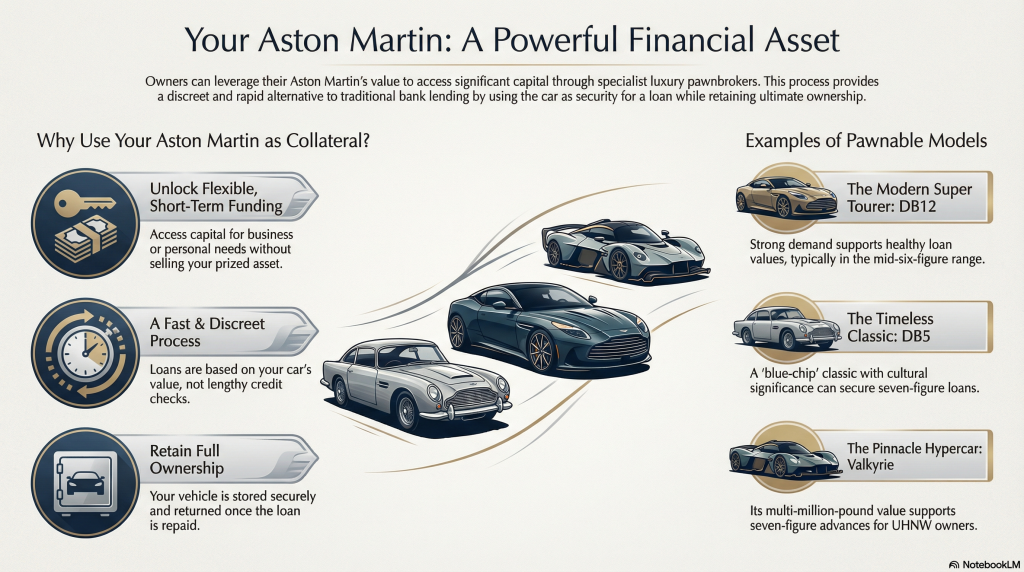

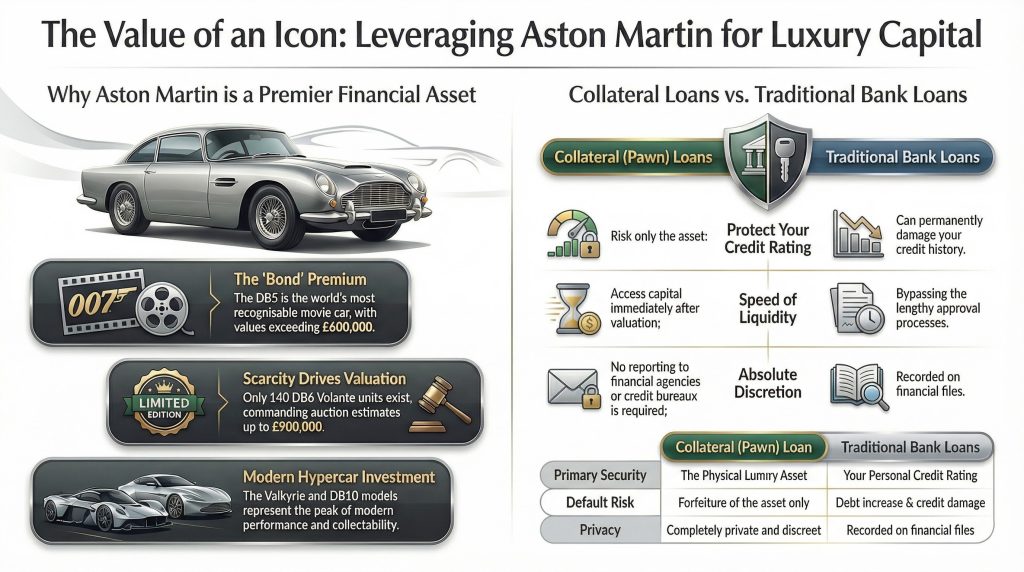

If you own an Aston Martin, you are sitting on a powerful financial asset that can unlock flexible, short‑term funding without having to sell your car. These iconic British grand tourers, supercars and luxury saloons are ideal for collateral lending at specialist luxury pawnbrokers, especially when you need a discreet, fast loan against a high‑value vehicle.

Unlike traditional bank lending, a reputable luxury pawn shop or high‑end collateral lender can offer secured loans against Aston Martin cars based on market value, condition and provenance rather than lengthy credit checks.

For many owners, pawning an Aston Martin is a practical way to release capital while retaining ownership, with the option to redeem the car once the loan is repaid. Below are ten Aston Martin models that work particularly well for classic car loans, luxury pawn shop funding and specialist collateral lending.

DB12

Launched in 2023 as the successor to the DB11, the Aston Martin DB12 is a modern “super tourer” and one of the most desirable current‑generation models you can pawn. Its mix of hand‑finished craftsmanship, twin‑turbocharged V8 performance, and everyday usability keeps secondary‑market demand strong, which supports healthy loan‑to‑value ratios when you approach a luxury pawnbroker.

Early DB12s in the UK typically list from around the mid‑six‑figure range, depending on age, mileage and specification. For collateral lenders, those values provide a robust basis for loans on late‑model Aston Martins, whether you are seeking a short‑term business loan, bridging finance or a personal cash injection using your car as security. If you want to pawn your Aston Martin DB12, factors such as service history and specification will influence the size of the loan, but you should find a strong appetite from luxury pawn shops.

Vantage

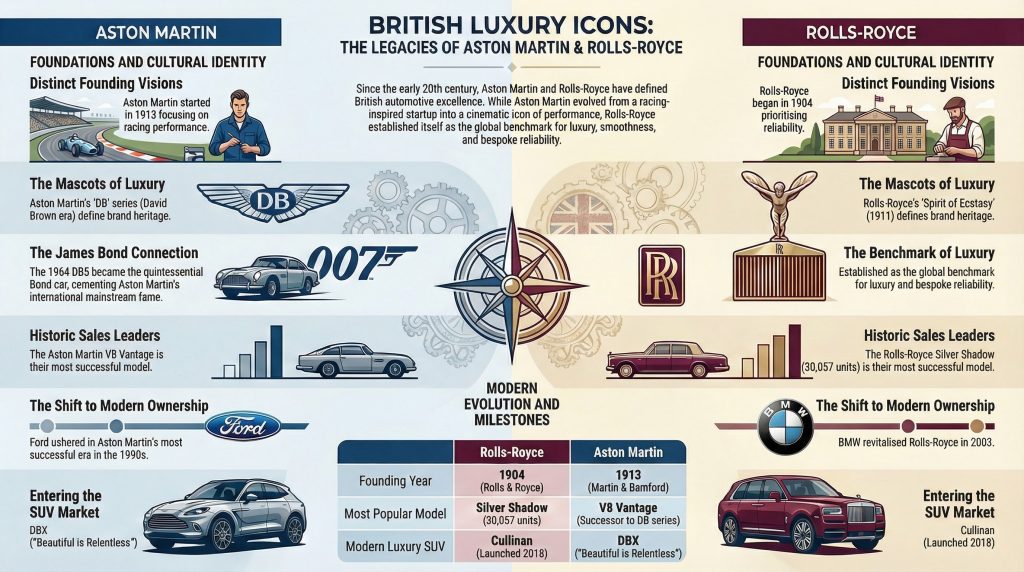

The Vantage has long been Aston Martin’s “driver’s car”, evolving from a 1950s performance upgrade into the standalone sports car line enthusiasts recognise today. The current‑shape Vantage, relaunched in 2018, is a compact, front‑engined sports car aimed at rivals like the Porsche 911, powered by a 4.0‑litre twin‑turbo V8.

From a pawn and collateral‑lending perspective, the Vantage’s appeal is its balance of everyday usability and performance, which keeps demand healthy across multiple model years. Sharp steering, strong acceleration and classic long‑bonnet, short‑tail proportions mean there is a broad market of buyers and collectors, something luxury pawn shops look for when underwriting loans against Aston Martin sports cars. Late current‑shape Vantages typically sit from the high‑five‑figure bracket up to the low‑six‑figure range for newer, low‑mileage or special versions.

For owners, this broad value spread gives scope for tailored loans against a Vantage, from modest advances on older cars to larger facilities on rare or recent examples. Because many Vantages are used regularly, luxury pawnbrokers will pay close attention to mileage, service history and condition, but a well‑kept car is usually straightforward to use as collateral.

DBX707

Introduced in 2022 as the flagship version of Aston Martin’s first SUV, the DBX707 was created to push the DBX into full‑blown super‑SUV territory. A heavily reworked twin‑turbo V8 and a 9‑speed wet‑clutch gearbox give it immense power and rapid performance, making it both a family car and a status symbol.

For collateral lending, that dual role matters: the DBX707 appeals to buyers who want practicality and prestige, which supports residual values and, in turn, the size of any loan against your Aston Martin. In the UK secondary market, low‑mileage, recent DBX707s generally sit in the mid‑ to high‑six‑figure range, especially for highly optioned examples. A pawn shop loan against a DBX707 can, therefore, unlock substantial capital for owners needing rapid funding.

If you choose to pawn your DBX707, expect lenders to focus on mileage, warranty coverage and main‑dealer service history. For many clients, pawning a DBX707 offers faster, more flexible access to funds than traditional finance, while the SUV is stored securely by the luxury pawnbroker.

Valkyrie

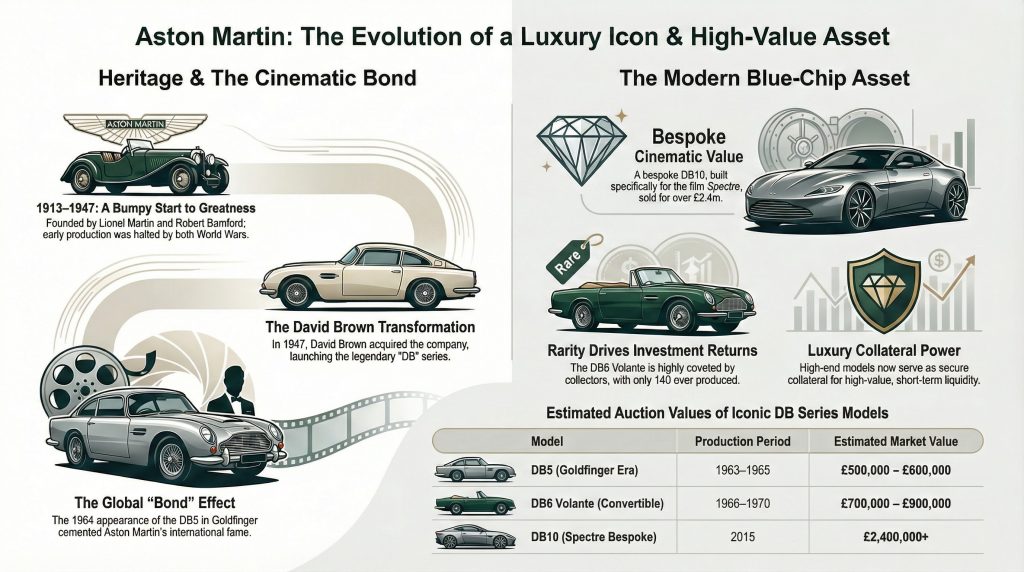

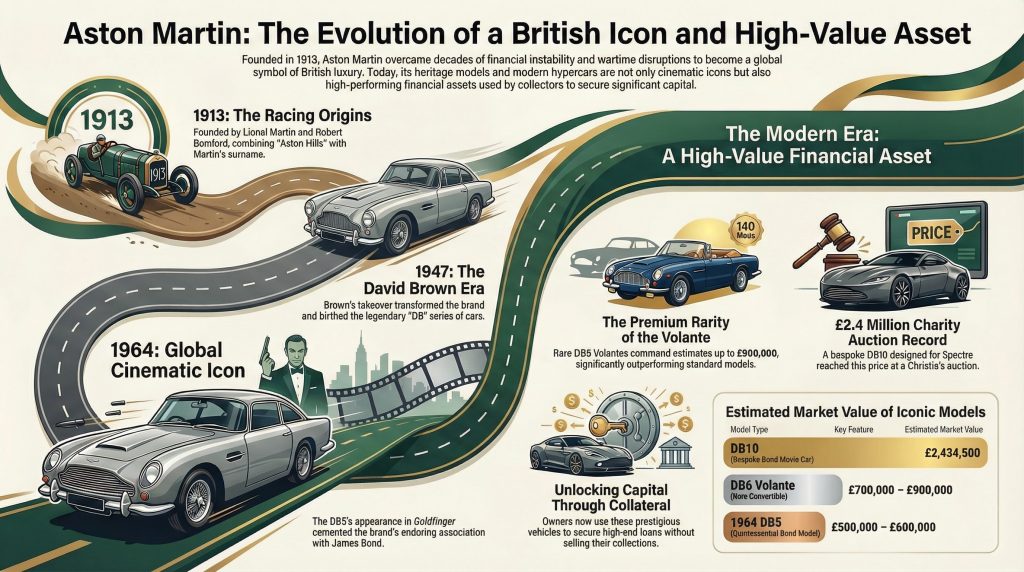

The Aston Martin Valkyrie is a road‑legal hypercar developed with Red Bull Racing and F1 designer Adrian Newey, created to deliver near‑race‑car performance for the road. Built in very limited numbers across coupé, Spider and track‑only variants, it sits at the top of Aston Martin’s performance hierarchy.

A naturally aspirated V12 paired with a hybrid system, extreme aerodynamics and tiny production numbers have made the Valkyrie a blue‑chip collectable. Auction sales place well‑kept examples firmly in the multi‑million‑pound bracket, making it one of the most valuable Aston Martins you can use for a pawn loan. For luxury pawn shops and specialist collateral lenders, this supports the potential for seven‑figure advances secured against a single car.

Pawning a Valkyrie usually involves bespoke underwriting, provenance checks and highly secure storage. For ultra‑high‑net‑worth owners, using this kind of hypercar as collateral can be an efficient way to access huge sums while retaining long‑term ownership of an appreciating asset.

Valhalla

The Aston Martin Valhalla, first shown as the AM‑RB 003 concept, is the brand’s first series‑production mid‑engined hybrid supercar, positioned just below the Valkyrie. Limited to 999 units worldwide, it combines a bespoke twin‑turbo V8 with electric motors and advanced aerodynamics.

From a pawn and loan perspective, the Valhalla is an emerging asset: its limited production, hybrid powertrain and close ties to motorsport technology make it a likely future collectable. Pricing is set in the high six‑figure range before options, and early expectations suggest that secondary‑market values could climb once cars start changing hands. This makes the Valhalla an attractive candidate for collateral lending with luxury pawnbrokers who understand modern supercars.

Owners seeking a loan on a Valhalla should expect lenders to look closely at allocation status, build specification and any early sales restrictions. As the market develops, the car’s rarity and technology are likely to support strong loan terms for those pawning this next‑generation Aston Martin.

V12 Speedster

The Aston Martin V12 Speedster, revealed in 2020 and built in tiny numbers from 2021, is a roofless, windscreen‑free two‑seater designed as a dramatic, collectable showpiece. Just 88 examples were produced, each powered by a twin‑turbo V12 and styled to evoke classic Aston racing cars.

Collectors prize the V12 Speedster for its raw driving experience, dramatic design and rarity. Original pricing and recent estimates place good examples in the upper‑six‑figure bracket, with some stretching higher depending on mileage and specification. If you pawn your V12 Speedster, a luxury pawnbroker can structure a significant loan based on those values, backed by secure storage and tailored repayment terms.

Because of the model’s limited production, many owners see collateral lending as a way to unlock liquidity without losing a rare asset. For lenders, its exclusivity and strong collector interest make it a compelling car to accept as collateral for high‑value loans.

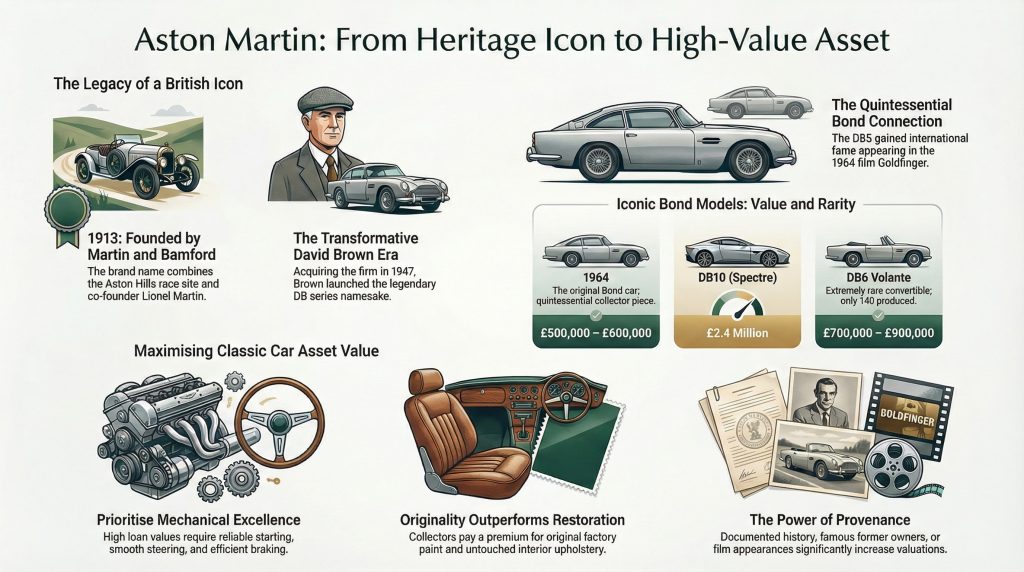

DB5

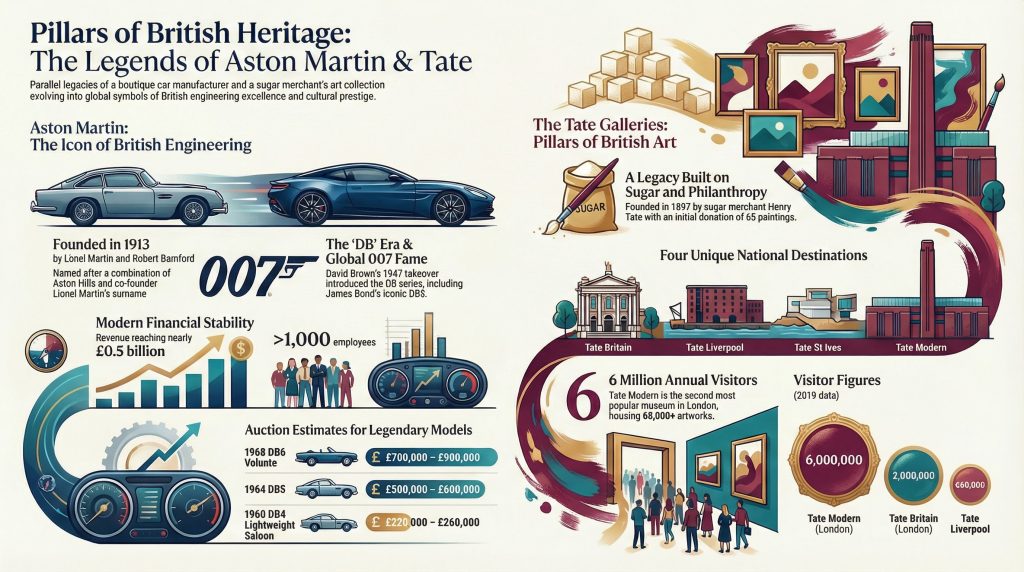

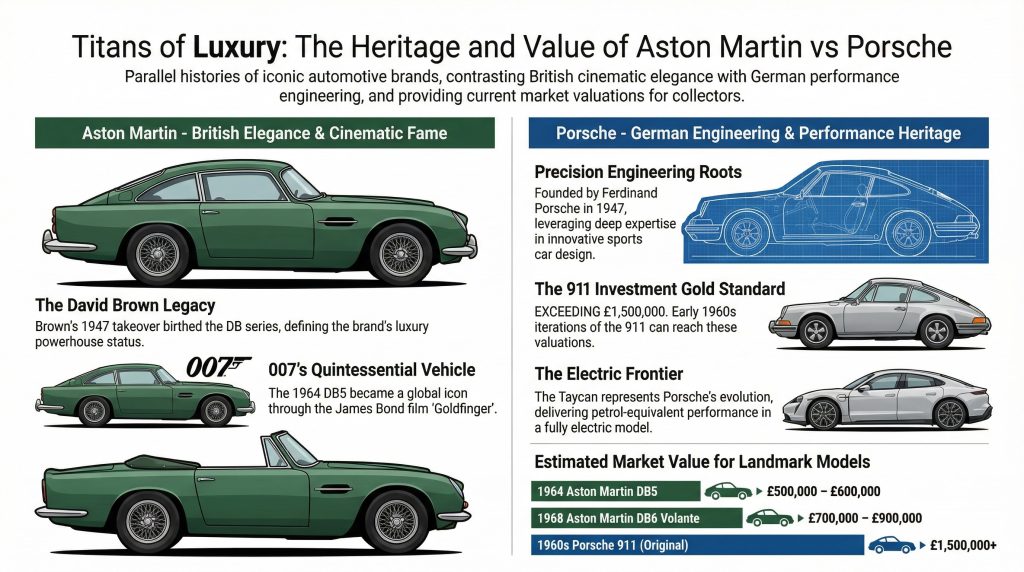

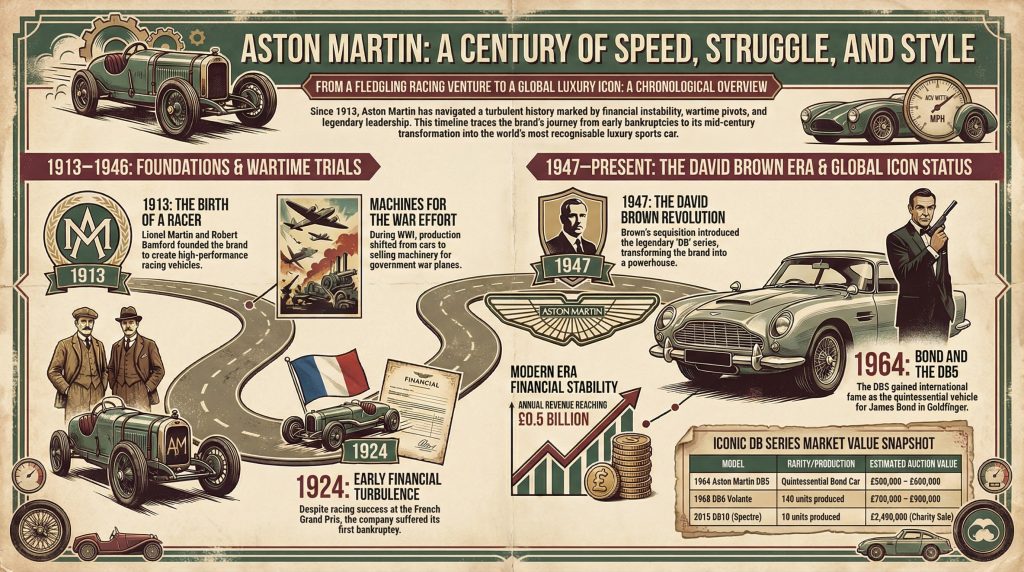

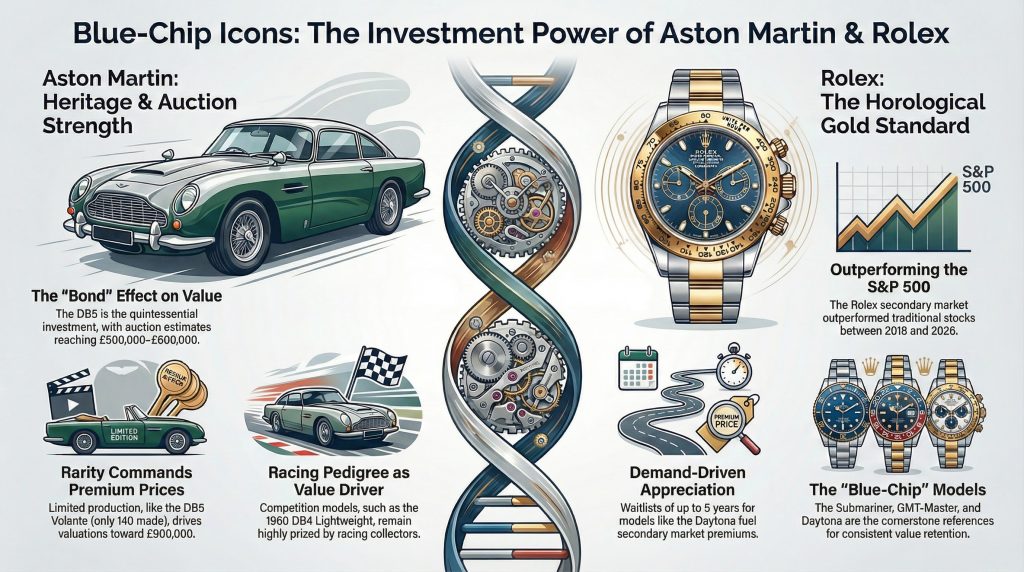

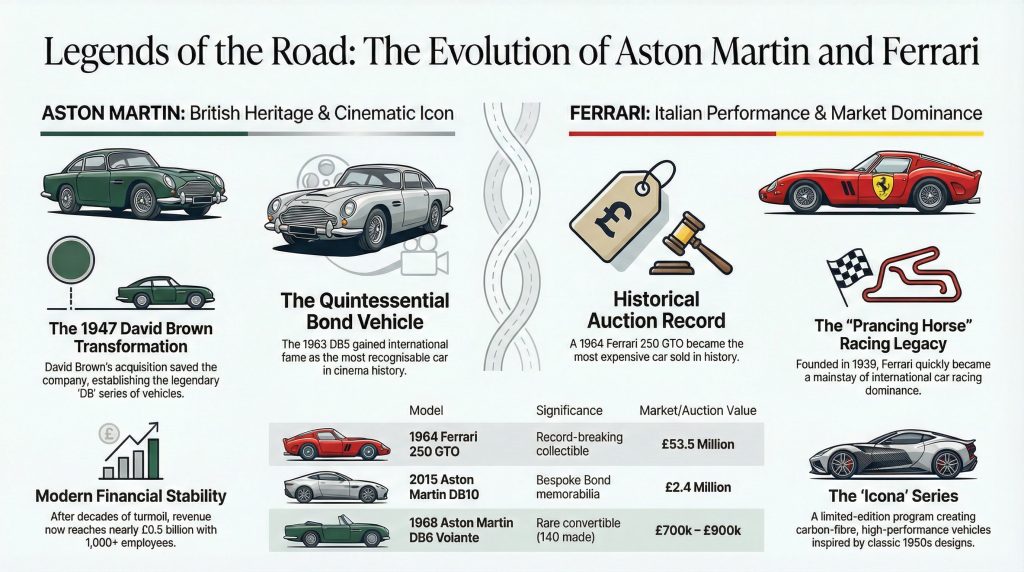

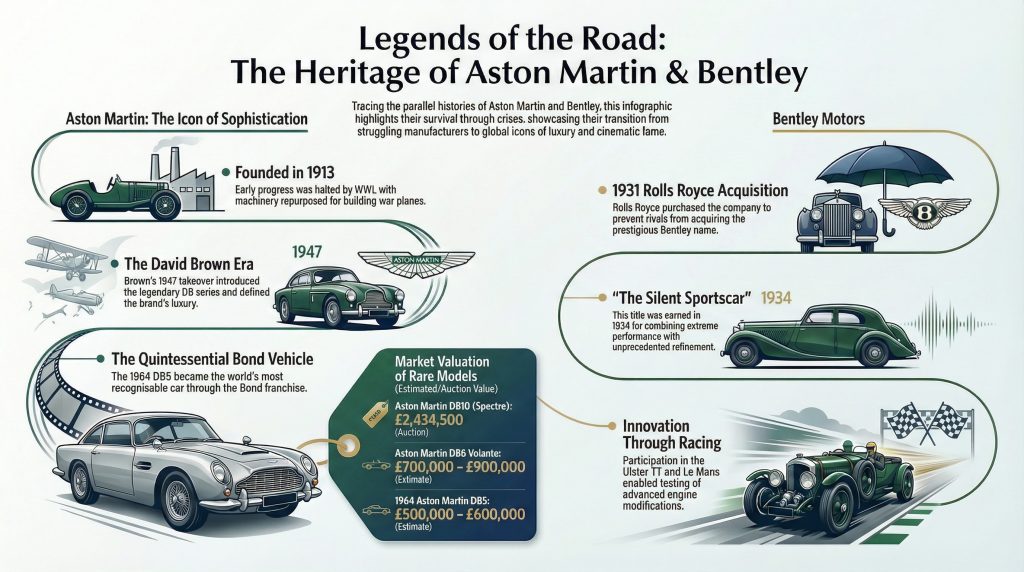

First built in 1963 as the evolution of the DB4, the Aston Martin DB5 set the template for the classic British grand tourer and became world‑famous as James Bond’s car in Goldfinger. Its combination of aluminium bodywork, straight‑six engine and hand‑finished interior has made it one of the most recognisable classic cars in the world.

The DB5 is one of the strongest candidates for classic car loans because it combines elegant styling, craftsmanship and cultural significance. Many luxury pawnbrokers see a good DB5 as a blue‑chip classic, with values often in the seven‑figure range for well‑kept examples and even higher for the very best cars. That makes it a powerful asset if you want to arrange a substantial loan against a classic Aston Martin.

When you pawn a DB5, provenance is critical. Lenders will examine history files, matching numbers, status and restoration quality to assess how much they can safely advance. In return, you gain access to significant capital while your car is stored securely and professionally.

DB4 GT Zagato

The Aston Martin DB4 GT Zagato, created in 1960, is a lighter, more aerodynamic evolution of the DB4 GT with a hand‑formed aluminium body by Italian coachbuilder Zagato. With only a handful of originals built and later continuation cars, it is one of the rarest and most desirable Aston Martins.

This model is among the most valuable Aston Martins you can use for a pawn loan, with original cars typically sitting deep in the multi‑million‑pound bracket. Its blend of British engineering, Italian styling and motorsport pedigree makes it a pinnacle classic car for collateral lending. A DB4 GT Zagato can support exceptionally large loans, often structured on a bespoke, case‑by‑case basis.

At this level, luxury pawn shops work closely with marque experts, valuers and insurers to ensure any loan reflects the car’s true standing and to provide top‑tier storage and security. For an owner, using a DB4 GT Zagato as collateral is a highly specialised but powerful financial tool.

Cygnet

The Aston Martin Cygnet, launched in 2011, is a luxury city car based on the Toyota iQ but upgraded with hand‑finished interiors and bespoke details. It was mainly aimed at existing Aston owners who wanted a compact urban runabout with the right badge.

Anyone looking to pawn a Cygnet should understand that it usually sits in the mid‑five‑figure range in the UK, with unusual or very low‑mileage cars attracting a premium. That means loans against a Cygnet are typically smaller than those on main‑line Aston Martin GTs and supercars, but it can still serve as a valuable collateral asset for a short‑term loan at a luxury pawn shop.

For urban‑based owners, pawning an Aston Martin Cygnet can unlock a modest amount of capital without selling a quirky, rare city car. Lenders will assess condition, mileage and the rarity of the specification when deciding how much to advance.

Lagonda

Lagonda saloons sit at the more eccentric end of the Aston Martin family, evolving from traditional post‑war luxury cars into sharp‑edged, futuristic limousines in the 1970s and 1980s. The best known is the wedge‑shaped Lagonda with its radical digital dashboards and avant‑garde styling.

Taking a pawnshop loan out against a Lagonda is usually straightforward with a specialist lender because it is a hand‑built British luxury car with distinctive four‑door proportions and a reputation as an icon of period wealth. Values are highly dependent on condition and model year, but usable classic Lagonda saloons generally run from substantial five‑figure sums into low six figures, with top examples commanding more.

For owners, this makes the Lagonda a flexible collateral asset. You can arrange anything from a mid‑range loan for short‑term needs to a more substantial facility on a particularly desirable car. Luxury pawn shops will factor in restoration status, originality and recent maintenance when determining how much they can safely lend.

Choosing a Luxury Pawnbroker for Your Aston Martin

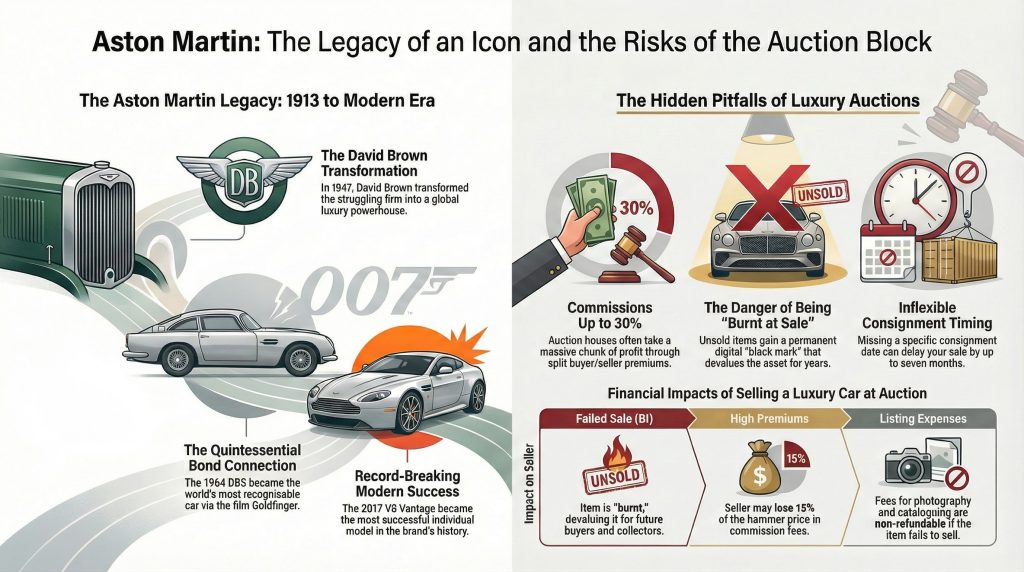

Whether you own a modern DB12, a daily‑driven Vantage, a classic DB5 or a multi‑million‑pound Zagato, using your Aston Martin as collateral can be an effective way to access capital without selling a prized car. The key is working with an experienced luxury pawnbroker or specialist collateral lender who understands the Aston Martin market, from current super‑SUVs to blue‑chip classics.

A reputable lender like New Bond Street Pawnbrokers offers transparent valuations, secure insured storage, tailored loan terms and a discreet process that relies on the strength of your Aston Martin as collateral rather than your credit score. With the right partner, pawning your Aston Martin or arranging a loan on a classic car can become a flexible part of your overall financial strategy.