I hope you enjoy this blog post.

If you want us to appraise your luxury watch, painting, classic car or jewellery for a loan, click here.

Pawnbroking assets vs. Bank Loans – Myths & Realities

Bank loans allow the individual to borrow against their credit rating. A collateral loan, in contrast, allows the individual to borrow against the value of an item that they own. With a collateral loan the individual is staking their owned item against the borrowing and the most that can be lost is the agreed item, which is known as the collateral.

When borrowing against your credit rating the borrowing is ongoing and the fees for missed payments and the damage to your credit rating can be far greater than the original borrowing. Herein we explore the differences between collateral loans and bank loans in greater detail.

What is pawnbroking?

Pawnbroking is a system whereby a pawnbroker offers a loans to individuals, with personal property pledged to the pawnbroker as collateral. A pawnbroker can operate on an individual basis, or as part of a business, known as a pawn shop. Believe it or not, pawnbroking is one of the oldest surviving professions, with its roots in 5th Century China.

It arrived in the UK following the Norman invasion in 1066, with pawnbrokers from the financial hub of Lombardy setting up shop in London. To this day, Lombard Street in the City of London bears the name of the Lombard pawnbrokers to honour their contribution to the City. Many centuries later, pawnbroking is still going strong, and showing no signs of going anywhere.

What is a bank loan?

When you take out a bank loan the money is loaned to you based on your credit rating alone. This means that you are borrowing against your rating as a strong financially responsible individual. Doing so can be risky, however, because there are wider consequences to borrowing in this manner if you miss a payment. Missing a payment will lead to fees being placed on your account, increasing the value that you then need to repay.

More so than this, however, a missed payment can also affect your ability to borrow again in the future. When you miss a payment on a bank loan, this is recorded on your credit rating and will impact on lending that you are able to get in the future. Bank loans can be effective when you know that you will always be able to meet the repayments but are not worth the risk to your credit rating if you are uncertain about your repayments.

What is a collateral loan?

A collateral loan is a loan that is taken out against an item of value that you already own. The item is used as collateral against the loan you are taking and this enables you to borrow without ever placing your credit rating at risk and without having to report the borrowing in any way to any financial institutions.

There are many benefits to this as it enables you to borrow without any risk of harming your financial position and suffering the wider impacts of having a poor credit rating.

Collateral borrowing can be carried out against a wide range of different items including fine wines, art, jewellery, watches, diamonds, gemstones and other items of value. This allows the individual to unlock the value of their assets and access cash over the short-term without risking anything more than the asset that they are putting up as collateral.

How does a collateral loan work?

The first important step in a collateral loan is that you need something that is valuable and that you don’t mind spending some time without. Almost anything can be pawned but you will need to hand it over to the pawnbroker during the period of the loan. The pawnbroker will then assess the item that you have put forward to pawn and will calculate the value that they are able to offer as a loan in return for the item.

The pawnbroker will then keep the item until the loan is repaid unless you decide to forfeit on the loan. In this case, they will keep the item that was pawned and you are freed from any obligation to repay any of the borrowed money. Unlike a bank loan the debt is then covered with no fees, nothing further due and no damage to your credit rating whatsoever.

What are the benefits of collateral loans over bank loans?

There are several benefits of collateral loans over bank loans. Not least is the benefit that there is no risk to your financial standing when you take out a collateral loan. A bank loan will leave you at risk of damaging your credit rating through failure to pay and will also lead to an ever-increasing debt that you need to repay because of the fees and charges that will develop over time. A collateral loan will also give you much more rapid access to cash.

As the collateral is placed far fewer checks are required before you can be given cash so you can expect to receive the payment of the loan immediately into your account or as cash depending on the value. Discretion is also a major benefit when you make use of a collateral loan as you will not need to receive any posted or digital communications about the transactions at all.

All of the paperwork can be completed in the store, meaning that you can keep all of the interactions discreet between yourself and the pawnbroker lending you the loan.

The biggest difference between a collateral loan and a bank loan is in the risk that you take when you take the loan out. When you take out a collateral loan you risk only an asset that you already own. When you take out a bank loan you risk your credit rating and your financial standing against the borrowing you make.

Taking out a loan with New Bond Street Pawnbrokers can help you to get access to cash instantly without having to borrow against your credit rating. This discreet and instant release of funds from assets can help you to keep on top of cash flow over the short term without having to go through credit checks and other delays.

There is also far less risk when using a pawnbroker as you will be borrowing against the value of the item rather than borrowing against your credit rating. Here we explore why you should take out a loan with a pawnbroker.

Study shows that more people would pawn

if they understood the process

A quarter of the general public have stated that they would consider using a pawnbroking service if they understood how it worked, according to a study by the National Pawnbrokers Association. Sadly, the Pawnbroking industry is often misunderstood, but for people who are asset-rich it can be one of the best ways available to raise capital. Indeed, go on the website of any pawnbrokers’ (ours, for one) and you’ll see a page describing the process.

In reality, the process is very simple. If you pawn an item, the broker will offer you a loan against the value of that item. There will be an agreed period of time in which the loan can be paid back, after which the pawned item will be put up for sale by the broker.

In these times of financial recession, it’s becoming tougher and tougher to secure a bank loan, so if you have valuable wares available, pawnbroking can be a more favourable option. Yet, the issue of misunderstanding remains. A staggering 90% of the population are aware of pawnbroking, yet very few understand it, as per a study by Bristol University.

Why is this? There’s a misconception about the pawnbroking industry that people who pawn their items are unlikely to see them again, that the pawnbroker will sell it off at the first opportunity. This is not so; 85% of loans against items at pawnbrokers across the UK are paid off. Here at New Bond Street Pawnbrokers, we’re keen to do away with the old-fashioned taboos, and show the industry as it really is; a safe, quick, and cheap way of raising capital as an alternative to a regular bank loan.

Those who frequently take out loans from pawnbrokers have a great deal of trust in the system, and many believe that the stigma is entirely unfounded. With a lower risk, and lower interest offered by pawnbroking services, it’s no surprise that customers are very happy with the service.

The Bristol University study found that 95% of pawnbroking customers were either ‘satisfied or very satisfied’ with the service. Not only this, but pawnbroking is actually on the up, with a huge 8% growth between June 2012 to June 2013

Additionally, customers typically build up good relations with their broker particularly in special situations, more so than their bank managers at the very least. This is shown by the high customer loyalty statistics; 71% of pawnbroking customers never switch their shop. This is typically because their pawnbroker is close to their home, and part of their community.

Compared to a bank loan, it’s actually a relatively simple process. There’s no credit check, little paperwork, and the cash can typically be available on the same day. Thanks to the loan being given against an item, rather than the lender’s credit rating, even those with significant debt can be confident of securing a loan.

Access capital instantly

One of the major benefits of taking out a loan with a pawnbroker like us is that you will get instant access to capital. With in-store asset analysts you can enter confident that you will be seen and your assets will be assessed promptly to allow you to get access to funds in just a short amount of time.

When you agree a loan we will grant you access to the funds immediately so that you have the money when you most need it. Taking loans out against items means that you can do so instantly and will not have to wait for long periods of time for approval and to get access to your funds.

Unlocking the value of assets

When you have assets of value it is far more sensible to unlock the value of those assets instead of borrowing against other aspects of your finances. Jewellery, artwork or other high-value items such as watches can hold significant value that is unlocked when it is simply shut away in your home, but New Bond Street Pawnbrokers can enable you to unlock this value and will give you access the value that you own beyond the assets that you hold.

With 60 years of experience in brokering and trading, New Bond Street Pawnbrokers are able to assess the value of items and offer a loan that is both significant and excellent value for the piece in question. With dedicated appraisal teams in-store for each type of asset that you may wish to pawn the experience afforded by this reputable firm will help you to get the loan that you deserve and unlock the real value from your assets.

Discreet funds

Importantly New Bond Street Pawnbrokers is a very discreet and quiet way of accessing funds that allows you to withdraw funds without alerting any financial agencies or anyone else of your borrowing. When you borrow through other means you will invariably have to undergo credit checks and other processes to ensure that you are able to cover the cost of the loan and will usually be required to receive communications at your address.

At New Bond Street Pawnbrokers, however, you will be able to carry everything out discreetly and nothing needs to be sent to you digitally or by post so you will be able to keep your transaction and your borrowing completely private at all times.

Borrow against the item

Most significantly, your borrowing is made against the value of the item that you are taking to the pawnbroker. Normally when you borrow or take out a loan this is done against your credit rating and this can serve to harm it. If you are to miss payments you will also be at risk of suffering further consequences as your credit rating reduces and your borrowing increases in cost as a result.

By unlocking the value of the asset at New Bond Street Pawnbrokers, however, you will instead be able to borrow in the knowledge that it is only the item you are borrowing against that is at risk of loss if you cannot repay the loaned amount. You will not under any circumstances suffer damage to your credit rating from such borrowing which keeps you safe in your other investments and will help to protect your financial position at all times.

If you are in need of fast, discreet and hassle-free access to a pawnbroker, then New Bond Street Pawnbrokers can be the perfect solution for your needs. Based in the heart of London, we are an easy-access pawnbrokers with a huge amount of experience in dealing with luxury assets.

From fine art to jewellery, wine, watches, antiques, diamonds and gemstones, our team at New Bond Street Pawnbrokers are highly experienced brokers making us perfect for your high-value borrowing. This experience in brokering and trading allows us to offer the highest possible value for pieces and this ensures that you are able to release the best possible value from your assets.

A step by step guide to the pawnbroking process

Confused by the pawnbroking process? You’re not alone. Studies have shown that more people would pawn if they understood the process. Therefore, our aim with this blog post is to break down the process of taking out a loan with a pawnbroker step by step. Read on for our definitive step-by-step guide to the pawnbroking process.

1. Choosing your item

Unlike a traditional bank loan, which uses the customer’s credit rating as collateral, a pawnbroking loan uses a valuable piece of the customer’s personal property as collateral. This means that, in order to take out a pawnbroking loan, the first thing you’ll need is a valuable item that you own.

You need to choose something that you won’t want or need to use over the period of the loan, because the pawnbroker you visit will hold onto the item for safekeeping until you can repay them.

Once you have chosen an item, do some research to attempt to ascertain its value. This can save you a wasted trip if you find out that the piece isn’t as valuable as you had hoped. You should also gather together as many provenance documents as possible – that is, documents that prove that you own the piece, and that it is legitimate. Once you have done all of this, you are ready to take your item to a pawnbroker.

2. Valuation

Once you’ve got the item you’re looking to pawn, you need to pick a pawnbroker that is suitable, and take it to them to be valued. While most pawn shops are generalist, and will happily take a look at almost anything of value, some pawn shops (like ourselves) are niche, and will only accept certain types of items.

When you’ve found a suitable pawnbroker, you should arrange a valuation of your item with them. They will use their experience in the field to place a value on the piece, which is based on the item’s market value. This is because this is the amount of money the pawnbroker will be able to sell the piece for if you choose not to pay off your loan. This means that the item’s current value provided to you by the pawnbroker could be higher or lower than what you originally paid for it.

3. Loan offer

Based on the valuation, the pawnbroker will then make you a loan offer (typically for the same amount as the valuation). If the valuation and/or the loan offer is not to your liking, you are free to walk away with your object at this point. Any pawnbroker worth their salt will not charge you for a valuation, so – financially – this is risk free.

4. Acceptance of loan

If you decide to accept the loan, the pawnbroker will draw up a contract detailing the terms and conditions of the loan. There are two things to keep an eye out for here; the length of the loan, and whether or not a contract extension is allowed. More on both of these points later. Again, if you take issue with anything that is in the contract, you are still able to walk away with your item, provided that you don’t sign.

Once you’ve signed the contract, the pawnbroker will take the item into their care, and give you the amount of money they offered you in the previous step. Most pawnbrokers will do this via bank transfer, but some will give you cash, especially if your item is of relatively low value.

5. Loan period

During the loan period – as stated in your contract – the money is yours to do what you wish with. You have until the end of the loan period to pay off the entirety of the loan, and get your item back in return. Your contract will also state whether or not the loan period is extendable or not.

If it is, you are able to choose whether or not to trigger an extension to the loan period once it ends. If it is not, the date that the loan period ends is the final date you can pay off your loan and reclaim your item. The loan period for a pawnbroking loan is typically seven months maximum, so you usually have time to make financial arrangements for the repayment of your loan. Indeed, many people who choose not to pay back their loan do so out of choice rather than necessity.

6. End of loan period

Once your loan period is over, you have three choices. Firstly, you can pay off the loan, in which case your item will be returned to you. Secondly, you can extend the loan to give yourself more time to pay it off, provided that this is allowed as per your contract. And finally, you can choose not to pay off the loan, in which case the pawnbroker will sell the item in order to recoup the money they paid to you.

What does New Bond Street Pawnbrokers loan against?

The valuation and appraisals team at New Bond Street Pawnbrokers is led by David Sonnenthal, the resident expert for Channel 4’s antiques show ‘Four Rooms‘. We have a skilled team of specialists who can accurately assess the value of your items, ensuring that you get the best possible deal when you loan against your assets.

We offer loans against all manner of luxury goods and high-value items, from prestige watches and fine art pieces to diamonds and jewellery. Unlock the value in your prized possessions now and retain ownership for the future. When you loan against a high-value piece, New Bond Street Pawnbrokers will ensure that it is kept safely and securely for you until the loan is repaid, so you know your special items are in the safest of hands.

Fine watches

Luxury watches and timepieces often carry an extremely high value. This value is determined based on the materials used, the brand or the maker, the age and condition of the piece and the provenance of the item. Manufacturers with the best reputation tend to produce the highest value timepieces: watches by Rolex, A Lange Sohne, Audemars Piguet, and Patek Philippe are among the most frequent names brought in to us for valuation.

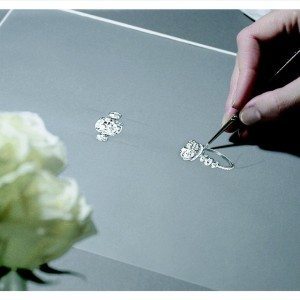

Fine jewellery

Jewellery is valued against a number of conditions, including the materials and gems used, the age and condition of the item, the origins and provenance of the piece and its anticipated retail value on the modern market. We will consider any fine jewellery piece, including bracelets and necklaces, rings, earrings, brooches and pins, and individual diamonds, gemstones and pearls. If you have the laboratory report for your jewellery, we can often provide you with a higher valuation against which your loan can be taken.

Fine art

As specialists in valuations and appraisals, we are well placed to give you an accurate assessment of your fine art pieces. If you are in possession of original pieces by prestigious artists, you could unlock the value held within them by bringing them to our Mayfair pawnbrokers. We consider the artist and their reputation, the quality and renown of the work, the condition it has been kept in and the market value of similar pieces. Our artwork loans are offered against paintings and drawings, sculptures, and ornamental or decorative pieces.

Fine wine

You may not realise it, but vintage wines are also eligible for our pawnbroker services and we are happy to loan against prestige wines for our clients. If your wine cellar is filled with classic wines and spirits from the world’s finest orchards and distilleries, you could take advantage of their value and unlock their worth. Our appraisal specialists will give you an accurate valuation of your vintage wine collection based on age and origin, label condition, and its storage and trade history.

Diamonds

Raw or cut diamonds are some of the world’s most valuable items, and if you have high-quality diamonds in your possession then New Bond Street Pawnbrokers is able to offer you a loan against your gemstones. We will give you an accurate valuation of your diamonds, based on history, clarity, carat and condition, and we will keep them safe for you while your loan is repaid. If you are able to offer the original certification report for your diamonds, we are likely to be able to offer you a better price.

Antiques

Your antique assets are ideal for borrowing against, as they retain value and may even increase in value over time. From furniture and ornamental items to coins, glassware and china, toys, weapons and even clothing, we can help you benefit from the value of your high-end items without having to sell them on and lose them forever. Every antique item is different and our in-house experts will need to assess your piece and determine its value, based on its history, rarity, market value and condition.

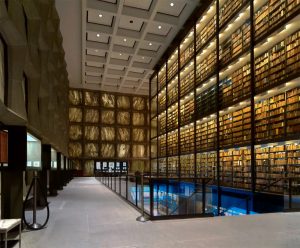

Rare books

There is a huge market for antique books, especially first editions and rare prints, or signed copies of classic stories. Children’s books that have become beloved classics are among the most sought-after, and antique books can fetch tens of thousands of pounds at auction. If you have antique books in your collection, bring them to New Bond Street Pawnbrokers and we will offer you a loan against their value.

Classic cars

Classic cars are among the most high-value machines on the road, and they hold plenty of value which our pawnbrokers can help you make the most of. New Bond Street Pawnbrokers will consider loans against vintage, classic and luxury cars across all classes, and we aim to give you the very best price based on your vehicle’s valuations. From Bugattis and Koenigseggs to Aston Martins and Rolls Royces, we will consider all makes and models in the prestige category.

If you have high-value assets and you want to secure a loan against them, contact the luxury goods specialists at New Bond Street Pawnbrokers today, and let us help you make the most of the cash stored within your high-end assets.

This post is also available in:

Français (French)

Deutsch (German)

Italiano (Italian)

Português (Portuguese (Portugal))

Español (Spanish)

Български (Bulgarian)

简体中文 (Chinese (Simplified))

繁體中文 (Chinese (Traditional))

hrvatski (Croatian)

Čeština (Czech)

Dansk (Danish)

Nederlands (Dutch)

हिन्दी (Hindi)

Magyar (Hungarian)

Latviešu (Latvian)

polski (Polish)

Português (Portuguese (Brazil))

Română (Romanian)

Русский (Russian)

Slovenčina (Slovak)

Slovenščina (Slovenian)

Svenska (Swedish)

Türkçe (Turkish)

Українська (Ukrainian)

Be the first to add a comment!