I hope you enjoy this blog post.

If you want us to appraise your luxury watch, painting, classic car or jewellery for a loan, click here.

Top 21 Most Expensive Diamonds Ever Sold at Auction as of 2024

The diamond industry is still reeling after a tumultuous 2023. There are some green shoots of recovery, but when DeBeers drop their prices by 10% to 15%, Russia’s Alrosa put a moratorium on mining to decrease market saturation, and India halts rough diamond imports, investors need to sit up and take notice. The big question is, what does this all mean for the most expensive diamonds in the world?

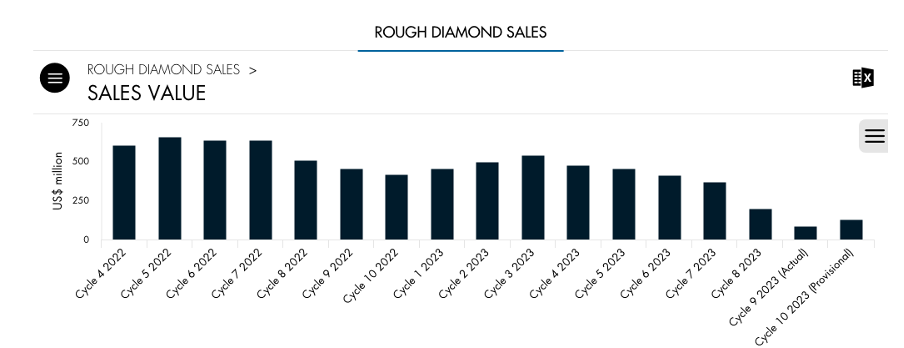

A quick glance at the DeBeers rough diamond sales from last year paints a picture of an industry in decline. However, the reality is a bit more complex.

There is a complex set of causes behind this revenue drop. Most notable is the fact that supply far exceeded demand in response to the COVID-19 market frenzy.

However, as an investor, it’s important to put these figures in context. The sharp decline in market prices is typically clustered around sub 1-to 2-carat diamonds within the retail sector. The thing is, these size diamonds are not considered rare when compared to the costliest diamonds in the world.

It’s well-established that retail diamonds don’t tend to increase in value. In fact, if you buy an engagement ring from a retailer, you’ll struggle to resell it without losing 25% to 50%. But that is not true for the rarest, and therefore, most expensive diamonds in the world.

The effect of lab-grown diamonds on the overall market

In a holistic sense, lab-grown or artificial diamonds have had an effect on the overall market. Overall, these synthetic diamonds tend to retail at around 65% to 80% of the costs of similarly sized and quality natural diamonds. However, they don’t hold their value. In fact, if you bought a retail diamond, you’d be lucky to get much more than between 25% and 50% of its value at resale.

That said, lab-grown diamonds have impacted the marketplace. Many people, especially younger generations, see them as a credible alternative to natural diamonds. As a result, they are growing in popularity and eating into the market share.

However, there are two things to consider. Firstly, lab-grown diamonds are not suitable as investment pieces. They are made in laboratories, and though the process is complex and expensive, it is getting cheaper. As such, these diamonds are not scarce. Supply can easily adjust to demand, meaning that it is hard to imagine a scenario where they increase in price or compete with the most costliest diamonds in the world.

Which diamonds do hold or increase in price

Retail diamonds and lab-grown diamonds do not typically increase in price or even hold their value. However, there are a set of diamonds that do: ultra-rare or uniquely colored stones. As you will see from our list of the most expensive diamonds in the world, the high sellers are pieces with a particular set of unique characteristics.

Let’s explore the stones that typically do increase in value.

1. Fancy-colored diamonds

Diamonds can come as colorless or in a variety of colors, like blue, yellow, green, and pink. Indeed, you’ll note from our list that six out of the top ten of the costliest diamonds in the world are pink-colored. Large, flawless stones in these colors are scarce and strikingly beautiful and can easily go for millions of dollars.

2. Investment-Grade White Diamonds

Colorless stones can also appreciate in value. However, it’s a situation that is reserved for truly rare stones with exceptional cut, clarity, and carat weight. Again, you’re talking 5 carats and above precisely because diamonds of 1 or 2 carats and below are much more common than people think.

3. Unique histories or characteristics

Another thing that can help a diamond appreciate and make it an excellent investment are stones with interesting backstories. That can mean ownership by a royal or a celebrity or some other interesting history or provenance. Stones with record-breaking sizes can also fit into this category.

The presence of some or all of these characteristics gives a stone the chance to become the most expensive diamond on earth.

What to know about the investment-grade diamond market

OK, so now that we are clear that some diamonds are suitable for investment, while others make great jewelry or symbols for milestone occasions, like an engagement ring.

But how can you tell a retail diamond and an investment diamond apart? And does an investment-grade diamond need to be among the most expensive diamonds in the world to turn a profit?

The big things you need to think about with investment-grade diamonds are rarity and demand. In short, for a diamond to appreciate in price, it needs to be somewhat rare, and there needs to be demand for the piece.

Market liquidity is another important factor in an investment. It’s all well and good to buy a unique piece, but if no one wants it, it’s hard to sell. On the other hand, if your diamond is too common, supply can easily outweigh demand, so when you go to seel it, there is too much competition and too many sellers prepared to negotiate on price.

Quick tips for choosing an

investment-grade diamond in 2024

Before we explore the costliest diamonds in the world, here are some tips for people who want to get into diamond investment.

1. Buy low

Buy low, sell high is an investment maxim that you’ll already know. But it’s incredibly important in the world of diamond investors. The lifecycle of a diamond involves going through many intermediaries and brokers before it gets to retail. In short, if you buy at retail prices, too many people have to take their cut.

So, buy as high up the chain as possible. That way, you have the best chance of recouping or increasing your investment.

2. To mount or not to mount

One of the benefits of investing in diamonds is that while you wait for them to mature, you can enjoy them from time to time. However, that involves mounting the diamond or setting it in a ring or on a necklace, and so on. The problem is that you vere into territory where your test clashes with potential buyers, and therefore, you could inadvertently reduce the demand for your piece.

We’re not saying you must keep it loose, but it’s something to consider.

3. Demand certification

Appraising a diamond requires knowledge, experience, and specialist equipment. Unfortunately, like many other industries, bad actors will try to take advantage of buyers. Ensure any piece you buy has GIA certification and get it valued from a trusted jeweler.

A GIA certification helps you feel assured that your diamond is worth the price. It’s also useful when you want to sell because potential buyers will enjoy the same assurance.

OK, so now that you know how the diamond investment game works, it’s time to move on to our list of the most costliest diamonds in the world ever sold at auction.

So, the top 21 most expensive diamonds in

the world as 0f 2024 are…

1. The Pink Star: $71.2 MIL

The Pink Star, formerly known as the Steinmetz Pink, currently holds the record from the Gemological Institute of America for being the largest flawless Vivid Pink diamond ever sold. The Pink Star fetched a staggering $71.2 million in under five minutes of bidding at Sotheby’s auction in Hong Kong.

The diamond, which has since been renamed CTF PINK STAR, was bought by famed Jeweller, Chow Tai Fook, and weighs 59.6 carats. It traces its roots to South Africa, where De Beers mined it in the year 1999. In its rough form, it weighed 132.5 carats. The Benny Steinmetz Group then intricately cut the diamond over 20 months to its present weight of 59.6 carats.

2. WILLIAMSON PINK STAR : $57.7 MIL

The second most valuable diamond in the world is also a pink diamond. The Williamson Pink Start was unearthed in Tanzania in the Williamson Mine, which has a reputation for producing rare “bubblegum” pink diamonds.

So, what are the characteristics that make this the second most precious diamond in the world? Firstly, it’s internally flawless. Secondly, “Fancy Vivid”, which is the highest color grade for a pink diamond. Finally, it’s 11.5 carat, cut into an oval shape from a 32-carat rough diamond.

In October 2022, the Williamson Pink Star went up for auction at Sotheby’s Hong Kong. After a frantic bidding war, the diamond sold for an incredible $57.7 million, making it the world’s most valuable diamond by carat with a price of $5m per carat, doubling the record set by the Winston Pink Legacy in 2018. The identity of the successful bidder is not known, and The fate of this glorious stone is yet to be determined.

Another diamond from the same mine was presented to Queen Elizabeth II as a wedding gift in 1947. She chose to have the rock fashioned into a brooch of exquisite and ornate beauty.

3. Oppenheimer Blue Diamond : $57.5mil

This extremely rare Blue Diamond weighing 14.62 carats is the world’s largest fancy vivid blue diamond to ever sell at an auction house, but that was still not enough to make it the world’s most valuable diamond.

In May 2016, the amazing diamond sold for a record $57.5 million, which included fees and commission at the Christie’s auction in Geneva.

The rectangular shaped diamond bears a unique hue with an astounding proportion. First owned by the Oppenheimer, the diamond originated from South Africa where the family had diamond mines.

The family owning diamond mines also meant that they also owned some of the world’s amazing and rarest diamonds.

4. De Beers Cullinan Blue : $57.4 MIL

The De Beers Cullinan Blue Diamond was unearthed in 2021 at the Cullinan Mine in South Africa. This vivid blue diamond is not only extremely rare for its color, but its internally flawless cut and size. When the diamond was waiting to be auctioned, Sotheby estimated it to go for around $48 million.

The Cullinan Blue happened to go up for auction as the Russo-Ukrainian War was beginning to shake the diamond industry. When the diamond sold on April 27, 2022, it sold for more than $57.4 million.

This high price makes the Cullinan Blue the most expensive and rarest diamond in the world at the time. It has broken several records in the diamond industry and is a beautiful specimen for diamond enthusiasts.

Given that Cullinan Blue was already the most expensive diamond in the world when it was sold at auction, a lack of supply and increased sanctions will increase the price of diamonds like it.

5. The Pink Legacy: $50 mil

Possessing the most expensive diamond color to date, “The Pink Legacy Diamond” originally belonged to the Oppenheimer family. The rare gem was mined in South Africa in 1980, weighing in at 18.96 carats, and sold at Christie’s for $50 million or nearly 50.4 million Swiss francs in November of 2018.

Acquired by the Harry Winston jewel company, this fancy vivid pink diamond was renamed the Winston Pink Legacy by the Harry Winston CEO, Nayla Hayek. Each carat sold for $2.6 million setting a world record at the time of this pink diamond’s sale. It has a cut-cornered rectangular-cut and previously sat on display at the Harry Winston store in New York.

The Pink Legacy holds this title as the rarest diamond with pink undertones, making it the highest price diamond of its kind.

6. Blue Moon of Josephine: $48.4 mil

Hong Kong billionaire, Joseph Lau, paid a whopping $48.4 million for the Blue Moon at the 2015 Sotheby’s auction in Geneva.

It weighs 12.03 carat and is considered the largest cushion-shaped cut diamond to ever appear at an auction. It has the colour of Fancy Vivid Blue.

Discovered in South Africa in January 2014, it’s worth noting that this was not the first record-breaking diamond to be bought by the mogul. He reportedly paid $28.5 million for an expensive cushion-shaped, 16.08 carat diamond at Christie’s auction, the day before Sotheby’s auction where he splashed over $48 million for the “Blue Moon”.

Joseph Lau has since renamed it “Sweet Josephine“, perhaps as a sign of affection for his eleven-year-old daughter. Similarly, “The Blue Moon” was renamed “The Blue Moon of Josephine”, again to denote his love for her daughter, Josephine.

7. The Graff Pink : $46.15 MIL

After setting a world record with the purchase of The Wittelsbach-Graff, Laurence Graff would shatter it two years later with the acquisition of “The Graff Pink” diamond at Sotheby’s auction, for a jaw-dropping price of $46.15 million.

It is emerald cut, has the colour of Fancy Intense pink and weighs 24.78 carats. The Gemological Institute of America has classified it as Diamond Type IIa, which puts it in the coveted ranks of the top 2% of the world’s diamonds. As with The Wittelsbach-Graff, the billionaire identified 25 natural flaws to be removed, to elevate its status to internally flawless.

His efforts were not in vain; though the Graff Pink now weighs 23.88 carats, its colour has been heightened from fancy vivid pink to vivid pink, and the clarity rose to internally flawless.

It held onto the record of the most expensive pink diamond ever sold till 2017 when the Pink Star dethroned it.

8. THE BLUE ROYAL: $44 MIL

This Blue Royal became the highest priced diamond sold in 2023 when it went to auction at Christie’s Geneva. The pear-shaped 17.61-carat stone had a pre-auction estimate of around $35 million but ended up selling for well above, at $44 million.

This internally flawless fancy vivid blue diamond is mounted on a ring with two side diamonds of two carats each. Indeed, the piece is so beautiful it would give even the most expensive diamond on earth a run for its money in pure visual appeal.

Rahul Kadakia, Head of Jewellery at Christie’s International, called the stone “a true miracle of nature,” and it’s easy to see why. Rocks of this clarity, color, and size are essential one-offs, which is why it’s the most costly gemstone of its kind.

The history of the Bleu Royal is shrouded in mystery. Experts suggest that it may have been unearthed at the Cullinan mine in South Africa. However, the mystery doesn’t stop there. It was first recorded in a private collection over 50 years ago, and the cut style suggests it was shaped before the invention of modern diamond polishing techniques.

So little is known about the history of this stunning diamond, which, if anything, adds to its appeal and allure that it’s no surprise that it’s one of the most costliest diamonds in the world.

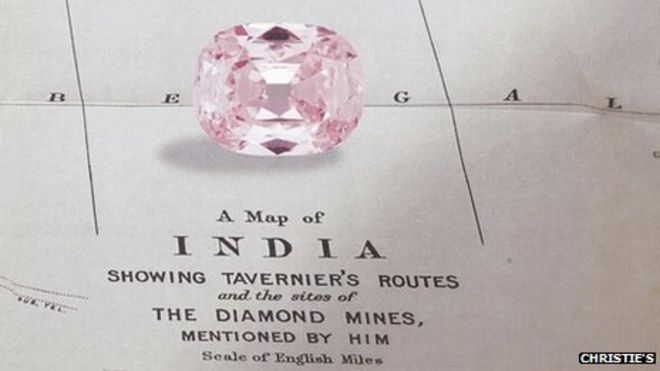

9. The Princie Pink Diamond: $40 mil

The Princie Diamond , which got its name from a 14-year-old son of Sita Davi, the Maharani of Baroda, is another rare and unique stone. The expensive diamond, which traces its origins from India, is among the largest pink diamonds in the world as of 2024.

When it first hit the auction, the 34.6-carat stone sold for $24.3 million.

In 2013, the diamond sold for a staggering $40 million at Christie’s in New York, making it one of the most expensive pink diamonds ever sold as of 2024. Though controversy still surrounds its ownership, it remains one of the most exquisite and rarest stones ever sold.

Image credit: bbc.co.uk & www.christies.com

10. The Orange : $35.5 mil

Pink and blue diamonds are some of the most treasured and appreciated gems. Adding the Orange Diamond to the list of the most beautiful coloured diamonds was worth everything because this stone is in a class of its own.

The rare gem weighing 14.82 carats was first estimated to sell for $21 million at the auction. However, “The Orange” exceeded expectations by selling at a record $35.5 million in 2013 at Christie’s Geneva auction.

The stone also set a new record of the highest per carat price for any coloured diamond ever sold.

What makes this diamond extra-special is its colour of pure-orange, which is very rare. The majority of orange diamonds have other secondary colors.

11. THE ETERNAL PINK: $34.8 MIL

Just like the most precious diamond in the world, The Eternal Pink is a stunning and ultra-rare pink-colored diamond. The cushion mixed cut comes in at a weight of over 10 carats, with the highest color grade and color for this type of diamond and an internally flawless structure.

The Eternal Pink was in the news in 2023 when it went for sale at Sotheby’s New York. It fetched an incredible price of close to $35 million from an unknown buyer.

This stunning piece was mined in Botswana by DeBeers in 2020. It was originally a rough diamond of close to 24 carats. Over the course of six months, Diacore shaped the stone into its present-day form, before it embarked on a global pre-auction exhibition tour that took in Hong Kong, Dubai, Singapore, Shanghai, Taiwan, and Geneva.

While there is little more than speculation about who owns the diamond, experts suggest that should we see it at auction again, it will fetch far more than $35 million.

12. De Beers Millennium Jewel 4 : $31.8 mil

The “De Beers Millennium Jewel 4” is a blue diamond valued at $31.8 million. Weighing 10.10 crats, it sold at Sotheby’s in Hong Kong in 2016 and is the second-largest fancy vivid blue diamond to ever make it to an auction. While it may not be the most valuable diamond in the world, it’s certainly one of the most beautiful.

13. The Largest Diamond Ever Sold: $30.6 mil

“The Largest Diamond Ever Sold” was purchased at a Christie’s auction in Hong Kong back in 2013. The biggest and one of the most expensive diamonds in the world as of 2024 was priced at a whopping $30.6 million. To this day, the white diamond does not hold a unique name like the others.

Weighing in at 118.28 carats, it is cut in the shape of an oval which is presently considered to be one of the most expensive diamond cuts in the world. People often refer to it as the “Magnificent Oval Diamond” in place of any official title.

Originally mined in an unspecified part of southern Africa in 2011, this jewel is the largest and most valuable, colorless diamond to ever reach an auction. It also remains the most expensive diamond ever auctioned in Asia to this very day (2023).

Source: https://www.gia.edu/gia-news-research-sothebys-diamond-auction-2013-shor

14. The Sakura: $30 mil

“The Sakura Diamond” is a purple-pink diamond that sold for $29.3 million at Christie’s auction in Hong Kong in May 2021. Named after the Japanese cherry blossom tree, this diamond weighs in at 15.81 carats and is the most expensive diamond in the world, of its particular color, to ever sell at an auction as of 2024.

Taking over the Perfect Pink, which used to hold the top spot for the priciest pink diamond ever sold in Asia, the Sakura diamond classifies as fancy vivid, and internally flawless. Fancy vivid is a title only 4% of the world’s pink diamonds receive, giving it all the more reason to cost nearly $30 million.

Additionally, this rare diamond jewel is the absolute largest of its type to go under the hammer. Not only is The Sakura the largest purple-pink diamond and the second-largest pink diamond in the world, the record-breaking continues as this gem earned the number one spot of the most expensive purple-pink diamond, a title that initially belonged to “The Spirit of the Rose.”

15. The 101 : $26.7 mil

The Harry Winston firm joined the ranks of other expensive diamond lovers by purchasing this flawless and rare stone from Christie’s auction in Geneva in 2013.

It traces its roots to Botswana where it was named 101, deriving its name from its near-perfect weight of 101.73 carats.

It is among the largest colourless diamonds known to exist, with its pear-shaped structure being likened to the size of a little egg. It is classified as flawless, and fetched $26.7 million, making it join the ranks of the most expensive diamonds to ever sell at an auction house by 2024.

It has been christened the “Perfect Diamond” and sold for a record $254,000 per carat, which is a colourless diamond world record. The Gemological Institute of America has classified it as “the most perfect” D-colour, type IIA flawless stone.

16. The Spirit of the Rose: $26.6 mil

“The Spirit of the Rose,” named after Vaslav Nijinsky’s “Le Spectre de la rose” 1911 ballet, sold for $26.6 million at Sotheby’s auction in Geneva back in November 2020. This gem was unearthed in northern Russia back in 2017, and cut from a much larger rough diamond uncovered in Alrosa.

Before the Sakura came along, “The Spirit of the Rose” broke the world record as the most expensive purple-pink diamond in existence to sell at an auction, as of 2024.

17. THE INFINITE BLUE DIAMOND : $24.3 MILL

In late 2023, the Infinite Blue Diamond went to auction in Sotehby’s Hong Kong with an estimated valuation of between $26 to $37 million. While bidding felt a little short of that range, it became the third most costly gemstone of its kind ever sold in Asia when it was bought for $24.3 million.

Unearthed in the Cullinan Mine in South Africa, the 11.28-carat fancy vivid blue is a piece of almost unrivaled beauty. Interestingly, it was cut so that it carried the number 8 in its carat weight with reference to the number 8, which is a symbol of infinity in Asia.

The diamond is set in an 18-carat white and pink gold ring with a halo of pink and white diamonds. Unearthed in 2020, it was unveiled to much fanfare by Petra Diamonds in 2021 before being shaped into its present form.

Blue diamonds are ultra-rare, and pieces of this size, quality, and splendor are even rarer. While the Infinite Blue may have fallen short of expectations, $25 million for a stone is still an exceptional amount.

18. BULGARI LAGUNA BLU : $24.3 MILL

Another contender for the most costly diamond in the world sold at auction for $24.3 million in 2023 is the Bulgari Laguna Blu. It’s a fancy vivid blue diamond with a weight of 11.6 carats. When it went to auction in Sotheby’s Geneva, it became the highest price diamond ever sold in the Swiss city.

The history of the diamond is incredibly interesting. The unmodified gemstone was housed in a ring in 1970. Then, it was switched into a necklace and worn by actress Priyanka Chopra Jonas, Bulgari’s Global Ambassador and worn at the Met Gala in New York.

19. The Wittelsbach-Graff Diamond : $24.3 mill

The Wittelsbach-Graff diamond, formerly only known as the Der Blaue Wittelsbach, weighs 31.06 carats and has a colour of Fancy Deep Blue.

The diamond’s history dates back to the 1600s when it was discovered in the mines of Kollur, which is in Andhra Pradesh, India. Billionaire Laurence Graff bought the stone in the 2008 Christie’s auction for a then world record of $24.3 million.

Back then, it had a colour of fancy greyish blue and weighed 35.56 carats. The new owner thought a diamond over 360 years old needed some retouches, to achieve a “perfect” clarity and brilliance. Though it lost 4.52 carats during the process, it enabled it to attain a higher grade from the Gemological Institute of America.

It now dons the coveted colour of “fancy deep blue” as opposed to its original colour of fancy deep greyish blue. Moreover, it is now rated Internally flawless (IF) which holds more weight than its initial rating of VS1 clarity.

After the recut, Laurence Graff renamed the diamond The Wittelsbach-Graff.

20. The Winston Blue Diamond : $23.8 mil

The Winston blue weighs 13.22 carats and is one of the largest flawless blue diamonds ever sold as of 2024.

The diamond, whose country of origin is South Africa holds the record for the highest price per carat (approximately $1.8 million) ever paid for a blue diamond.

It is the largest, flawless Vivid Pink diamond in the world and was sold for a record $23.8 million at Christie’s auction in Geneva Magnificent Jewels. It was initially known as “The Blue” but was renamed “The Winston Blue” by Nayla Hayek, the CEO of Harry Winston Inc.

21. The Perfect Pink : $23.3 mil

Not all diamonds are made equal; pink diamonds, in particular, hold the record for the most expensive diamonds in the world as of 2024. Their rarity notwithstanding, the fascination with pink diamonds dates back to the Elizabethan Era, when they were held as a symbol of happiness. Today, the colour pink is thought to symbolize love and tenderness, which is as rare as the pink diamond.

The Perfect Pink is a rectangular cut, type IIA diamond with a weight of 14.23 carats. It sold for an astounding $23.3 million at Christie’s 2010 auction in Hong Kong, setting a record as the most expensive jewel ever sold in Asia.

So what is the most expensive diamond in the world in 2024? While this updated list has yet to beat the most valuable diamond in the world, “The Pink Star,” it’s as clear as these gorgeous crystals that diamond auctions are here to stay.

The Impact of the Ukraine War on the Diamond Industry

While certain regions are being directly affected by the Ukrainian conflict, the diamond industry is being hit hard as well. Russia accounts for about 25-30% of all rough diamond supplies, and sanctions on Russia are cutting off that supply line.

1. Restrictions and Sanctions

The Russian producer Alrosa was included in the U.S. government’s OFAC Specially-Designated Nationals (SDN). This status makes it impossible for banks to process payments meant for ALROSA, which means customers can’t purchase rough diamonds from them. The U.S. government has made it difficult for transactions to go through, even if they are in non-dollar amounts.

The worldwide diamond shortage has struck India the hardest. India polishes most rough diamonds, many of which originate in Russia. This fact could directly impact 2-3 million people, from employees to indirect workers to their families. And there will be massive shortages as well for companies wanting to purchase polished diamonds.

On top of the sanction, brands and retailers have taken it upon themselves to avoid purchasing polished diamonds that originated from the Russian rough. While previous conflicts have affected the diamond industry in some way, the Ukrainian conflict has had a major impact.

2. Increase in Prices

Of course, since there is a substantial shortage of diamonds there will also be a dramatic increase in their price. Unless other rough producers can increase their production to meet demand, polished prices and price points for jewelry will increase to reflect the low supply. A low supply affects the cost of the rarest diamonds in the world in 2024.

With such a large shortage, certain large companies are looking to increase their share of laboratory-grown diamonds (LGD). But keep in mind that LGD supplies are also limited, especially when it comes to small diamonds.

LGD prices will look more appealing to customers and can benefit from this limited supply of rough. But with the dramatic increase in demand in 2024, who can say whether that will remain the same for long?

Contact us

This post is also available in:

Français (French)

Deutsch (German)

Italiano (Italian)

Português (Portuguese (Portugal))

Español (Spanish)

Български (Bulgarian)

简体中文 (Chinese (Simplified))

繁體中文 (Chinese (Traditional))

hrvatski (Croatian)

Čeština (Czech)

Dansk (Danish)

Nederlands (Dutch)

हिन्दी (Hindi)

Magyar (Hungarian)

Latviešu (Latvian)

polski (Polish)

Português (Portuguese (Brazil))

Română (Romanian)

Русский (Russian)

Slovenčina (Slovak)

Slovenščina (Slovenian)

Svenska (Swedish)

Türkçe (Turkish)

Українська (Ukrainian)

Albanian

Հայերեն (Armenian)

Eesti (Estonian)

Suomi (Finnish)

Ελληνικά (Greek)

Íslenska (Icelandic)

Indonesia (Indonesian)

日本語 (Japanese)

한국어 (Korean)

Lietuvių (Lithuanian)

Norsk bokmål (Norwegian Bokmål)

српски (Serbian)

Tamil

Be the first to add a comment!