100 bottles and the release does not sell out, then you are left with a product that will not go up in price and perhaps could even drop.

Are the best whiskey investments in individual bottles or collections?

Whisky investors love a collection. Distilleries are more than aware of this fact, and as a result, they have put together many collections in recent years, often with some additional items like a book, special cases, or, in one example, a cabinet. So, the big question is whether bottles are worth more if they are part of a collection.

The short answer is that yes, in the case of rare or limited whiskey, having a complete collection can be worth more than each bottle if broken down and sold individually.

However, it’s worth considering that a collection that fetches more than its constituent parts could be a less liquid asset than individual bottles. Indeed, the potential market for collections is smaller than individual bottles, so you may need to wait a while before finding a seller.

Is a whisky cask purchase the

best option for investors in 2025?

When deciding between a whisky cask and a whisky bottle, one of the first things that you should think about is tax implications. In particular:

- Whiskey casks are considered “wasting assets” because they have a life of around 50 years or less. As such, they are exempt from capital gains tax

- Whiskey bottles, on the other hand, can last far beyond that. So, you’ll need to pay capital gains tax on sales above £6,000.

Of course, whiskey barrel investment has a considerably different timeline than bottle investment. For starters, Scotch whisky investments via cask take three years for the product to be legally considered whisky. From there, you also need to let the bottle mature. So, you are looking at a lot of years before the product matures into something that might be interesting. However, it’s important to note that casks are available for purchase at various stages of maturation.

The other thing to think about here is that you are buying in bulk before breaking the cask down into bottles at a later date. Let’s say that’s a 10-year process. You are effectively given the distillery a 10-year advance on a product that needs to beat inflation. Profits are possible, but there are a lot of variables that can affect your returns.

Should you invest in bourbon?

While most of this guide has focused on fine whisky, there are other bottles that sell well at auction, too. So, can bourbon be the best whiskey investment?

Bourbon investment is an interesting whiskey for investment niche. It’s primarily US-made, so it is more popular in the North American market, but there are plenty of exceptions. What’s more, bourbon as followed a similar upward trajectory as the whisky investment market over the last decade or so, with one bottle going for as high as $100,000 at auction in 2021. Again, select bourbon casks have skyrocketed since 2010, with an average return of 13.8%.

If you’re buying new-release bottles, the website The Bourbon Culture has some advice. They say that even limited runs of just 100 bottles follow a predictable pattern where collectors and investors panic buy bottles on the secondary market, but once demand is sated, this causes price drops of as much as 33% over two months, as was the case with Four Roses Small Batch Limited Edition.

If you have a good feel for the market, you should invest in bourbon.

Factors that augur well for whisky

investment in the future

While the market has slowed down since its peak, there are still positive signs for investors in 2025 and beyond. Here are a few things to look out for.

1. Developing countries will play a bigger role

Whisky is already very popular in Asian countries, where it is seen as a status symbol. In particular, India and China are major importers and appreciators of fine whisky. However, as these countries develop economically, an emerging middle class with more disposable income will boost the market.

2. Falling interest rates

If high inflation continues, we may see more investors enter the whisky market as they seek investments to hedge against the erosion of savings. However, world banks have attempted to tackle these issues with interest rate rises, which means there is less capital for investment.

Financial experts say interest rates will be cut during 2025, with the most optimistic predictions suggesting that Q2 will see interest rates drop. If that happens, the fine whisky investment market could bump prices.

3. Growing interest among younger generations

Bonafide Research’s Global Whisky Market Overview, 2023-28 report valued the market at $2.7 billion in 2022. However, they predict a CAGR of 6.34% and a total value of $127 trillion by 2028.

Indeed, there is reason to believe that whisky may be the drink of choice for many millennials who are on the hunt for authenticity. In some markets, such as South Korea, this appreciation for whisky has caused exports to increase by 80% in 2023.

Best whiskey investment tips for 2025

The global whisky investment market reached a stunning peak around 2018. That was a period of incredible accelerated growth. However, as this alternative asset class grew in size, the market became more efficient.

The fallout of this incredible rise is that investment funds have touted the high potential returns within the whisky market. Some are even pointing to historic highs and telling investors they, too, can 500x their investments.

While the market is still buoyant and profits are there to be made, it may be a long time, or never again, before we see this kind of growth. This should not come as a surprise to investors. However, if you temper your expectations, there are still good returns to be made from whisky investments.

Here are the best whiskey for investment tips to help you navigate the market in 2025 and avoid disappointment.

#1. Go deep with your research

There are lots of incredible repositories of data about whisky prices, both at auction and from retailers. Like with any investment, you need to stay on top of the trends and look at the causal factors behind the prices.

For example, a Macallan Red Collection went for almost $1 million at Sotheby’s in late 2020. However, the proceeds were for charity. As a result, it went well above the asking price. So, if you see a Maccalland Red Collection going for half that amount, you shouldn’t see it as a sign to remortgage the house and collect a cool £1 million. The lesson here is that numbers are all well and good, but context is everything.

#2. Don’t rule out whiskey cask investment

A whisky cask purchase gives you a few options. For starters, you can hold on to the cask and let it mature before bottling. This is definitely a long-game type of investment, but it could be where the profits are. For example, you could buy a 10 year aged cask and wait it out until it hits 15 or 20.

#3. The highest returns lie in the riskiest propositions

This maxim is true in all investments. However, it’s particularly true in the case of new-make spirits. In essence, these products have not yet become whisky. They need at least three years before they can be classified as such, and then they need to be matured in barrels in the hope that they become an enjoyable drink for future collectors.

There are so many variables at play that you’d need to be a soothsayer to predict how each cask may turn out. What’s more, you’ll also need to account for how tastes and styles of whisky will change in the future.

There are lots of new distilleries emerging on the market. Many of them have skilled distillers and offer a lot of potential. However, not all of these businesses will emerge from this decade intact. Be very careful about how much exposure you have to these new players, even if you have an above-average appetite for risk.

#4. Exercise caution with whisky funds that offer the moon and the stars

Any whisky fund that tries to tell you that you can achieve 2010 to 2018 levels of returns in 2025 is suspect. The market has changed, and these sorts of gains are only available within specific scenarios. We are not here to say that these numbers won’t be posted again, but slow and steady returns are far more likely. If someone promises you 40%, be very, very cautious.

A more recent 2020 report further emphasises the growth of the “whiskey as investment” trend over the years:

OUR PICK OF TOP 10 WHISKIES INVESTMENTS

FOR 2025 (IN OUR OPINION)

With whisky fast becoming just as valuable a resource as luxury watches or jewellery, what has long been a collector’s asset for some has become an excellent form of investment for others.

As for the best whisky to invest in 2025, there are plenty of promising options out there – but these make out the top ten as part of our whisky investment guide if you’re considering rare whisky investment for yourself:

1. Glenlivet 1981 Whiskey Exchange Exclusive

There’s nothing like exclusivity to raise the value of a whisky investment, and Glenlivet’s 36-year-old single malt scotch, complete with a sherry finish, is undoubtedly a collector’s piece.

With a limited number in circulation, totaling 702, this is one of the best whiskey investments you could make in 2023 and is likely to increase in value over time (provided you store it safely for long enough).

Amongst the best whisky to buy for your 2025 investment portfolio, these bottles currently go for below £600 – and that price is only likely to shoot up once the limited edition runs out.

2. Diageo Game of Thrones Collection

First released in 2019, with sales still coming through in the 2021s, this unique collector’s whiskey is all about having the set over a single bottle. With a complete series of 8 bottles trailing for £398, sets have already entered the auction market for triple that.

But considering the scarcity of this unique collection, and the connection with a fan-favorite series, the value of these bottles is only going to rise, making it yet another exclusive whisky that will increase in value.

If you can get your hands on every one, each created in one of Diageo’s distinct distilleries, it just might be one of the best whisky to invest in 2025.

3. Bowmore 1973 Islay

Bowmore has already made a name for themselves in the whisky auction field, with their bottles fetching incredible prices depending on rarity and distillery date.

The 1973-distilled single malt scotch was only bottled back in 2016 – giving it an incredible 32 years to reach maturation to a near-perfect standard.

While an initial bottle is costly, with prices set at £6,500, investing in this particular whiskey could be a fantastic return on investment in 2025 if you’re willing to hold on to it for a good few years to increase upon scarcity and make it worth the rare whisky investment.

4. Macallan Rare Cask 2020 Release

Macallan is a big name in the auction circuit, and a solid choice for cask whisky investment in 2025 if you’re considering breaking into to market for the first time.

The brand itself has a good track record, but the Rare Cask series, in particular, is far more than your average tipple. With only 1% of Macallan’s whisky deemed suitable for Rare Cask, this one’s an excellent find – and with a few year’s wait, can easily be worth a reasonable sum if you consider Macallan rare cask 2025 investments.

A starting price of £225 is affordable for just about any investor that wants to whisky invest direct – even if you choose to buy in bulk.

5. GlenDronach 1992 27 Year Old

With a total of just 304 bottles, and as one of the last creations of the old-school GlenDronach distillery before its closure for six years, this whisky has the kind of rarity that’s sought-out by collectors and investors alike.

Matured in a single sherry butt, this limited edition was bottled relatively recently and sold out quickly – making it one worth spotting for a potentially valuable whiskey investment in 2025.

With a price tag of £300, this one isn’t too expensive either, making it an even better proposition for those who may not be very familiar with how to invest in whisky.

6. Glenglassaugh 1978 40 Year Old

If you’re still wondering ‘which whisky to invest in 2025?’ that’s more middle of the road than inexpensive or a large investment, then the £999 Glenglassaugh 1978 40 Year Old might just fit the bill.

A store exclusive for The Whisky Shop – further adding to its rarity – only 298 bottles were created in total in 2019. As a notorious distillery that has spent more time with its doors closed than open, and with a long history dating back to 1875, this is a brand that can be found on countless whisky investment guides around the world.

7. Macallan Exceptional Single Cask 1950

It wouldn’t be the best whisky investment in the 2025 list without a second mention of one of the biggest investment brands in the business.

These bottles are on the costly side, with a limited run of 336 and maturation for nearly seven decades to add to their appeal. For £69,000 per bottle, this Macallan is a serious investment piece – but for those looking for the best whisky to buy for investment for more significant returns, this particular Speyside single malt has plenty of appeal.

8. GlenDronach 18 Year Old Allardice

If you’re after a slow burn whisky investment instead of a quick return, then this brand of GlenDronach might be the ideal choice for you. If you’re looking for a speedy increase, this one may not be the best whisky to invest in 2025.

But if you’re willing to wait, a slow and steady rise is standard for these bottles, allowing you to dip your toe in the water of cask whisky investment with a little less risk.

Created from limited-edition yearly casks, the £100 price point of the GlenDronach 18 Year Old Allardice is particularly attractive. Not quite as costly as the 1992, but valuable nonetheless.

9. Tamdhu Edinburgh Airport exclusive

Tamdhu is a rising star in the 2025 whisky investment market, thanks to their small batches and award-winning approach to whisky creation. A price tag of £279 makes this bottle more affordable than others on the market. With a small-scale operation and minimum runs, this is one option that can really pay back on investing in whisky casks and bottles.

Bottled in 2019, with a limit of 597 bottles, this one’s an Edinburgh Airport exclusive, further adding to its rarity.

10. Johnnie Walker Black Label Directors Cut Blade Runner 2049 Whisky

It isn’t just film buffs that love this unique, limited-edition blend of investment whisky. While slightly less scarce at 39,000 bottles created, the special packaging and unique, smoky twist are sure to make the value of this collector’s item shoot up over time.

With a starting price of £399.95, if you’re looking for a long-term proposal, this may be one of the best whisky to buy for investment. You won’t see a return quickly, but it’s an excellent collector’s piece to have in the meantime.

With whisky now a fully-fledged investment field, finding the best whisky to invest in is the key to seeing that fantastic return on investment beyond 2025.

But as with jewellery, cars, or watches, time adds value: so patience is required to really see the worth when you whisky invest direct online or through a broker. Rare whisky investment is very much in its infancy, so now is the best time to invest in what you can, and maybe take a few small risks up-front to see what works for you.

11. Hibiki 21 Year (Wooden Box Limited Edition)

With a beautiful depiction of Mt Fuji on its limited-edition case, this 2,000-run Japanese whisky is incredibly ornate, further adding to its appeal at auction. With a single bottle selling for €800 at auction in 2017, Hibiki’s limited edition whisky is likely worth even more today, making it amongst the best whisky to buy for investment in 2025.

What is the most collectible whisky in 2025? (Further Thoughts)

When it comes to whiskey investment in 2025, as we have seen, the lots that are going under the virtual hammer are bottles spanning five decades; the oldest was bottled in 1945, while the most recent was bottled 30 years ago, in 1987.

Perhaps the most eye-catching lot to invest in is lot 42, which contains one bottle of The Macallan whisky from every year in 1954-1986. The collection of 33 bottles has been valued at between £57,000 – £72,000.

Another one of the best whiskey to invest in (and the costliest) is the Macallan Selected Reserve 1946, originally bottled in 1998 as a 52-year-old whisky. Of course, in 2025, this whisky is more than 70 years old and has been valued at £7,800 – £9,800.

Another lot to keep an eye out for in 2025 when considering investing in whisky is a collection of Macallan Gran Reserva whiskies, one for each year from 1979 to 1982. This collection is expected to fetch between £6,700 and £8,800.

Much like fine wines, old and rare whiskies will often be of particular investment value to collectors.

When it comes to provenance, the head of wine and whisky at Bonhams Hong Kong once said that they often pick The Macallan distillery because they believe it is one of the best investment whiskey, loved by collectors, investors, and enthusiasts alike. Certain whisky enthusiasts may disagree with the accuracy of that statement, but there’s no doubt that the brand is among the very elite in the world of Scotch whisky.

Here at New Bond Street Pawnbrokers, we manage multiple portfolios of valuable collections, and recently we achieved a sale on behalf of a client at Bonham’s that was particularly memorable.

If you’re looking to pawn fine wines, get in touch with us today. Our Blenheim Street pawn shop is based in the heart of Mayfair. Appointments can be made, but are not 100% necessary; we’re always happy to take walk-ins. We look forward to seeing you – and your fine wines – very soon. Some of the wine we loan against includes Chateau Petrus, Chateau Margaux, Chateau Lafite, and Chateau Mouton to name just a few.