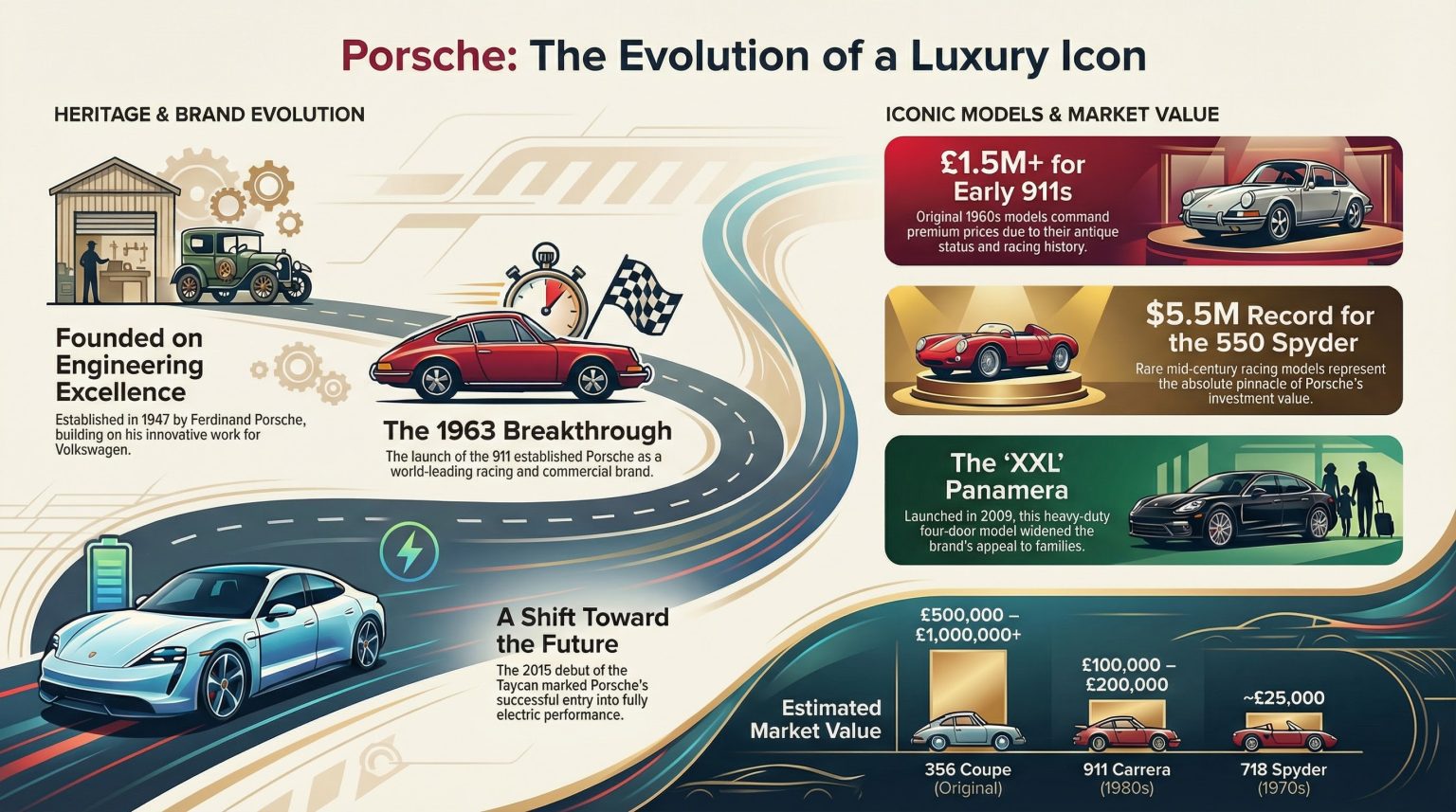

Porsche has spent more than 75 years building some of the most recognisable sports cars in the world. From the early 356 to successive generations of the 911, the brand’s cars have become icons of design, motorsport success and everyday usability. That combination means a Porsche often represents more than transport: it signals taste, success and a genuine love of driving.

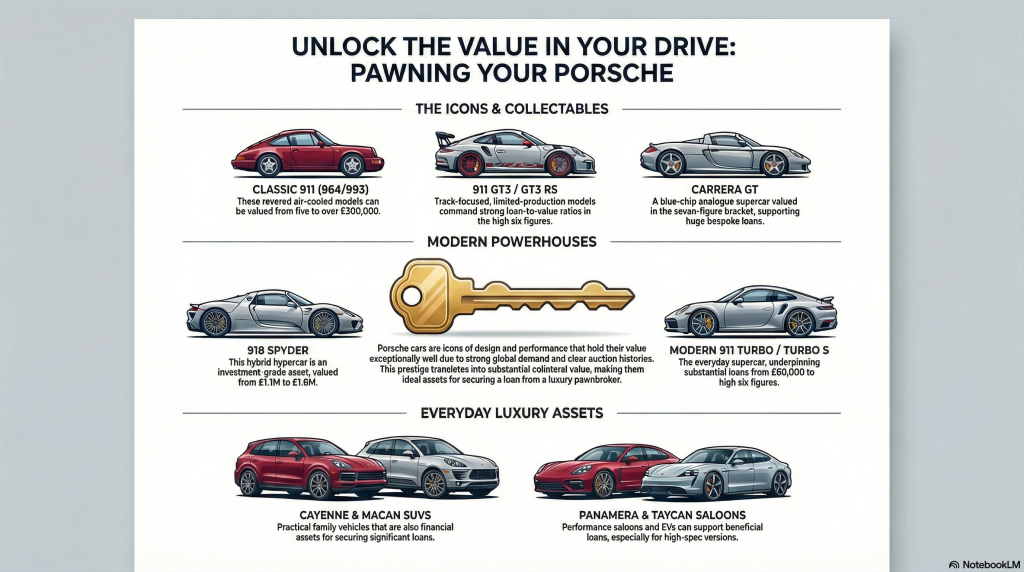

Crucially, that prestige also translates into substantial collateral value. Well‑chosen Porsche models tend to have deep global buyer pools, clear auction histories and strong demand across both classic and modern markets, helping them hold their value. If you want to pawn your Porsche or take out a loan against it at a luxury pawn shop, you are unlikely to be short of interest. Below are ten Porsche models that work particularly well for high‑end pawn loans, classic car finance and specialist collateral lending.

Porsche 911 (964, 993 and 997 Carrera and Turbo)

The Porsche 911 in its 964, 993 and 997 generations shows the model’s evolution from a classic analogue sports car into a modern everyday supercar. The 964 of the late 1980s and early 1990s introduced power steering, ABS and improved aerodynamics while keeping the iconic silhouette, and its Turbo variants have since become blue‑chip collectables. The 993, launched in the mid‑1990s, is revered as the last air‑cooled 911 and combines muscular looks with a more refined chassis and, in Turbo form, all‑wheel drive and serious performance. The 997, produced from the mid‑2000s, brought back classic round headlights with modern reliability and usability, making Carrera and Turbo models highly sought after as usable performance cars.

On the secondary market, good 964 and 993 Carreras typically range from around the mid‑five‑figure bracket to well into six figures, with Turbos often in the £150,000–£300,000 region or more, while 997 Carreras and Turbos commonly sit between roughly £35,000 and £90,000 depending on specification and mileage. Raising capital against your Porsche 911 at a luxury pawn shop lets you access loans based on these valuations while the car is stored securely, rather than having to sell it outright. For many owners, pawning a Porsche 911 is a way to unlock significant capital while retaining the option to redeem a highly collectable car.

Porsche 911 GT3 and GT3 RS

The Porsche 911 GT3 and GT3 RS take the 911 formula and strip it back to its racing core, evolving into some of the most focused road‑legal track cars on sale. Starting with the 996‑generation GT3 in the late 1990s and the first GT3 RS in 2003, these models revived Porsche’s RennSport tradition with lighter bodies, naturally aspirated flat‑six engines and chassis tuning derived directly from endurance racing. The latest 992‑generation GT3 and GT3 RS push that approach further with a 4.0‑litre high‑revving engine, advanced suspension and extreme aerodynamics, including active aero and a towering rear wing on the RS.

If you want to pawn your Porsche GT3 or GT3 RS, recent 992 GT3s commonly advertise in the mid‑ to high‑six‑figure range, with well‑specced GT3 RS and special‑series cars stretching higher depending on mileage, options and provenance. For specialist Porsche pawnbrokers, that mix of track pedigree, limited production and strong enthusiast demand makes GT3 models ideal candidates for performance‑car loans. These cars often command strong loan‑to‑value ratios, especially when they have low mileage and desirable factory options.

Porsche 911 Turbo and Turbo S

The Porsche 911 Turbo and Turbo S have long been the everyday supercars of the range, pairing brutal straight‑line performance with surprising refinement and usability. The legend began with the air-cooled 930 Turbo of the mid‑1970s, whose flared arches, whale‑tail spoiler and explosive single‑turbo power delivery created a fearsome reputation. Later 964 and 993 Turbo models added more power, luxury and, on the 993, twin turbos and all‑wheel drive. With the move to water cooling, the 996, 997 and later 991/992 Turbo and Turbo S turned the 911 into a devastatingly fast GT that can be used in all weathers.

On the secondary market, good air‑cooled Turbos such as 964 and 993 examples commonly trade from the low six figures to well over £150,000. Modern 997 and 991/992 Turbo and Turbo S cars frequently list from around £60,000 up to the high‑six‑figure bracket depending on generation, mileage and specification. If you take a loan against your Porsche 911 Turbo at a luxury pawn shop, that broad but robust value range underpins substantial secured lending, with the car held as collateral until you redeem the loan. For owners who want an everyday supercar to work as a financial asset, pawning a Turbo can be a convenient option.

Porsche Carrera GT

The Porsche Carrera GT is one of the brand’s most revered modern halo cars and a benchmark for analogue supercars. Built around a carbon‑fibre monocoque and subframe with a manual gearbox, ceramic clutch and minimal driver aids, it offers an intense, old‑school driving experience that stands apart from more electronically managed supercars. Its design, motorsport‑inspired engineering and limited production run of only a few hundred examples worldwide have made it a blue‑chip collectable with strong global demand.

As a result, the Carrera GT sits firmly in the seven‑figure bracket on the secondary market, with well‑kept cars often trading from close to £1 million up to significantly higher figures. If you pawn your Porsche Carrera GT with a specialist classic‑car pawnbroker, those values can support huge, bespoke loans, with the car stored under high‑security conditions for the duration of the agreement. For ultra‑high‑net‑worth owners, using a Carrera GT as collateral is a way to access substantial capital while keeping hold of a landmark Porsche.

Porsche 918 Spyder

The Porsche 918 Spyder is the brand’s hybrid hypercar flagship and a key part of the modern “holy trinity” alongside the McLaren P1 and Ferrari LaFerrari. Built in a limited run of 918 units between 2013 and 2015, it pairs a naturally aspirated V8 with two electric motors for a combined output well north of 800 bhp. The powertrain sits in a carbon‑fibre monocoque with advanced plug‑in hybrid technology that allows both brutal performance and short‑range electric running.

The car’s Nürburgring lap record at launch, its technological significance in Porsche’s electrification story and its capped production have made the 918 an investment‑grade collectable with strong global demand. In Europe, advertised 918 Spyders commonly sit deep in the seven‑figure range, with many cars clustered around the £1.1 -£1.6 million bracket depending on mileage, specification and whether they have the Weissach package. For owners, this makes the 918 Spyder one of the strongest Porsche models to use as collateral if you wish to arrange a high‑value pawn loan while keeping long‑term ownership of a flagship hypercar.

Porsche Taycan

The Porsche Taycan is the company’s first series‑production electric car and a central pillar of its modern range. Launched in 2019 as a high‑performance battery‑electric sports saloon, it sits on a dedicated platform and offers power levels from base rear‑wheel‑drive cars through 4S, GTS, Turbo and Turbo S variants. Performance often rivals or exceeds many combustion 911s, with rapid charging enabled by an 800‑volt electrical architecture. The Cross Turismo estate‑style derivative adds more cargo space, all‑wheel drive and mild off‑road capability.

In the UK secondary market, mainstream Taycan models have seen noticeable depreciation, but high‑spec GTS, Turbo and Turbo S versions, and desirable Cross Turismo variants, tend to hold their value better. Late‑model Taycan GTS and Turbo S cars are often advertised in the mid‑ to high‑five‑figure or low‑six‑figure bracket. If you pawn your Porsche Taycan at a luxury pawn shop, these values can support beneficial mid‑range loans, particularly on well‑optioned, low‑mileage examples. For many owners, a loan against a Taycan is a way to extract capital from a modern EV without having to sell into a soft market.

Porsche Panamera

The Porsche Panamera is the brand’s grand tourer saloon, introduced in 2009 to combine 911‑style performance with four doors, real rear seats and long‑distance comfort. Over two generations, it has expanded into a wide range that includes muscular V8 Panamera Turbo and Turbo S models, as well as high‑performance hybrid variants like the Panamera S E‑Hybrid, 4 E‑Hybrid and Turbo S E‑Hybrid. This breadth means there is usually a Panamera specification attractive to both everyday buyers and enthusiasts.

In the UK used market, V8 and hybrid Panameras show solid demand, with first‑generation hybrid and V8 cars often found from the mid‑£20,000s to around £40,000, and newer Panamera 4 E‑Hybrid and Turbo S E‑Hybrid models frequently advertised from about £45,000 to £90,000. If you want to pawn your Porsche Panamera, specialist pawnbrokers can structure loans around these values, with the car serving as security while you unlock short‑term capital. The mix of performance, practicality and brand prestige makes the Panamera a popular choice for secured loans.

Porsche Cayenne

The Porsche Cayenne is the SUV that transformed Porsche from a niche sports‑car maker into a major luxury brand. Launched in 2002, it proved that a high‑riding 4×4 with a Porsche badge could sell in large numbers worldwide. Across three generations, it has evolved from relatively utilitarian early models into a broad line‑up that includes powerful GTS and Turbo V8S and increasingly sophisticated plug-in hybrids like the Cayenne E‑Hybrid and Turbo S E‑Hybrid.

On the UK secondary market, older V8 Cayenne GTS models from the first and second generations can often be found from around £15,000–£30,000. Late‑model third‑generation GTS examples typically advertise from roughly £60,000 up to over £110,000 depending on age and mileage, while plug-in hybrids such as the Cayenne E‑Hybrid and Turbo S E‑Hybrid generally sit higher. These values make it relatively straightforward to take out a pawn loan against your Porsche Cayenne, whether you need a modest sum on an older car or a more substantial advance on a newer, high‑spec SUV. For many owners, a loan on a Cayenne is a practical way to use a family vehicle as a financial asset.

Porsche Macan

The Porsche Macan is the brand’s compact luxury SUV, launched in 2014 to bring Porsche’s sports car driving feel into a smaller, more everyday package than the Cayenne. Built on a shared platform but heavily reworked, it has been offered with turbocharged four‑cylinder and V6 engines in S, GTS and Turbo versions, and has become one of Porsche’s core volume models worldwide.

Resale performance is a significant part of the Macan’s appeal, with it generally holding value better than many rival compact luxury SUVs. In the UK, earlier Macan S and Diesel models often start in the low‑ to mid‑£20,000s, while desirable GTS examples commonly advertise from around the high‑£20,000s up to roughly £70,000‑plus for late, low‑mileage cars. A knowledgeable Porsche specialist pawnbroker can use these values to offer competitive loans when you pawn your Macan, giving you quick access to capital while the vehicle is safely stored. For city‑based owners, pawning a Porsche Macan can be a neat way to unlock funds without giving up a versatile daily driver.

Porsche 928 and 944

The Porsche 928 and 944 are the best‑known members of the brand’s front‑engined “transaxle” family, using a rear‑mounted gearbox to balance weight and give them a very different feel from rear‑engined 911s. The 928 arrived in the late 1970s as a luxurious V8 grand tourer intended to replace the 911, winning European Car of the Year and remaining in production into the mid‑1990s. The 944 followed in the 1980s as a more affordable, sharp‑handling four‑cylinder coupé that became one of Porsche’s best‑selling models.

Today, typical Porsche 928s in sound condition often sit from roughly the low‑ to mid‑five‑figure range, with late S4 and especially GTS models stretching into higher brackets. For the 944, average cars sit around the low‑five‑figure mark, while desirable Turbo and Turbo S variants can demand much more depending on mileage and condition. Loans at Porsche‑savvy pawn shops are generally based on these market levels, allowing you to unlock quick capital when you pawn your 928 or 944 while retaining the option to redeem the car once the loan is repaid. For many enthusiasts, that makes these transaxle Porsches a flexible part of both their collection and their financial planning.

Choosing a Luxury Pawnbroker for Your Porsche

Whether you own a classic air-cooled 911, a modern Taycan, a 918 Spyder or a family‑friendly Cayenne, using your Porsche as collateral can be an effective way to access capital without selling a prized car. The key is working with an experienced luxury pawnbroker or specialist collateral lender who understands the Porsche market, from entry‑level classics to seven‑figure hypercars.

A reputable lender like New Bond Street Pawnbrokers can provide transparent valuations, secure insured storage and tailored loan terms that rely on the strength of your Porsche as collateral rather than your credit score. With the right partner, pawning your Porsche or arranging a loan on a classic or modern model can become a flexible, discreet part of your overall financial strategy.