I hope you enjoy this blog post.

If you want us to appraise your luxury watch, painting, classic car or jewellery for a loan, click here.

Top 33 Most Expensive Auction Items Ever Sold as of 2024

Ever wondered “What are the Most Expensive Auction Items “, ” What is the most expensive item ever sold at auction”, or “What are the most expensive things sold at auction”? Or, more specific questions like “What is the most expensive art sold”, “What are the most expensive historical items”, and “What are the most expensive antiques”?

Auctions tend to attract a wide variety of bidders and buyers, both in-person and over the phone, due to the variety of rare and scintillating items on sale.

The most prestigious of auctions offer one-of-a-kind pieces of jewelry and artwork, timeless memorabilia, and other rare treasures found nowhere else but under the hammer.

It’s for this reason that auctions have been known to fetch large sums for single items. From art to artifacts, yachts to precious gems and metals, reputable auctions are renowned for hosting the most coveted items in the world, with prices entering the hundreds of millions; indeed the largest auction houses will facilitate the sale of the most expensive auction items and things in the world.

33) Marilyn Monroe’s “Subway Dress”

Possibly one of the most famous items of clothing of the 20th century, and a worthy entrant on our list of the most expensive auction items and things ever sold as of 2024, the ivory pleated dress was designed by William Travilla in 1955 for Marilyn to wear in the movie “The Seven Year Itch,” directed by Billy Wilder.

Almost as iconic as the wearer herself, the dress concocts the image of Marilyn Monroe stood atop a subway grate, trying to use its skirt to cover herself. The famed footage has since found its way onto thousands of ‘retro’ themed items, from clothing to home wares. To own the original, however, is something altogether different.

Previously owned by Singin’ in the Rain actress Debbie Reynolds, the dress’ style echoes that of 1950s and 1960s Hollywood, with a halter-like bodice and a plunging neckline. Monroe’s husband at the time, Joe DiMaggio, was said to have “hated” the dress.

Debbie Reynolds sold the dress, which had become ecru in colour due to its age, in 2011 – estimating that it would sell for $1-2 million.

The dress and wristwatch worn by Marilyn Monroe during her famous performance of ‘Happy Birthday Mr. President’ for then-President John F. Kennedy in 1962 have been sold at auction for a combined $5m. Monroe’s Madison Square Garden performance has become iconic in popular culture in the decades since it occurred, thanks in part to incessant rumours about her alleged sexual relationship with Kennedy. The performance took on an added significance when Monroe died of a drug overdose less than three months later, aged only 36.

The most expensive dress of all time

The dress and watch were both sold at Julien’s Auctions in West Hollywood, an auction house specialising in memorabilia relating to Hollywood films, as well as famous American musicians. The dress smashed its $3m estimate to sell for $4.8m, making it the most expensive dress of all time, while the watch sold for $225,000.

The dress provided a good return on investment for the private collector who sold it; they paid $1.27m for it at Christie’s in New York in 1999. The most expensive dress prior to this sale was Monroe’s iconic dress from the film The Seven Year Itch, which sold for $4.6m in 2011.

The dress, a flesh coloured design interwoven with 2,500 crystals, was so skin-tight that Monroe reportedly had to be sewn into it on the night of her performance. It sold to museum chain Ripley’s Believe It Or Not, who have 32 museums across the world, including one in Piccadilly Circus, London. Ripley’s have announced that the dress will go on display in their Hollywood museum, before moving to different museums around the world.

The Ripley’s museum in London has a large collection of Marilyn Monroe memorabilia, so it’s fair to assume that the dress will make an appearance in the British capital at some point. Our pawnbroking team specializing in collectibles , and we will be keeping our eyes out.

One to watch

Also up for auction was Monroe’s Blancpain cocktail watch, which exceeded estimates of £100,000 to sell for $225,000. Interestingly, the winning bid was tabled by Blancpain themselves, who later announced their intention to display the watch at the Blancpain museum in Switzerland. This particular piece was far less iconic and recognisable than the headline lot; Marilyn Monroe’s dress, therefore it sold for far less. But this is the indication of a wider trend.

The enduring appeal of Marilyn Monroe

More than 50 years after Monroe’s death, her image is still an iconic and ubiquitous one. A famous example of the enduring appeal of Marilyn Monroe is Andy Warhol’s ‘Marilyn Diptych,’ which shows a portrait of the actress repeated numerous times in Warhol’s iconic pop art style. Considering that Monroe still remains so iconic after five decades, any piece of memorabilia relating to her directly is likely to keep increasing in value. If you’ve got something in your possession that once belonged to her, it might be worth getting it valued. You could be in for a nice surprise.

32) The British Guiana One Cent Magenta stamp

Were our list of most expensive auction items & things measured on price per square inch, this item would surely top it.

At .04 grams in weight, the British Guiana One Cent Magenta stamp was once sold for a penny when it was first printed, in 1856. The rarest stamp in the world, it is a one of a kind collector’s item which has belonged to such names as Count Philippe la Renotiere von Ferrary, Arthur Hind and John E. du Pont.

After du Pont’s death, the stamp was sold several times at various auctions, ultimately claiming a spot as one of the most expensive items ever sold at Sotheby’s as of 2024.

Its standing as one of the most expensive auction items comes from its rarity, and the prestigious pastime of stamp collecting.

The stamp was bought by shoe designer Stuart Weitzman for the sum of $9,000,000. When collecting the item, Weitzman reportedly tucked the stamp into his back pocket, so as not to draw attention to it.

31) The Flowing Hair Silver Dollar

First minted in 1794, the Flowing Hair silver dollar was the first dollar coin ever issued by the United States.

The coin was struck in silver, following the establishment of a national Mint by Alexander Hamilton. Today, the coin is an incredible rarity, with very few surviving from the era, which explains why this is one of the most expensive antique auction items as of 2024.

In 2013, the over 200-year-old coin more than doubled the previous world record of $4.1 million for a coin sold at auction, according to Stack’s Bowers Galleries.

It’s said to have been the finest known surviving coin from the original minting, hence its value. It was part of the Cardinal Collection, amassed by collector Martin Logies, before it went under the hammer.

Stack’s Bowers Galleries sold the coin for $10,000,000 in New York to Legend Numismatics, a rare coin firm based in New Jersey.

30) Cycladic Marble Figure – $16.8mil

Christie’s Antiquities Department topped the world record price at auction in 2015 when it facilitated the sale of one of the most expensive auction items worldwide that year, a Cycladic marble figure. A reclining female figure carved in marble, the sensational sculpture is over 3000 years old, dating back to circa 2400 BC.

Standing at just 11.5 inches tall, the piece is the only complete figure of the twelve works attributed to the Schuster Master known to have survived . It was acquired by Madame Marion Schuster of Lausanne in 1965 and was subsequently moved to a private collection in the United States.

The carved marble figure sold for $16,882,500 at Christie’s.

29) Patek Philippe Henry Graves Supercomplication Watch : $24 mil

Commissioned by billionaire Henry Graves Jr, this painstakingly crafted 18 carat gold watch took eight years to create.

Previously sold at auction in 1999 for $11,000,000, the watch was purchased by Sheikh Saud Bin Mohammed Bin Ali Al-Thani of the Qatari royal family, who sold it back to the auction house 15 years later.

The final bid at Sotheby’s in 2014 was 23,237,00 Swiss Francs – at the time, over $24,000,000 – making the Patek Philippe Supercomplication the most expensive auction watch in the world as of 2024.

Explore some of the watch’s competitors for the title of ‘most expensive’ in our list of The Most Expensive Watches Sold At Auction Ever.

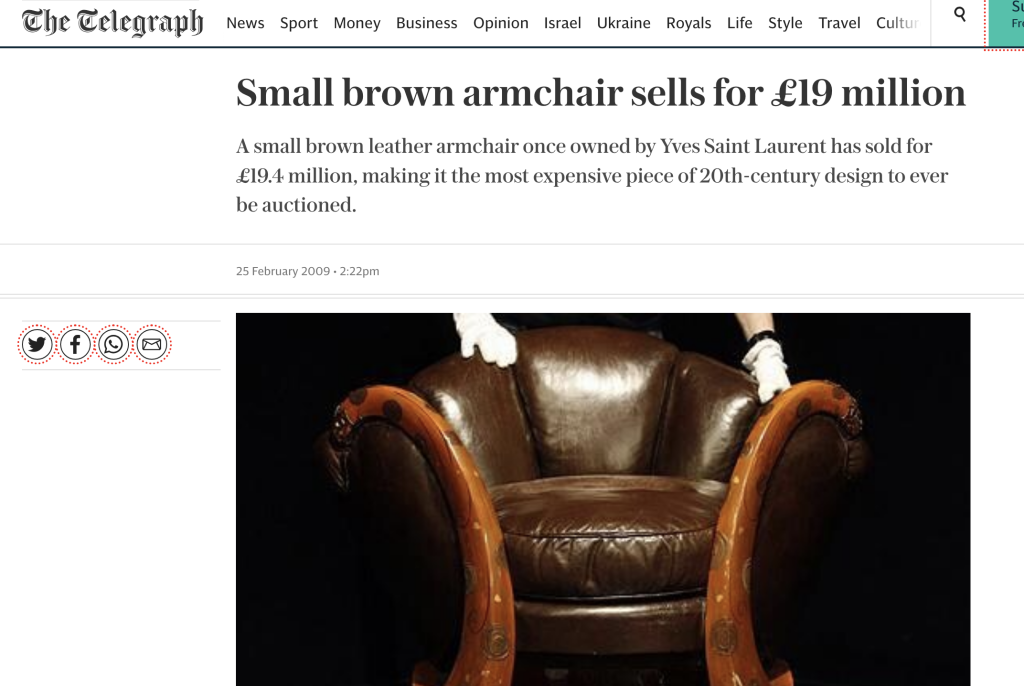

28) Fauteuil Aux Dragons by Eileen Gray – $28.3 mil

This leather armchair was once owned by Yves Saint Laurent, and was designed by Irish artist Eileen Gray. Originally crafted in white, the chair is now upholstered in brown leather.

Standing at just 24 inches high, the unique French piece is known as the ‘dragon’s’ armchair, due to its ornate sculptured armrests. Gray, who studied at the Slade School of Fine Art, spent two years crafting this item, from 1917 to 1919.

The chair’s original owner was Suzanne Talbot, Gray’s first ever patron.

Philippe Garner, Christie’s international head of 20th Century Decorative Art and Design, said of the piece: “It is a fabulous piece. The sale was a homage to the great personalities, designers, collectors and patrons who so marked their era in Paris in the 1920s and 1930s and to the pioneering vision of Yves Saint Laurent and Pierre Berge as collectors.”

The piece sold for an astonishing $28,300,000 – significantly higher than the $3,000,000 at which Christie’s had it valued, making this antique another interesting entry on our list of the most expensive things ever sold at auction as of 2024.

27) Roman Era Statue of Artemis and the Stag – $28.6 mil

The 2000 year old bronze statue was unearthed in 1920, and depicts the goddess Artemis. It has been said that the piece is a superb example of ancient Roman bronze sculpture, and one of the most beautiful works surviving from the era.

London art dealer Giuseppe Eskenazi bought the statue for an anonymous collector, after an unusually long round of bidding at Sotheby’s. When the hammer fell, the price sat at $28,600,000 – setting a new record as the most expensive sculpture ever to sell at auction, and a well-deserved entry in our Top 20 Most Expensive Items Ever Sold at Auction as of 2024.

26) Leonardo Da Vinci’s Codex Leicester – $30.8mil

In 1994, Microsoft founder Bill Gates purchased a 72 page notebook at auction. The collection of pages contains ideas, drawings and diagrams from the mind of renowned polymath Leonardo Da Vinci.

Historians regard Da Vinci as a genius with a “feverishly inventive imagination”. He was a painter, inventor, sculptor, and engineer – to name just a few of his areas of expertise. But this item focuses predominantly on his passion for science and houses his notes and thoughts on the relationship between the Earth, sun, and moon.

Bill Gates puts the notebook on display at a rotation of selected museums, allowing visitors to see first-hand the innermost workings of Da Vinci’s mind.

The manuscript is one of the most expensive auction items we came across, having been purchased by Gates for $30,800,000.

25) The Clark Sickle Leaf Carpet – $33.7 mil

This Islamic carpet sold at Sotheby’s in June 2012, setting the auction record not just for an Islamic carpet, but for the most expensive Islamic auction work of art and item.

The piece is thought to have been woven in Kirman in the 17th Century. Its distinctive elegance has retained an exquisite quality despite its age. Decorated with swirling vines and vibrant flowers, the carpet was stored for decades by the Corcoran Gallery of Art.

Mary Jo Otsea stated that the carpet was the “highlight of [her] 30 year career”, saying that “no-one ever expected to see it on the market. Its beauty and rarity – the closest comparisons are in museums.”

After a ten minute multi-bidder contest, this remarkable carpet was sold to an anonymous bidder for $33,700,000.

24) Marie Antoinette’s Pendant – $36 mil

This drop-shaped natural pearl pendant sold in 2018 at Sotheby’s in Geneva, and was billed as a once in a lifetime purchase.

This was the crowning piece in a set of 10 pieces formerly owned by the Queen Marie Antoinette, some of which had not been seen in public for 200 years until the auction date, which is why we absolutely had to included it on our list of the most expensive things sold at auction as of 2024.

The last Queen of France before the French Revolution, Marie Antoinette was the wife of King Louis XVI. Both were executed during the uprising in the 18th Century that brought down the aloof opulence of French royals.

She smuggled some of her most treasured possessions to her relatives during the revolution.

The pendant sold for $36,000,000 at Sotheby’s.

23) Badminton Cabinet – $36.6 mil

This magnificent cabinet is made from ebony and decorated with fine ormolu and pietra dura. Made in 1726 by Florentine workshops, the piece was commissioned by a then 19-year-old Henry Somerset, the third Duke of Beaufort.

The piece is a triumph of craftsmanship, incorporating a wide range of materials, including agate, lapis lazuli, Sicilian red and green jasper, chalcedony, amethyst quartz and other superb hardstones.

It takes its name from Somerset’s home, Badminton House, where the 12ft 7in cabinet stood for over 25 years. Following the death of the tenth Duke in 1984, the cabinet made its way into the public domain when it was sold at auction.

When it returned to auction in 2004, it broke its own record price and sold for $36,662,106 to Dr Johan Kraeftner, Director of the Lichtenstein Museum in Vienna…definitely one of the most expensive item in the world at the time, and as of 2024 too.

22) Jimson Weed/White Flower No. 1 by Georgia O’Keeffe – $44.4 mil

In 2014, Jimson Weed/White Flower No.1 broke records as the most expensive work ever sold at auction by a female artist. The world-renowned Georgia O’Keeffe’s previous auction record was $6.2 million, a figure which was eclipsed by the sale of this painting.

Best known for her signature style and subject of magnified flowers, this particular canvas is unusually large for O’Keeffe. Born in 1887, O’Keeffe is recognized today as the mother of American modernism for her work.

Sotheby’s described the painting as “a strikingly bold and elegant representation of the artist’s mature intent and aesthetic.”

The purchase was primarily funded by Walmart heiress Alice Walton, who helped to obtain the piece for the Crystal Bridges Museum in Bentonville, Arkansas.

The piece sold for $44,400,000 in New York.

21) 1962 Ferrari 250 GTO Berlinetta – $48 mil

Another record-breaking sale, the 1962 Ferrari 250 GTO Berlinetta is the most expensive car ever sold at auction, as of 2021.

Hailed as the “Holy Grail in collectable cars,” the Berlinetta was built to compete in the 3-litre class FIA World Championship in 1962. It won the 1962 GT championship and has over 15 wins to its name. It was also driven by Phil Hill, the first American Formula 1 World Champion. What’s more, it is also fit for street use.

Ferrari’s GTO ‘family’ consists of just 39 cars, and this Berlinetta lived safely under the ownership of Italian enthusiast Fabrizio Violati for 49 long years, until it was re-sold in 2014.

The car sold again in 2018 at Sotheby’s for $48,000,000.

20) 1962 FERRARI 250 GTO BY SCAGLIETTI – $51.7m

If you thought the Berlinette was the most expensive Ferrari GTO on our list, you’d be wrong. In November 2023, an Ohio man placed the car for auction in Sotheby’s New York and got $51.7m for the classic racer.

This particular version of the iconic racer has a 3765 Chassis number. In fact, it was the only version that was fitted with a 4-liter engine. In 1975, the vehicle was sold to the head of the American Motors Corporation before finding a new owner in 1985. Then, 38 years and a restoration or two later, it came back on the market.

The Ferrari 250 is considered by many to be the apex of motor vehicle design. If you happen to be in the possession of a classic car and looking to pawn it , then Ferrari is one of the classic cars we loan against at New Bond Street Pawnbrokers.

19) Oppenheimer Blue Diamond – $57.6 mil

There could have been a number of rare diamonds on our list of the most expensive auction items and things, but the Oppenheimer Blue diamond made history in 2016 as the most expensive jewel ever sold at auction as of 2024.

The diamond is also the largest vivid blue diamond ever offered at auction, with its rectangular cut weighing 14.62 carats and previously belonging to Philip Oppenheimer.

The previous record was held by the Blue Moon Diamond, which sold for $48,600,000.

Bidding opened at 30 million Swiss francs at Christie’s in Geneva and was ultimately sold for $57,600,000 to a phone bidder after an extensive 20 minute battle. Of course, if you own fine jewellery or diamonds, and contemplate the idea of pawning it, do get in touch with the experts at New Bond Street Pawnbrokers!

18) PINK STAR DIAMOND: $71M

The Pink Star Diamond is a 59.60-carat, internally flawless pink diamond that is widely considered to be one of the rarest and most valuable gemstones ever seen. The stone was originally mined by the De Beers company in Botswana in 1999. Upon discovery, it was a 132-carat rough diamond. However, thanks to the work of the renowned diamond cutter Isaac Wolf, it was whittled down into its present-day shape.

In November 2013, the stone was sold to Wolf for $83 million. However, when he could not afford the bid, he defaulted, meaning the stone found its way back on the market in 2017. Hong Kong jeweler Chow Tai Fook was the winner this time, with a bid of $71 million at Sotheby’s Hong Kong.

The stone is roughly the size of a strawberry, and its vividness makes it a total one-off.

17) PORTRAIT OF DR. GACHET BY VINCENT VAN GOGH – $82.5m

Vincent Van Gogh’s Portrait of Dr. Gachet is one of the artist’s finest works. Painted during a purple patch in 1890, the painting was purchased by Ryoei Saito 100 years later for a sum of $82.5 million, making it the most expensive painting ever sold at the time. Shortly after Saito purchased the painting, he claimed that he would have it cremated with him when he died. Indeed, it has not been seen since, despite extensive investigations after the Japanese magnate’s death in 1996.

The painting itself has an incredible story. After Van Gogh had a mental breakdown in 1888, where he famously cut off his ear, his brother sent him to stay with Dr. Gachet. Although Van Gogh was initially displeased with this arrangement, he soon came to see Gachet as a brother. Only six weeks after completing the portrait, Van Gogh shot himself and later succumbed to the wounds.

Art historians suggest that the painting represents an attempt at modern portraiture, with Dr. Gachet’s sad face “the heartbroken expression of our time,” according to Van Gogh. There is something incredibly stirring and melancholic about the work that is only extended by the story of its composition and ultimate disappearance.

16) Portrait of an Artist (Pool with Two Figures) by David Hockney – $90 mil

This enigmatic painting of two men and a swimming pool by David Hockney sold at Christie’s in November 2018.

David Hockney is a talented painter, craftsman, and set designer. He has been on the art scene since the 1960s and is currently enjoying somewhat of a renaissance.

The painting, by an openly gay artist, depicts the emotional life of gay men – a rare theme in artwork at such a price point. It was one of the most admired paintings at Mr Hockney’s retrospective at the Metropolitan Museum of Art.

Surpassing its predecessor, Balloon Dog by Jeff Koons, the painting broke records as the most expensive work by a living artist sold at auction as of 2024, selling for $90,300,00.

At New Bond Street Pawnbrokers we facilitate auction based assessments for loans on fine art – do get in touch with our experts!

15) Rabbit by Jeff Koons – $91 mil

Jeff Koons wasn’t without the record for long, however. The controversial artist’s sculpture took the place as the most expensive work by a living artist just six months after David Hockney’s painting broke the auction record.

The shiny stainless steel sculpture, created in 1986, was inspired by a child’s inflatable toy and has been revered by art critics as elegant and alluding to earlier pieces by Duchamp and Warhol.

Koons’ career has been uneven, and so the sale comes as validation after he was forced to downsize his studio in 2017.

The sculpture sold at Christie’s to Robert E. Mnuchin, an art dealer and father of Treasury Secretary Steven Mnuchin. The price stood at $91,100,000 when the hammer fell. Without a thought, one of the most original and most expensive item sold at auction to 2024.

14) GIACOMETTI’S Chariot – $101m

Alberto Giacometti’s Chariot is a bronze sculpture made in 1950. It features a gaunt woman standing balanced on top of two wheels. It is widely considered to be one of the high points of Surrealist art, with historians suggesting that the piece was influenced by an Egyptian chariot that Giacometti saw at a museum in Florence.

The sculpture was first exhibited in 1951 at the Pierre Matisse Gallery in New York City, where it was immediately recognized as a masterpiece. Since then, it has been exhibited at major museums around the world.

Chariot was sold at auction by Sotheby’s in 2014. It sold for $1.1 million. However, it was expected to go for more. Nevertheless, the price cemented Giacometti’s place as one of the most important and iconic artists of the 20th century.

13) MEULES – CLAUDE MONET – $110m

Meules is a stunning piece of Impressionist art by Claude Monet. The piece is part of a series of 25 haystacks that Money completed between 1890 and 1891. A gorgeous use of light and hazy broad brushstrokes give this

Sotheby’s expected the piece to go for around $55 million. However, with six bidders interested it soon blew past the estimated price and went for a staggering $110 million. Only eight of the original 25 are still in private hands, with most of the pieces now owned by museums.

The sale confirmed the enduring appeal of the French master, and is the most expensive painting ever sold by Monet.

12) VERGER AVEC CYPRÈS, VINCENT VAN GOGH: $117m

When the late Microsoft co-founder Paul Allen passed away, many pieces of his spectacular art collection came to market. Verger Avec Cypres, which translates to Orchard with Cypresses, was one of the most exciting pieces because it represents Vincent Van Gogh at the peak of his powers.

Painted in 1888, the painting is still striking today thanks to its harmonious palette and expressive brushwork. The cypress flower is long associated with death, which gives the painting a subtle yet haunting quality.

In November 2022, the painting went to auction at Christie’s New York. It was forecast to net around $100 million, but it went for $117 million instead, making it the most expensive Van Gogh sold at auction.

11) THE SCREAM – EDVARD MUNCH -$120m

There are not many paintings with as interesting a backstory as Edvard Munch’s “The Scream”. The iconic piece of art features an anguished man against a swirling background. It’s a phenomenal example of Expressionist art, which seeks to distort reality to get at our interior feelings and emotions.

In 2012, the painting went up for auction in Sotheby’s New York. It was expected to fetch around $80 million. However, over the course of a dramatic 12 minutes, five bidders competed until New York financier Leon Black won with a bid of $120 million.

Munch created four different versions of the painting. The 1895 pastel version was the one that became the most expensive painting in the world when it was sold at Sotheby’s. A year after the sale, this version was shown at the New York Museum of Modern Art.

10) LA MONTAGNE SAINTE-VICTOIRE, PAUL CÉZANNE: $137M

Mont Sainte-Victoire is a mountain in Southern France. It is also the name of one of the most expensive paintings ever sold at auction. Another piece that was part of Paul Allen’s collection, this Paul Cézanne masterpiece went to auction at Christie’s New York in November 2022 and was bought for $137 million.

Allen bought the painting for $38.5 million in 2021. When it went to auction in 2022, it was estimated that it would fetch around $120 million, but it soon blew past that figure. It was the second most expensive painting by Cézanne ever sold, behind The Card Players which was sold in private to the State of Qatar in 2012 for an eye-watering $250 million.

9) Giacometti’s Pointing Man – $120mil

“L’homme au doigt” or “Pointing Man” is a life-sized sculpture of a thin man in the typical style of artist Alberto Giacometti. Giacometti is widely celebrated as a giant of the modern art world.

The sculpture took just nine hours to make – Giacometti created it in one night in 1947, hurrying to have it ready for his first exhibition in New York. Initially, it was meant as part of a larger composition, but Giacometti changed his mind, deciding that the sculpture was a complete work on its own.

As a result of this sale at Christie’s in 2015, The National Portrait Gallery announced its first-ever Giacometti exhibition to commemorate the 50th anniversary of his death, which ran in 2016.

When it was sold in New York for $141,000,000, it became the most valuable sculpture ever sold at auction, and one of the most expensive auction items ever sold on auction as of the time of this writing in 2024 – beating another of Giacometti’s sculptures, the famous “The Walking Man”, which sold in 2010 for $104,000,000.

8) THREE STUDIES OF LUCIAN FREUD BY FRANCIS BACON – $142M

The Three Studies of Lucian Freud is an oil on canvas triptych by Francis Bacon. Completed in 1969, it depicts fellow artist Lucian Freud caged and sitting on a cane-bottomed wooden chair. Painted at Bacon’s studio at the Royal College of Art in London, it is widely recognized as some of the artist’s best work.

In November 2013, at Christie’s New York, they became the most expensive paintings in the world when they sold for $142 million. The painting was expected to fetch around $80 million, so the final price caused quite a stir. Heavyweight collects Larry Gagosian and Gyu Shin were outbid on the night by the American billionaire businesswoman Elaine Wynn.

Freud and Bacon had been friends since 1945. They had both sat for each other a number of times, which is part of the appeal of this iconic work. Indeed, Bacon considered it as one of his favorite works he produced, in part because it represents a close and meaningful relationship with Bacon.

7) 1955 MERCEDES-BENZ 300 SLR UHLENHAUT COUPE – $144M

If you asked the question, “what are the most expensive auction items ever sold?” would you presume that a car could be so high on the list? Well, the first thing you need to know is that it’s not just any car. In fact, it is one of only two ever made.

The 1955 Mercedes-Benz 300 SLR Uhlenhaut Coupé is a two-seater that was built during the company’s period atop the world of Formula 1 racing. It has a 3-liter engine and the motor can reach 300 horsepower. But performance is just part of the appeal. It has a beautifully stylish shape and gullwing doors, giving it a very cool aesthetic.

Mercedes-Benz held on to the vehicle and occasionally showed it at an exhibition. However, in May 202, they put it up for private auction with Sotheby’s. The item attracted a lot of interest and was won by a bid of $144 million.

6)LES POSEUSES, ENSEMBLE BY GEORGES SEURAT – $149m

Les Poseuses Ensemble, also known as Three Models, is one of Georges Seurat’s most beloved pieces. It is considered a response to critiques of his style that claimed his work was cold and unrepresentative of life.

Perhaps the most remarkable aspect of the painting is its use of pointillism, the process of painting with small, delicate dots. This technique makes the painting seem as though it has form and contours and a vibrant, shimmering surface.

The work was sold at auction for $1 million in 1970 and was privately owned until 2022, when it went on sale at Christie’s. Experts expected the piece to fetch $100 million. However, the rarity of the piece meant that it went for almost 50% more. It is now at home in the Barnes Gallery in Philadelphia.

5) The Gigayacht – $168 mil

The most expensive item sold in an online auction as of 2024 was the sale of the Gigayacht. The Gigayacht is a 405 foot long pleasure yacht kitted out with innumerable luxuries, from a movie theatre and helipad to its 18 guest rooms and suites. However, the yacht was not yet built on the date of the sale.

The yacht’s design has a unique draw of just 5 feet, allowing her to motor into most ports.

Craig Timm, president of 4Yacht Inc, asked for a half-price bid, with the understanding that the actual price would be twice that, due to eBay’s inability to process bids above $99,999,999.

The winning bid was $168,000,000 on eBay.

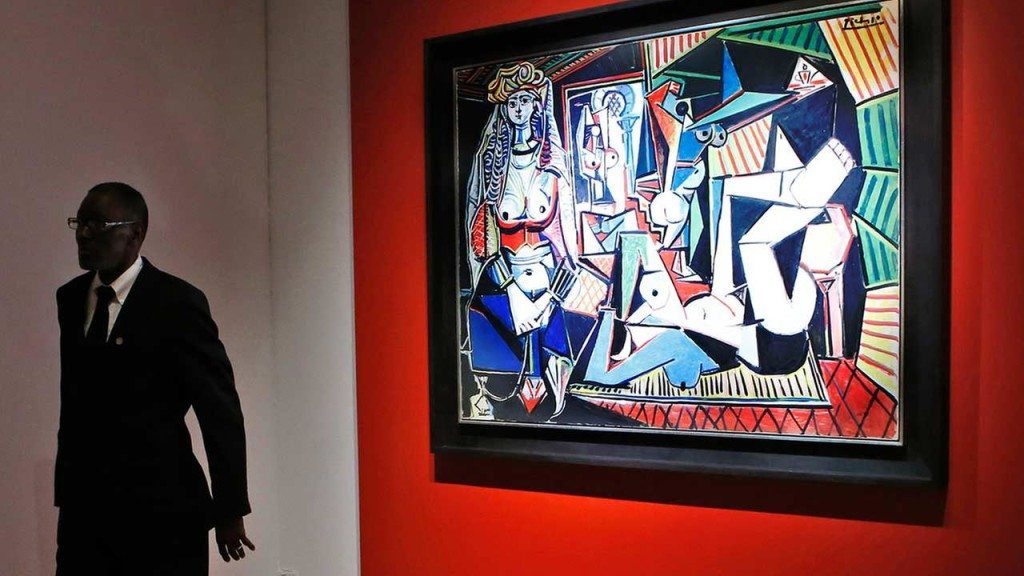

4) Les Femmes d’Alger (Version O) by Pablo Picasso – $179 mil

Painted in 1955 by Pablo Picasso, Les Femmes d’Alger (Version O) was created as part of Picasso’s rivalry with Henri Matisse that turned into a sort of adoration. After Matisse’s death in 1954, Picasso mourned by creating 15 works in homage to Eugene Delacroix’s 1834 painting Les Femmes d’Alger, which was held in high regard by the late Matisse. The original depicted Algerian concubines in their harem and was known in the 19th century for its sexual content. In the 1950s, it hung in the Louvre where Picasso would visit it.

When asked how he felt about Delacroix, Picasso replied “That bastard. He’s really good.”

The vivid cubist masterpiece sold at Christie’s in 2015, to an uproar of cheers, applause and gasps, for a breathtaking $179,400,000, an undeniable entry on our list of the most expensive auction items ever sold as of 2024.

Contemporary critic Étienne-Joseph-Théophile Thoré described the original Women Of Algiers with much emotional connection and reverence for the artist. He described the painting by saying:

“This is the tranquil and contemplative life of the Orient… No doubt these women have imbibed opium or hashish. No doubt they are deluding themselves inwardly with some dream of the Prophet; but this is not affecting anything outside of them, save for the air of perfume surrounding their voluptuous bodies” Theophile Thore 19th century.

3) SHOT SAGE BLUE MARILYN BY ANDY WARHOL – $195m

It’s hard to think of two more iconic 20th-century American figures than Andy Warhol and Marilyn Monroe. The pair were certainly a winning combination in the eyes of one bidder, who paid a startling $195 million at auction by Christie’s in 2022.

Painted in 1964, just a few short years after Monroe’s untimely death, the 40 x 40-inch piece is one of the most instantly recognizable works of Pop Art. The piece was part of a group of five silkscreen images that Warhol made of Monroe. They are referred to as the “Shot Marilyns” because they were mistakenly shot through by a visitor to Warhol’s gallery shortly after completion.

It’s hard to tell why this painting’s appeal is so enduring. So art historians say that it is a savage critique of celebrity and cite Monroe’s vacant stare that contrasts so heavily with the bright and chirpy colors. Indeed, the painting is still striking to this day because of the bold and innovative use of color, making it one of the most recognizable and accomplished examples of Pop Art.

2) INTERCHANGE BY WILLIEM DE KOONING – $300m

Created in 1955, this masterpiece by Dutch-American abstract expressionist Willem De Kooning became the most expensive painting in the world in 2015 when it was sold for $300 million. However, its stay at the top would be short-lived when Leonardo Da Vinci’s Salvator Mundi went for $450 million in 2017.

De Kooning was one of the originators of abstract expressionism, which was the first American Modern Art movement. This 79.0 in × 69.0 in oil on canvas work holds a meaningful place in art discourse within the US. However, its appeal goes beyond mere historical significance.

Interchange is technically impressive with loose and expressive brushwork. The painting exhibits an emotional energy and inner turmoil that has fascinated art lovers for decades. The David Geffen Foundation put the piece up for sale and sold it alongside a Jackson Pollock piece for a total of $500 million. The buyer was Kenneth C. Griffin, a hedge fund manager with a personal fortune of $35 billion.

1) Leonardo Da Vinci’s Salvator Mundi – $450 mil

A long-forgotten painting, it was authenticated in 2008 as a lost masterpiece of Leonardo Da Vinci by some of the world’s greatest Da Vinci experts in London. One such expert remarked that the painting had “presence.”

Despite rumblings in the art community that the painting was illegitimate, and possibly the work of Da Vinci’s imitator, Bernadino Luini, the portrait of Christ was unveiled for the first time in the National Gallery in 2011. Six years later, it sold at Christie’s and became the most expensive painting ever auctioned. It was purchased for the Louvre Abu Dhabi and was scheduled to be unveiled in September 2018. However, for the time being, it has been postponed without explanation.

Whilst some critics have taken the postponement to mean that the painting has been discovered to be a fake, the most likely theories suggest that there has been significantly more restoration required on the painting than previously anticipated. Some images have been released of the restoration, which has cleaned back some of the original treatment by respected restorer Dianne Dwyer Modestini.

With only 20 or so Da Vinci paintings surviving today, the Salvator Mundi – if indeed authentic – is truly priceless – which explains why it tops our list at an enormous sale price of $450,300,000.

Art as a commodity

Now… the sale of these expensive art pieces, on the facade shows a great reverence for the art in front of them. So much so that they are willing to spend £100 million+ on a single work of art, a sum that is disposable income only reserved for the world super-rich elite, with money born from oligarchy, plutocracy, energy or other monetary producing global conglomerates.

It raises artistic questions itself, why, do the people with the utmost tier of wealth be deserved of something that was born of emphatically the opposite. Of emotion of strife, and of a normal man.

The Women of Algiers: Picasso’s Interpretation of a classic

Art celebrity

This is the situating of art in the 21st century. We will pay vastly for something that speaks emotively to us, as human beings negotiating an over-populated vastly unequal society we inhabit. How does something so pure become so tarnished by capitalist, individualistic consumption, indeed that is an opinion reserved for art and cultural commentators, not to our team.

However, one thing can be unreservedly said. Art is an autonomous commodity within the global market, which is embroiled in all aspects of celebrity (artists as celebrity), exchange, equality and the essence of art itself, which is expressive of human emotion.

Pablo Picasso – Ambroise Vollard 1915

As one journalist exclaims, this record may not be broken for a decade, as he reflects on some of the most expensive artworks of our post-modern, digital times. Just as Piccaso’s love affairs let’s hope that the selling of art is plentiful, but not wildly commoditised and sensationalised till we forget the meaning of the art itself, and we become a piece of art ourselves, symbolising loss, error, passivity, greed and detachment.

After all as one Journalist at the Independent said at one time , for example, The Women of Algiers is far from being Picasso’s best work…its value is simply, and unashamedly, down to clever PR tactics.

Loans against fine assets

Contact the multi-award London based pawn shop team at New Bond Street Pawnbrokers if you consider a loan against luxury jewellery, diamonds, classic cars, rare books, fine watches, wine collections and more!

This post is also available in:

Français (French)

Deutsch (German)

Italiano (Italian)

Português (Portuguese (Portugal))

Español (Spanish)

Български (Bulgarian)

简体中文 (Chinese (Simplified))

繁體中文 (Chinese (Traditional))

hrvatski (Croatian)

Čeština (Czech)

Dansk (Danish)

Nederlands (Dutch)

हिन्दी (Hindi)

Magyar (Hungarian)

Latviešu (Latvian)

polski (Polish)

Português (Portuguese (Brazil))

Română (Romanian)

Русский (Russian)

Slovenčina (Slovak)

Slovenščina (Slovenian)

Svenska (Swedish)

Türkçe (Turkish)

Українська (Ukrainian)

Albanian

Հայերեն (Armenian)

Eesti (Estonian)

Suomi (Finnish)

Ελληνικά (Greek)

Íslenska (Icelandic)

Indonesia (Indonesian)

日本語 (Japanese)

한국어 (Korean)

Lietuvių (Lithuanian)

Norsk bokmål (Norwegian Bokmål)

српски (Serbian)

Tamil

Be the first to add a comment!