I hope you enjoy this blog post.

If you want us to appraise your luxury watch, painting, classic car or jewellery for a loan, click here.

Top 15 Rare Books Ever Sold as of 2024 ( + Guide to Old Books Investment)

Not sure whether you should be investing in rare books in 2024? Want to know what were the top 15 most rare, old, or expensive books in the world ever sold at auction?

Literature carries a wealth of knowledge that stretches far beyond the words on the page. Book collectors can range from seasoned collectors with a home collection to expert collectors who actively seek out rare and old books to build their collections further.

If for whatever reason, you find yourself in need of additional funds then you might find that investing in rare and old books may pay off beyond 2024…you may be able to take out a collateral loan against the value of some of the more valuable copies in your collection.

TOP 15 RARE & OLD BOOKS IN THE WORLD,

EVER SOLD AT AUCTION AS OF 2024

As we move through the age of digital information, rare books provide us with a link to the past. However, the rare book market is adjusting to our more connected era. Sotto voce sales (between clients and private dealers) are becoming a thing of the past, with most high-profile deals happening at auction.

Indeed, that’s not the only shift. Recent years have seen the demographic of rare book buyers change. Where once typical buyers were business people in their 50s, the new generation of buyers are VC firms or tech magnets that have spent their lives immersed in digital information. In fact, the industry has transformed so much over the last few years that it was even featured in the New York Times Style section.

The industry is growing at pace, and while religious texts are still the most treasured and expensive books, the list of most expensive books features some first editions that reflect contemporary tastes.

However, there is a lot to think of from an investment perspective. While our very expensive books will be out of reach for all but the most well-capitalized investors, there are huge opportunities for savvy buyers. For example, original copies of Darwin’s Origin of the Species have 10x in recent years.

Similarly, first editions of popular contemporary texts can shoot up in price for prescient investors. In effect, many investors buy the books that resonate with them. If a text has significance to their childhood, a first edition can fetch an excellent price.

So, let’s take a look at the world’s most valuable books sold at auction as of 2024 to give you an idea of the market.

CODEX SASSOON

The Codex Sassoon is a book that contains all 24 books from the Hebrew Bible. The text is dated around the late 9th century and is considered one of the most complete versions of the Hebrew Bible. The book is named after its previous owner, David Solomon Sassoon.

The codex is written in Tiberina Hebrew and features 792 pages. Only about 8 pages are missing, which is remarkable for a text of its age. While the text is beautiful and deeply intricate, it is also known for the occasional spelling or punctuational mistakes.

In May 2023, Alfred H. Moses bought the book for a cool $38.1 million. It is now on display in the National Library of Israel in

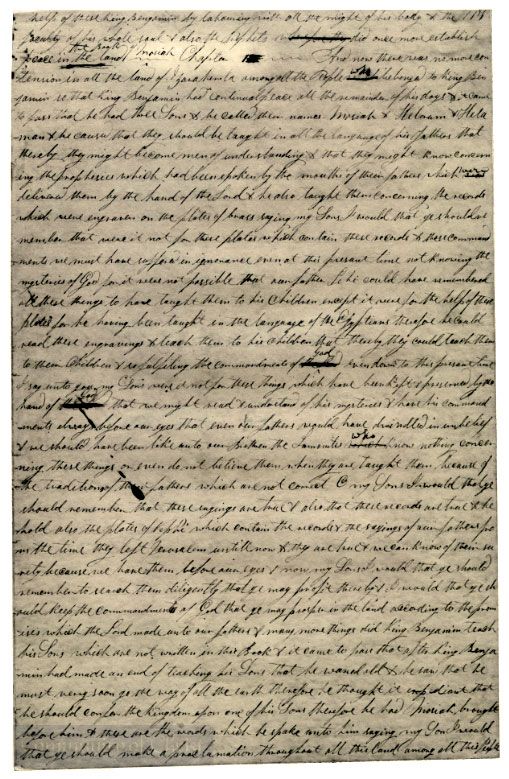

Printer’s Manuscript of the Book of Mormon

One of the earliest copies of Mormonism’s most sacred text, the religious group believes that Joseph Smith translated the found writing with God’s help in 1827.

The print that brought in so much money was one of the original copies of Joseph Smith’s texts. One of the earliest adherents to Mormonism, Oliver Cowdery, hand-wrote this copy of the “Book of Mormon.”

Cowdery gave this valuable rare and old book to David Whitmer, and his grandson sold the work to the Community of Christ in 1903. After over a century in the Community’s possession, the Mormon Church of Jesus Christ of Latter-Day Saints used donations to purchase the manuscript for $35 million in 2017, a worthy entry in our 2024 list of the most expensive rare and old books in the world ever sold at auction.

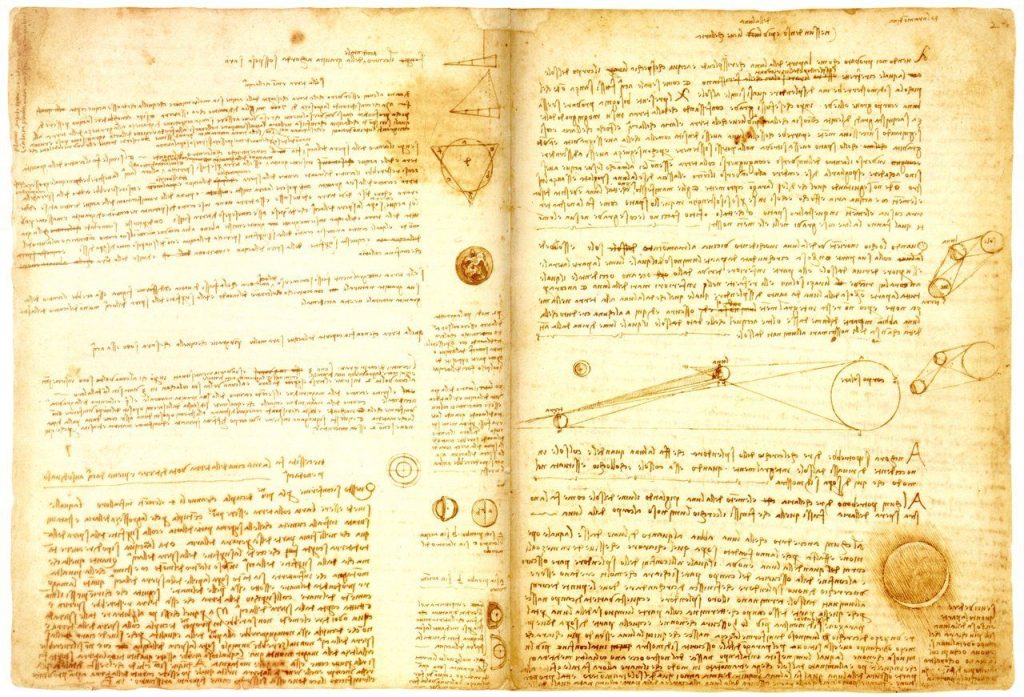

Codex Leicester

The “Codex Leicester” is a journal of Leonardo Da Vinci’s scientific writings, making it one of the rarest, oldest and most expensive books in the world as of 2024.

Da Vinci wrote the “Codex Leicester” by hand between 1504 and 1508, and Thomas Coke, the Earl of Leicester, bought this rare book in 1719. His family owned the manuscript until 1980, when art collector Armand Hammer aquired it for $5.1 million.

Hammer’s investment in rare books paid off when Bill Gates purchased Da Vinci’s work in 1994 for $30.4 million. Gates, famous for tracking down antique, rare and old books for sale, has loaned the work to museums for all to enjoy.

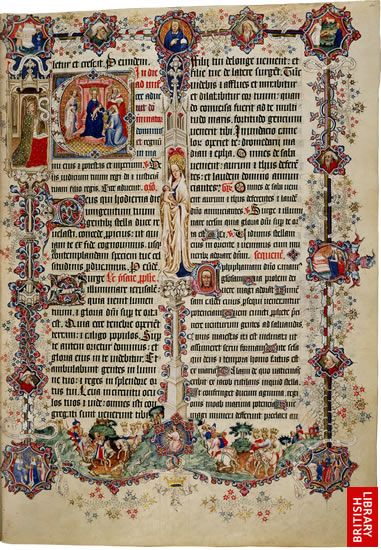

Sherborne Missal

The “Sherborne Missal” is a liturgical rare book that belonged to Sherborne Abbey in Dorset. The hymnal is one of the best surviving old books of the Medieval period, making it a catch for investors in old books, and of course, one of the most expensive rare books in the world ever sold as of 2024.

Ralph Percy, the 12th Duke of Northumberland, sold the “Sherborne Missal” to the British Library in 2001 for $21 million. As one of the rarest books in the world, buyers of old books were looking to snatch up the missal, but Percy ultimately decided to sell it to the library to help waive his £9.4 million inheritance tax.

BOOK OF TANG

The Book of Tang, also referred to as the New Tang History, is a 10-book volume that details the Chinese Tang Dynasty. The book is part of a longstanding tradition of dynasties compiling the history of their predecessors. However, one of the things that makes this text so interesting is that it was rewritten by order of Emperor Renzong of Song because the original text lacked sufficient clarity.

Unlike the original, also known as the Old Book of Tang, this version omitted a lot of the spiritual or mythological accounts associated with past emperors. The effect would shorten these sections considerably. Scholars instead added more bureaucratic and practical information, including a series of Treatises.

The text was hidden from public view for years, briefly emerging in 1980 before going underground once more. In 2018, the book sold at auction in China for $17.06 million.

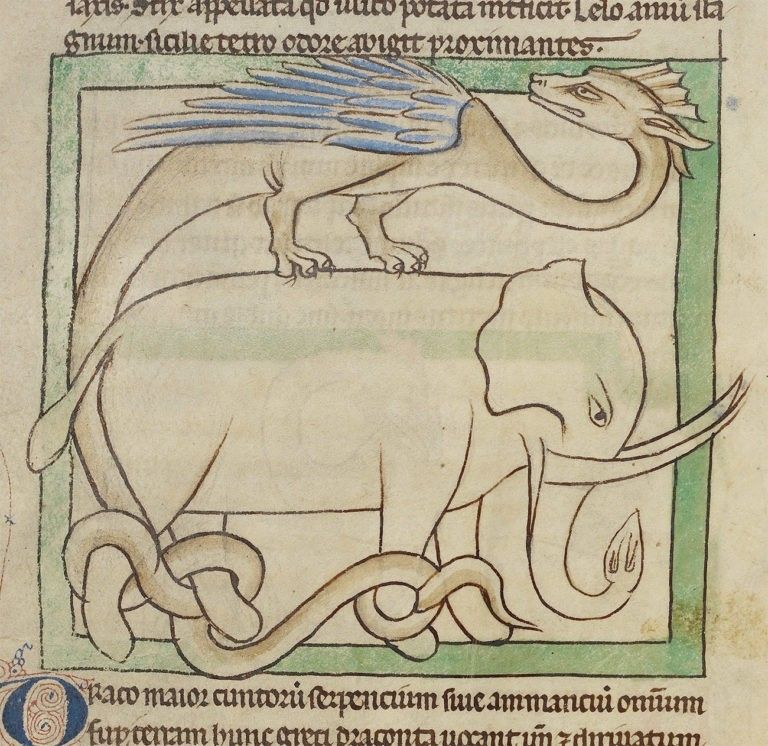

Northumberland Bestiary

The “Northumberland Bestiary” is an illustrated rare book dating to the 1250s describing various animals and rocks. This old book has 112 miniature paintings and most likely came from northern England.

The “Northumberland Bestiary” also came from the renowned buyers of old books, the Dukes of Northumberland. Ralph Percy’s father, Henry Percy, sold the publication to a private collector in 1990.

Later, in 2007, the Getty Museum in Los Angeles bought the bestiary for $20 million, beating out other bidders who partook in the high-profile auction dedicated to the investment in rare and expensive books.

St. Cuthbert Gospel

Although valuable Harry Potter books are some of the most high-priced, expensive, collectible books, the most expensive titles ever sold are usually one-of-a-kinds like the “St. Cuthbert Gospel.”

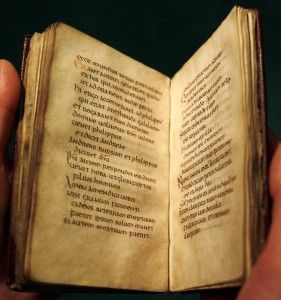

“St. Cuthbert Gospel” has been one of the most outstanding vintage books for sale in the world of antique investment books. The 7th-century gospel came from a saint’s coffin, St. Cuthbert of Lindisfarne, and is the oldest European book found entirely intact.

This rare book eventually came into the possession of the Society of Jesus, who sold the important gospel to the British Library in 2012 for $14.3 million. The “St. Cuthbert Gospel” is now one of the most protected and expensive collectible books in the world as of 2024.

Bay Psalm Book

Overall, those who invest in antique rare books tend to look out for firsts, and the “Bay Psalm Book” is definitely a first. The psalter from Cambridge, Massachusetts, was the first book printed in Colonial America in 1640.

The “Bay Psalm Book” was published only twenty years after the Pilgrims landed in what is now the United States, making it an outstanding achievement at the time. People used this rare book for over a century, even though almost none of the tunes remain in use today.

Despite falling into relative obscurity, rare book dealers re-discovered the old book when it went for auction at Sotheby’s in 2013. Boston’s Old South Church decided to sell the psalm book, the first time one of the “Bay Psalm Book”s has gone up for auction in 60 years, to raise money for their ministries.

A private rare book dealer bought the psalter for $14.2 million, one of the most expensive in the World to date (2024 at the time of this writting)

Rothschild Prayerbook

The “Rothschild Prayerbook” has always been a highly sought-after piece for those who make investments in the rarest, oldest and most expensive books in the world. This rare book, which comes from the early 1500s, is a Flemish illuminated manuscript book of hours.

The “Rothschild Prayerbook” had changed hands many times since its creation, including a short time when the Nazis took possession of it. Before the Nazis confiscated the book, the Rothschild family owned the prayerbook, and after the government returned it to them, they sold the manuscript in 1999.

The 1999 auction was at Christie’s in London and the expensive book sold for $13.4 million. In 2014, Christie’s sold the manuscript again, this time for about $10 million, making it one of the most expensive rare and old books in the world in 2024.

GOSPELS OF HENRY THE LION

The Gospels of Henry the Lion is a mid-12th century illuminated book commissioned by Henry the Lion from Brunswick Cathedral in Germany. It is widely considered one of the most glorious examples of Romanesque illustration and features vivid scenes of the life of Jesus Christ and the Apostles.

Written in Latin on 226 pages of parchment, the book features 50 stunning full-page images of the gospels. Historians suggest the book was commissioned around 1173 and was the most costly book in the world until Bill Gates purchased the Leicester Codex.

The book remains an important historical document and source of information about medieval German culture and a testament to the work of illumination at Saxony’s Benedictine abbey of Helmarshausen

The Gospels of Henry the Lion were purchased for $11.70 million at Sotehby’s in 1983 by the German government with the support of private donors. It is now held at the Herzog August Library in Lower Saxony.

The Birds of America

While rare and old children’s books can fetch high dollars, so can old science titles, such as “The Birds of America.” John James Audubon’s rare book with over 400 hand-drawn illustrations is one of the most outstanding natural history books of all time.

The one that sold at Sotheby’s auction house in 2010 was a first edition that has survived since the early 19th century. Investors in antique, rare, and old books had waited for the work to come onto the auction block for a long time and the book finally sold for and expensive yet understandable $10.3 million.

FIRST FOLIO

The First Folio, also known as Mr. William Shakespeare’s Comedies, Histories, & Tragedies is a collection of work by the beloved William Shakespeare. Published in 1623, some seven years after his death, it is widely regarded as one of the most seminal texts ever written.

The book contains about 38 of Shakespeare’s plays, including The Tempest, Macbeth, and Twelfth Night. Historians suggest that around 750 copies of the book were printed, with only a third surviving today. The First Folio, with an autographed letter of authenticity by eminent Shakespeare scholar Edmond Malone, is the most prized.

In October 2020, the First Folio was purchased by an American rare book collector, Stephan Loewentheil, for $9.98 million. Mills College in Oakland, California, was forced to sell the tex after running into financial difficulties. Reports at the time suggest that Loewentheil purchased a different rare copy of the book in 2010, with speculation that he may have also bought another in 2020.

The Complete Babylonian Talmud, Printed by Daniel Bomberg

“The Complete Babylonian Talmud,” printed by Daniel Bomberg in Venice in the early 16th century, outlines rabbinical debates over Biblical law.

Sotheby’s sold the near-perfect first and second editions for $9.3 million in December 2015. From the Westminster Abbey collection, people appreciate the Babylonian Talmud for its thoroughness of the topic and the beauty of its binding, which has helped this rare book enter on our 2024 list of the most expensive old books in the world ever sold.

HISTOIRE DE MA VIE

The Histoire de ma vie is a memoir and autobiography chronicling the life of the famed Italian adventurer Giacomo Casanova. Written in 1789, the original book features scenes and pages that had been censored by previously published versions because they were considered too offensive at the time.

The title of the book translates to The Story of My Life. It features around 3,500 pages and details the rich and storied life of Casanova. Written in French, it is believed the manuscript was given to his nephew, Carlo Angiolini, after his death. The manuscript briefly stayed with the family before it was purchased by a German publisher. Subsequent censored versions of the book were released before the original text finally saw light of day in 1960.

In February 2020, the book was purchased by the National Library of France for $9.06 million

Harry Potter and the Philosopher’s Stone

In the world of rare children’s books, one of the first editions of “Harry Potter and the Philosopher’s Stone” caught the attention of old and rare book collectors and investors.

One of 500 first edition hardbacks, the rare Harry Potter book has Rowling’s name listed on the copyright page as Joanne Rowling and was only supposed to sell for between $27,000 and $41,000. Yet, the book ended up selling for $110,000 at an auction in Leyburn.

To quickly sum up the 5 most expensive rare and old in the world as of 2024, you can also watch our short video below:

You may also like…

Are rare and old books a good investment in 2024?

Identifying whether or not a book holds any value is tricky, but there are certain things that you can look out for to help you in identifying whether or not the rare, old and potentially expensive books you hold are going to land you in a gold mine or not.

Investing in rare old books is not as straightforward as most people may think, and not all antique books are valuable – there is, of course, a certain knack attached to understanding where the value lies within literature and in literary collections.

So…are rare and old books a good investment in 2024?

Well, from first editions to limited runs and signed copies, collecting rare books can become a fascinating hobby. There may be a box of books in the attic with treasure hidden within, but how do you know which are worth less than the paper they’re printed on?

Starting a collection of rare or old books as an investment

For novice investors that consider investing in vintage books in 2024, it may seem like a good idea to consider every old or rare book as an investment opportunity, whether they’re from online auctions or second-hand shops. However, beyond 2024, a collection of rare books will be worth more as an investment if it has a focus or a theme.

For example, an entire collection of the Bronte sisters’ books will be a better investment than a few single books from various series. Likewise, an entire collection of herbals from the nineteenth century would be of particular interest to certain collectors at auction, so specializing can be a way to make your investment in rare and old books really pay off.

When you have an idea of which rare and old books you want to buy as an investment, find out from a specialist dealer or website to quickly assess which edition is the most valuable or expensive. You may expect that first edition books are always a good investment, but actually, later editions can be surprisingly sought after, especially if they contain additional illustrations or amendments. The first edition of William Camden’s Britannia can fetch up to £1,000, but a later edition with maps can be worth up to ten times that amount. Research is essential.

Other tips for novice collectors that consider investing in old and rare books in 2024 include having dry and free of dust dedicated areas to keep these precious assets. Slipcases can protect books further, and particularly fragile tomes can be rebound by a specialist.

Do consult an antiquarian book expert before doing this though, to ensure that its value isn’t adversely affected.

When investing in rare books, what factors affect the price?

In 2015, a list called the Rare Book Index was compiled, listing the 30 most valuable 20th-century classics. The first edition of one of these rare book titles can net anywhere between £2,550 and £247,000. The latter is the potential selling price for the first edition of The Great Gatsby by F. Scott Fitzgerald. The story itself is as popular as ever, with a feature film having been produced in 2013. The first edition of this one-of-a-kind rare book has increased by a staggering 1,372% in value over the past two decades, so a copy in excellent condition could be one to hang on to for now.

The biggest appreciation in value can be seen in George Orwell’s Animal Farm. Over 20 years, the value of this rare book rose over 2,500%: from a mere £190 to £5100. It’s thought that the political themes within the book keep it fresh and relevant for each new generation, adding to its appeal at auction, and making it one of the best investments in rare books opportunities in 2024, though of course nowhere close to the most expensive old books in the world we talked about above.

Physical factors that affect the investment price of rare and old books include the condition of the pages and the dust jackets. Dust jackets are fairly rare these days and even books that were once sold with dust jackets to protect them tend to have lost them over the years. Some were thrown away by the initial purchaser, or even by the cashier as they were sold.

Finding a first edition with a dust jacket intact can make a surprising difference to the price. The first edition of Dashiell Hammett’s Maltese Falcon can fetch £1,500 at auction. Find a copy with the dust jacket, and you can increase that amount to up to £75,000.

In contrast, an old book that has yellowed pages and what is known as ‘foxing’ can actually increase the appeal of investing in this rare title well beyond 2024. Foxing refers to brown spots on the page; an unavoidable ravage of age that affects most books at some point, even those that are meticulously cared for.

Enthusiastic collectors and investors in rare books see these natural flaws as confirmation of the old age and integrity of the book, and will sometimes pay more than if the copy is pristine and paper-white.

In conclusion, are rare books a good investment in 2024? …as you probably found out by now, the answer is “it depends”.

What should I be looking for when assessing whether vintage books are a good investment?

As is the case in most situations, being the first generally pays and primacy is of high importance when valuing rare and old books for investment. Books that are known to contain the earliest mentions of particularly significant events, characters, or concepts carry a great deal of value to collectors – particularly if they are sparse in their number.

At the same time, rare books that are part of the first set of prints are of high value. It’s important to differentiate at this point between the first print of a book and a first edition, as investment value differs significantly between the two, and can make the whole difference between a modest ROI and one of teh most expensive books in the world!

All books have the first edition, as all books that are published have to have the first run, and the value is found in books that are in the first round of printing. If a rare book is unexpectedly popular, then a second edition, then a third, and so on will be printed and that original batch of first prints will rise in investment value exponentially. This was especially the case with regards to the Harry Potter series, where J.K. Rowling’s debut novel Harry Potter and the Philosopher’s Stone had an initial first print of around 500 copies, 300 of which were given to libraries.

These books, because of their scarcity, are particularly rare and recent sales of first prints have sold for around £27,000. The demand for books like this is high, with collectors paying above and beyond to get their hands on their own copy.

With older books, the condition of the rare book can be a determining factor in its investment value. In more recent publications, where the binding of books has become much more prevalent, then the value can be influenced significantly by the condition of the book’s jacket – books that are missing their jackets will lose a large proportion of their investment value.

As an example, the first edition of F. Scott Fitzgerald’s The Great Gatsby, in perfect condition with a dust jacket, reportedly sold at auction for around $400,000, but a similar book lacking its jacket sold for a mere (in comparison) $8000.

Books that are as close to their original publishing condition, along with other appealing factors such as the original binding, the year of publication, and whether your copy is an original first print edition or not, are much more likely to carry a higher price tag. Often, the age of a book can be determined simply by looking at the condition of the paper, how it feels, and how the text looks against the paper. Binding, and its condition, play an equally important role.

If you know for a fact that a book within your possession was previously owned by someone significant or was contained at some point within a specialized library, then it may well have a value higher than you would normally expect of your 2024 investment. This is what we refer to as provenance – the history of an object’s ownership. Rare books that are believed to carry value through provenance normally require proof of authenticity.

Having written confirmation of a rare book’s proof of origin definitely increases the value of the book and also makes the process much simpler if you decide to use your book as collateral against a loan – an investor in rare and old books being aware of its value is one thing, but an investor who has proof of origin that determines a higher value is a whole other kettle of fish and leaves you in a much stronger position as owner.

It’s all well and good arguing that a particular book used to be held in a famous figure’s library, but if you have the documentation to back up your claims then it will make it much easier further on down the valuation process line.

Rare books – that is, books that are considered not for their previous owners, or their binding, or their print number, but for the fact that there are very limited copies of the book, or a particular edition of a book, in circulation – is actually considered one of the least important reasons for investment value in a book.

If you find that you are unsure about the investment value of a particular book, simply bring the book into our shop to arrange a free assessment.

Which titles fetch the most at auction?

Some of the most expensive rare books in the world have been known to sell for millions at auction, though of course as you found out by now the answer to the question “are rare books a good investment in 2024” is far from simple, or straightforward.

A copy of US ornithology rarity The Birds of America sold for $11.5 million in 2010. Only 119 copies of this old book are known to exist today. The 18th century Traité Des Arbres Fruitiers, a treatise on fruit trees, fetched $4.5 million in 2006, making it one of the most expensive books in teh workd ever sold at the time. This five-volume set shows the importance of creating themed collections, and the value a specialist collector will place on specific volumes.

Not every rare or old book is worth millions, of course. A great example of a good return on an affordable rare book investment is the Penguin paperback classics. These reprints of classics were launched in the 1930s for a few pennies. It’s possible to find them in charity shops or second-hand bookshops for around five pounds if you’re lucky. They can sell for anything up to £100 each.

So, while they’re not bringing in the millions of the most expensive books in the world, in 2024 they are a huge return on a very small investment if looked after properly. These Penguins are characterized by their brightly colored covers, so are easy to spot. Look for bright orange for fiction, crime stories in green, biographies in dark blue, and travel books in pink. A whole collection will appreciate in investment value over time.

What to avoid when investing in rare, old or expensive books

When considering “are books a good investment in 2024?”, don’t presume that buying online will be of better value than visiting your local bookseller or specialist dealer. A rare book may seem cheaper online, but you can rarely check the genuine condition for yourself, making it a risky investment purchase.

Rare book dealers have a reputation to protect, so will rarely overcharge, and visiting a store or individual in person means you can see and maybe even handle the investment books before buying. This gives you a much better sense of the condition of the item, and if your rare or old books were a good investment beyond 2024.

A book in terrible condition, even if it’s a rare first edition, may not be worth very much at all. There’s a difference between a bit of foxing and pages which are crumbling to dust at every touch. Paying a small amount for a rare find is only a good investment bargain if it’s going to last, intact, until you intend to sell it.

Always buy the best condition that you can reasonably afford, as avid collectors will look for the same.

It’s rare to have a huge return on a book purchased very cheaply, but with a bit of knowledge, a rare book investment can be a lucrative choice in 2024 and beyond. Find a specialist bookseller who can give you advice on what rare or old books are worth something. They will be able to advise you on what to keep and what to sell. Use websites such as AbeBooks and the Antiquarian Booksellers’ Association to view a wide range of books and get an idea of the investment prices they currently go for at book auctions.

Lastly, focus on a theme for your collection, whether it’s classical authors, one favorite writer of your own, or a subject matter that will appeal to specialist collectors.

Visit New Bond Street Pawnbrokers

If you believe that you own a rare or old book that you could use as a form of collateral and you have reason to believe that its value is of a significant amount, then that is where New Bond Street Pawnbrokers can help you out. To ensure that you receive the best possible value from pawning your rare or old book, our specialised appraisers will scrutinise the item and give it a valuation based on whether or not it possesses any or all of the qualities mentioned above.

At our central London-based pawn shop, we have over 30 years’ worth of experience and we collaborate with a number of informed and experienced book experts within the industry to fully and accurately appraise your collection.

As well as providing you with the money you need, our services will help you to discover more about your rare book collection than you could possibly imagine….this should further confirm to you whether parting ways or pawning your rare books collection is the right thing to do in the current 2024 market!

Because we use only the most knowledgeable of rare book experts within the field, they will do their utmost to find out as much as possible about the old books you offer as collateral and their authors – our skills set us apart from the rest and we are able to put together a timeline of the book based on the materials it is composed of, the binding and other defining features.

Combined, these features will allow us to come up with a suitable quote for you that is both respective of their value and fair to you as the owner.

At New Bond Street Pawnbrokers we offer loans against the following assets: diamonds, fine jewellery, classic cars, fine wines, fine art and fine watches as Patek Philippe ,Audemars Piguet or Rolex, antique silver, and Hermes handbags.

This post is also available in:

Français (French)

Deutsch (German)

Italiano (Italian)

Português (Portuguese (Portugal))

Español (Spanish)

Български (Bulgarian)

简体中文 (Chinese (Simplified))

繁體中文 (Chinese (Traditional))

hrvatski (Croatian)

Čeština (Czech)

Dansk (Danish)

Nederlands (Dutch)

हिन्दी (Hindi)

Magyar (Hungarian)

Latviešu (Latvian)

polski (Polish)

Português (Portuguese (Brazil))

Română (Romanian)

Русский (Russian)

Slovenčina (Slovak)

Slovenščina (Slovenian)

Svenska (Swedish)

Türkçe (Turkish)

Українська (Ukrainian)

Albanian

Հայերեն (Armenian)

Eesti (Estonian)

Suomi (Finnish)

Ελληνικά (Greek)

Íslenska (Icelandic)

Indonesia (Indonesian)

日本語 (Japanese)

한국어 (Korean)

Lietuvių (Lithuanian)

Norsk bokmål (Norwegian Bokmål)

српски (Serbian)

Tamil

I am a book collector who never looked at my books as investments, but can say those I have purchased have appreciated considerably. Some increased 1000% in 20 years. One I considered selling back to the dealer I originally bought it from, who remembered the book after 20 years and was very interested. My point being true collectors love their books, and sell them to people who love them too. To be an investment, you have got to find someone to sell it to. It’s not like buying gold. Buy the rare books you love and enjoy them, and depend upon selling them to someone who loves and enjoys them too. Otherwise, stay out. You will lose your shirt.