I hope you enjoy this blog post.

If you want us to appraise your luxury watch, painting, classic car or jewellery for a loan, click here.

Investing in Diamonds – what you must know in 2024

Diamonds, as they say, are a girl’s best friend. They’ve also been a great acquaintance for investors around the world for several centuries. However, recent years have been challenging for the industry, leading some to wonder if diamond investment is still a winning strategy.

During the pandemic, diamonds were one of the best-performing purchases. Stay-at-home shoppers, flush with savings on travel and other expenses, purchased them in their droves. Since then, things have not gone to plan. As economies reopened, diamond sales took a hit. Suppliers were left with too many investment diamonds, and demand was saturated.

Inflation problems in the US and a property collapse in China also took a toll in recent times because both are critical diamond investment markets. Other factors to consider are the emerging growth of the lab-grown diamond market and consumers’ questions about the sustainability of genuine diamonds.

2023 saw wholesale polished diamonds drop in value by 20%. Rough or uncut diamonds plummeted by as much as 35%, leading DeBeers to cut prices in early 2024 by between 10% and 25%.

If you want to buy diamonds for investment in 2024, you have to be pragmatic and understand that only specific diamonds appreciate in value.

Ultra-rare diamonds can increase in price. Red, blue, or pink diamond investment is still a viable strategy in 2024. Additionally, some colorless diamonds can also make great investment pieces, particularly if they have outstanding characteristics, such as cut, weight, and clarity.

Diamond market size

While the outlook for 2024 is uncertain, there are some reasons for hope. The diamond industry market size is worth over $100 billion, with experts suggesting a market growth of around 3% to 4.5%. Indeed, analysts suggest that should lead to an overall valuation of nearly $130 billion by 2030.

The current state of the market

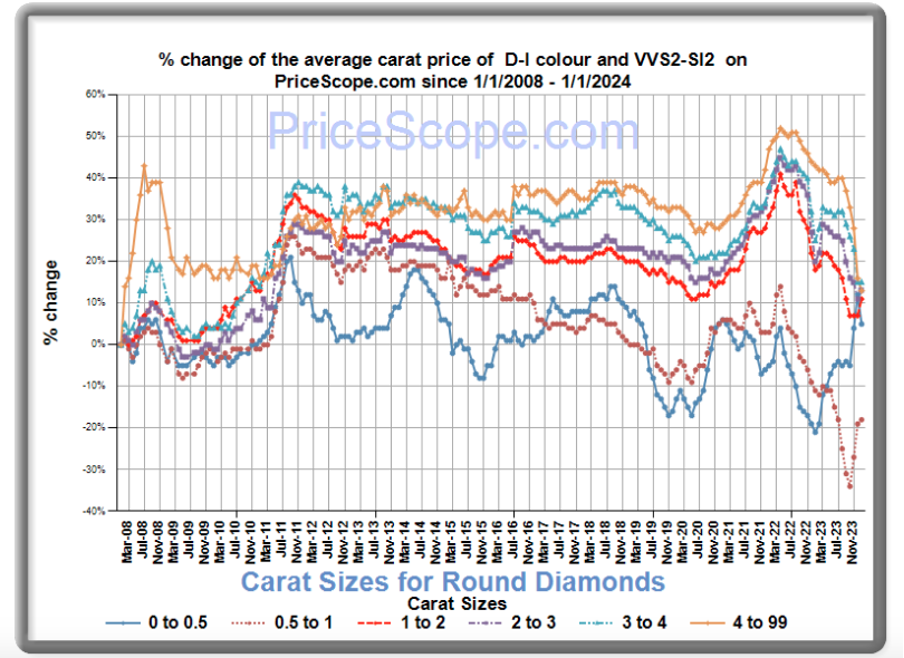

Pricescope.com data for the current price of round-cut diamonds paints a gloomy picture, as seen below.

DeBeers isn’t the only diamond supplier feeling the pinch. Alrosa, a prominent Russian diamond miner, canceled diamond sales for a couple of months at the end of 2023 in a bid to restrict supply and bump up demand.

While creating artificial demand has been part of the diamond industry playbook from its inception, it’s concerning news for diamond investors. However, context is everything, and some experts say the decision is just a temporary blip. Indeed, the Rapaport Diamond price list suggests that 2023 finished strong, largely due to the holiday season, so it’s clear that demand is still there.

Factors affecting diamond investment in 2024

Any good investment strategy relies on having access to the right information. So, if you want to buy diamonds for investment in 2024, you need to stay on top of the factors that will affect the market. Here is what you need to know

1. Russian Sanctions

Sanctions in Russia have led to the ban on diamond exports. What’s more, the Kimberley Process Certification Scheme — designed to tackle the flow of “conflict diamonds” — has become tighter, which will tighten supply from Russia and other regions. This situation will restrict the number of investment diamonds for sale, which could bump up the price.

2. Lab-grown diamonds

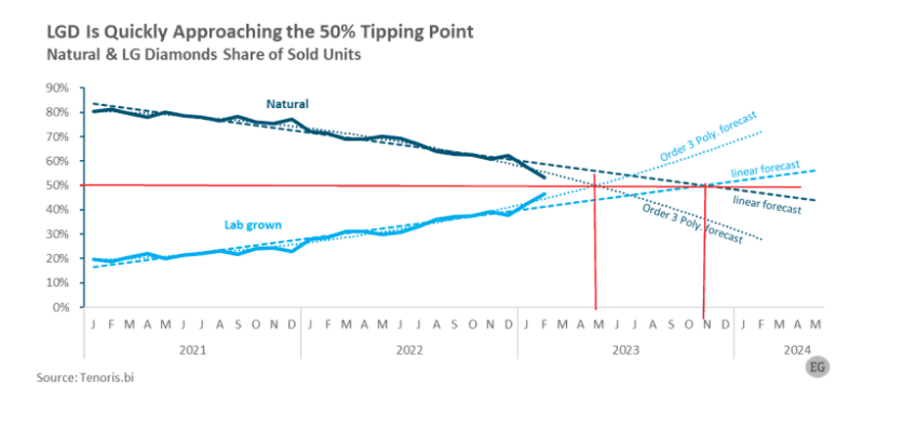

Many millennials are less interested in diamonds than previous generations and are instead embracing synthetic or lab-grown diamonds. Indeed, diamond analytics market expert Edhan Golan suggests that lab-grown diamonds currently sit at 17% of the market. What’s more, he suggests that it’s a matter of when, rather than if, lab-grown diamonds dominate the market.

A quick glance at market data from Tenoris (via Edhan Golan) demonstrates the trend and suggests that by “50% of loose diamonds sold by American jewelry retailers are expected to be lab-grown diamonds” from 2024 and beyond.

However, it’s hard to determine the effect that these changes will have on the investment diamond market. Lab-grown diamonds lack the history, cultural significance, tradition, and rarity of natural diamonds. As such, their presence is unlikely to disrupt the premium end of the diamond investment market.

3. Economic growth

Inflation and interest rates are coming down. With some financial experts revising their predictions of a recession in 2024, things are looking up. However, there is still a lot of uncertainty around what to expect this year, with an economic slowdown a distinct possibility.

There are three major economies that diamond investors must keep an eye on. The US is, by a long way, the world’s largest diamond market, accounting for around 50% of all sales. Renewed growth in the region will benefit diamond investors. However, China and India are both significant markets, too. Growth in these economies could more than offset any softness in the US market.

4. Price instability

There are a number of interesting demand factors that you need to consider during 2024. For starters, as we’ve mentioned above, diamond supply is being controlled to strengthen demand. Additionally, rough diamond production has yet to hit pre-pandemic levels, which means supply is limited, especially for rare stones.

After a weak 2023, if demand picks up, stockpiled diamonds may hit the market. Sellers who were hesitant to offload last year might see 2024 as an opportunity. This situation has the potential to destabilise the market. For now, ultra rare or coloured diamond investment might be the only path forward for solid returns.

How to value a Diamond for Investment in 2024: The five C’s

Diamond investments are relatively unique in the sense that, despite making accurate valuations as to their worth, their bespoke desirability can greatly increase their value.

So, in deciding to place your best diamond investment in 2024, you should first have an idea of how to value them yourself. This way, when you visit an auction, you know ahead of time that, firstly, your stones are valuable, and secondly, you’ll have some sort of idea of the investment price and value of the diamonds you are looking to invest in.

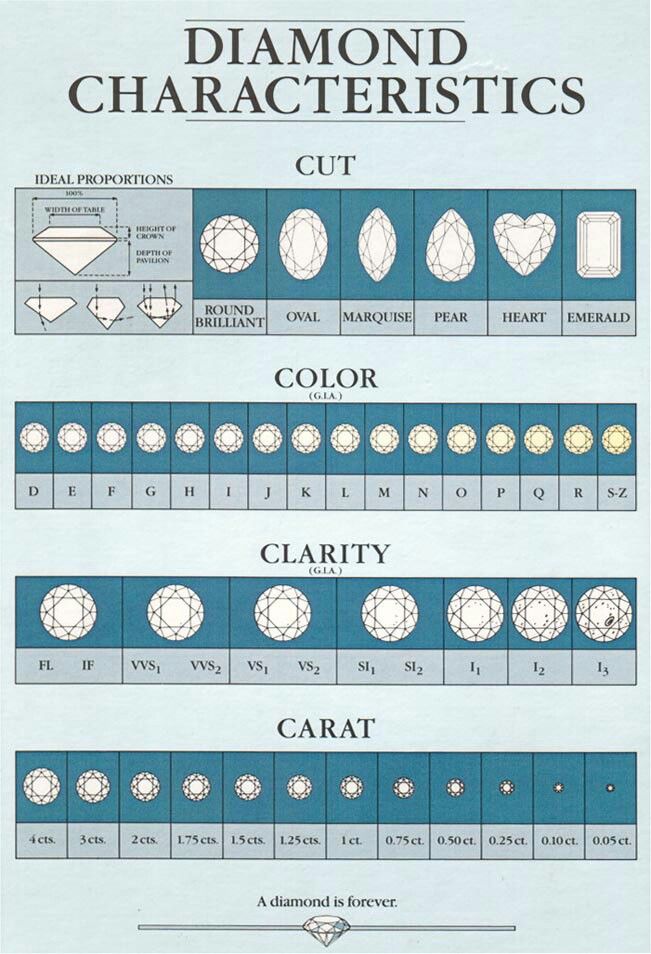

Valuing a diamond is done by analysing a number of different criteria, which starts by examining each of the 4 Cs. For those taking their first steps into investing in diamonds, remember the five C’s to help guide you in making the right diamond investment with the most potential for future growth.

Carat

The size of the diamond can have a huge impact on its investment value and must be accurate.

Cut

Mainly a point of taste, the cut of the diamond shouldn’t hamper its value too much but for short-term investing it is worth considering current trends on the market.

Colour

As discussed above, although white diamonds are more traditional, coloured diamonds can have sudden growth in investment value so are worth considering in 2024.

Clarity

This point is less important for coloured stones but refers to how pure the stone is.

Certificate

This is perhaps the most crucial of the ‘C’s’ for investing as a certificate is essential for getting the best price when selling the diamond on.

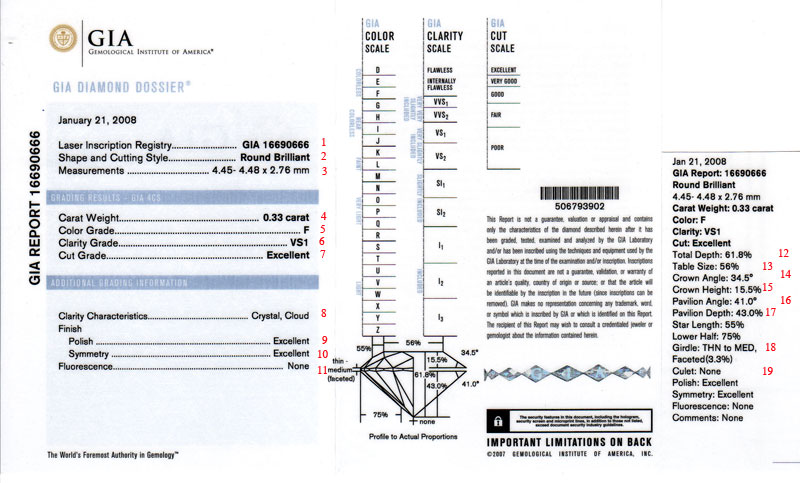

The 4Cs – a closer look

The 4 Cs were first developed by the Gemological Institute of America (GIA) to form the basis of how to carry out gemstone appraisal on diamonds. They are; clarity, carat, colour, and cut. You can read more on each of them below.

1. Clarity

The clarity of a diamond can also be seen as its purity.

Analysing a diamond’s clarity will mean examining all of the irregularities it holds both internally and externally. These internal flaws are known as inclusions, and external ones are called blemishes. It is not simply the number of these incursions or blemishes a diamond holds, but also the size of them, their positions, their colour and also their nature.

Examining these flaws cannot be done with the naked eye instead, they are looked at under 10x magnification.

Afterwards, the diamond will be ranked on the GIA Clarity Scale:

– Flawless

– Internally Flawless (IF)

– Very Very Slightly Included (VVS1, VVS2)

– Very Slightly Included (VSI1, VSI2)

– Slightly Included (SI1, SI2)

– Included (I1, I2, I3)

Flawless would be the most valuable of diamonds with absolutely zero incursions or blemishes, and I3 would be the least valuable for investment purpuses with a number of different flaws.

2. Carat

The carat scale is used to measure the weight of a diamond. The term carat comes from ancient times when people used Carob tree seeds to balance scales.

As you would imagine, the more carats a diamond is, the more valuable it becomes for investing purpuses. One carat translates into 200 milligrams, though when discussing carats, they are often standardised into a 100 points system. So for example, a 0.7-carat diamond would be 70 points.

As mentioned earlier, however, there are certain circumstances that can make the investment in diamonds quite tricky.

Take the following example: if you have 2 identical diamonds which are 0.98 and 0.99 carat in weight respectively, then the 0.99 carat diamond would be worth 1% more. However, say you then had a third diamond which was again near identical but was 1.00 carat, it would likely be worth as much as 20% more than the 0.99 carat one.

This is because of the human element of purchasing diamonds. Someone would pay a premium for a 1 carat diamond as they could state and have proof that it was 1 carat, whereas if you purchased a 0.99 carat diamond, you could never honestly claim it is 1 carat. These sudden surges in value occur at a number of points in the investment pricing scale of diamonds, such as at around 0.3, 0.5 and 0.7 carats.

3. Colour

Much like clarity, the colour of a diamond is ranked on a scale, known as the GIA Colour Scale. It works on the following system, with D being the clearest and most valuable, and Z being the least valuable.

– Colourless (D, E, F)

– Near Colourless (G, H, I, J)

– Faint (K, L, M)

– Very Light (N, O, P, Q, R)

– Light (S, T, U, V, W, X, Y, Z)

This scale is used for colourless diamonds. Of course, diamonds can come in different colours, such as yellow, black or blue, and these will affect their desirability for investment. The GIA scale is therefore only used for colourless diamonds, whereas coloured diamonds are generally more valuable.

4. Cut

The cut of a diamond is the only part of the valuation process for investment, which is affected by the human touch. All other aspects are determined by nature and how they were formed over thousands of years.

The cut of a diamond is what decides how light will react with it, and how beautiful it will be to the human eye once complete. There are a number of different common designs for diamonds, and each one will have a different way of manipulating the following three areas.

- The fire – This is how white light gets scattered out into a number of different colours

- The brightness – How brightly light is reflected both internally and externally.

- The scintillation – The reflections within the diamond will produce patterns of dark and light areas.

- The final proportions and finish of the diamond will affect how light plays with the diamond and its final aesthetic appeal.

Some common cuts of diamond include:

- Round

- Marquise

- Pear

- Emerald

- Asscher

- Cushion

- Princess

- Oval

Other things to consider when valuing a diamond

for your 2024 investment portfolio …

1. Certificates

Sometimes referred to as the 5th C of valuing diamonds, a certificate is a valuable way of defining the exact and authentic quality of a certain diamond. These are very good to look out for as it gives you an immediate and trustworthy idea as to the exact value of the diamond you are looking at for investment.

However, you should bear in mind that there are a number of different classifications of diamond certificates, and you may hold favourability over one or two. For example, the GIA certification system is known for being incredibly strict when designating a level of clarity.

Here are some of the most famous certificates a diamond can hold:

– Gemological Institute of America (GIA)

– The International Gemological Institute (IGI)

– The Diamond High Council – Hoge Raad Voor Diamante (HRD)

– European Gemological Laboratory (EGL)

2. Laser inscriptions

If a diamond has a laser inscription on it then the idea is that this represents a blemish and should, theoretically speaking, diminish its investment value.

However, this is again another sign of how human preference can break the valuing methods. A personalised or unique message skilfully inscribed on the side can only be properly viewed by magnifying glass and ads a personal element that can be more highly sought after.

You may also see certification ratings inscribed which will again, likely increase the value as it can be used to prove the authenticity and worth of the diamond investment. Certification can be lost, stolen, or forged, but a laser-imprinted message is undeniable.

3. Know what to look for

It’s an age-old adage, but the crux is: if it looks too good to be true, then it probably is.

Diamond investors should be wary of diamonds advertised with a colour in inverted commas – ‘blue’ diamonds for example – as this is typically an indicator that the diamond has been treated. While such items may still be classifiable as natural, they are usually lower in clarity and subsequently irradiated to obtain a more marketable colour.

No piece is ever just a pair of earrings or a necklace. There is a huge difference in value between investing fine and costume diamond jewelry. The first step in establishing the true value of an item is to work out whether it can be considered fine jewelry. Fine jewelry is crafted from precious stones like diamonds and metals, so tends to have a much higher value than costume jewelry.

Many pieces of fine diamond jewelry are manufactured by designers, luxury fashion brands, or well-known jewelry houses, which will add investment value to the item. Costume jewelry, on the other hand, is made of relatively inexpensive materials, such as crystal necklaces and earrings. Was it made by a well-known jeweler, such as Cartier? These highly sought-after diamond pieces can gain a considerably higher investment price, so it’s important to establish all of the finer details about each piece of jewelry you wish to pawn.

Look for marks on the jewelry which could indicate the level of craftsmanship and the type of precious metal. If it was crafted by a specialist jeweler, it could be a one-of-a-kind piece with a high investment value. There are specific designers such as Cartier, Tiffany’s, Graff, Harry Winston, Chopard ,Boucheron and Van Cleef and Arpels whose diamond jewelry is highly sought-after for investment purpuses, with pieces from the first half of the 20th century particularly valuable due to the high levels of demand.

A knowledge of cuts, clarity, and metals will help you to assess what the diamond piece you consider investing in really is. You don’t need to know all the details – the experts can help with that – but it can be good to have an idea of what the piece is so you know how much capital you can realistically expect to gain.

4. Making a wise purchase

Noting that the market for diamonds investment has risen by 20 per cent in the last year alone, David Sonnenthal of New Bond Street Pawnbrokers had plenty of advice to impart on the prospect of investing in precious stones, including the following:

• While prices can and do fluctuate, diamonds will rise in investment value – provided the purchaser has bought it as close to market price as possible.

• It’s not always possible to get close to market price, but anything between 25% to 30% over current market value still makes for a viable asset.

• Brands such as De Beers and Graff are firmly in control of the market, on account of owning some of the best stones on the planet.

• Don’t rush into diamond investing without doing some research.

5. Transforming loose stones

It’s possible to purchase stones with the intention of turning them into finished jewellery pieces for sale at an auction house or retail outlet, and the addition of platinum or gold can even have a positive effect on the price you can command. However, those purchasing stones for investment are advised to keep them loose.

6. Manufacturer

Having the name of a prestigious jewellery manufacturer attached to your diamond can add significant investment value to it. Manufacturers like Van Cleef and Arpels, Stephen Webster, Buccellati, Tiffany and Co, and Boucheron are all highly respected and are known for their top-quality craftsmanship.

If any diamond pieces and jewellery are made by such manufacturers and are in great condition with a certain degree of rarity, then you can expect it to be worth much more. Other well-respected jewellery manufacturers include Lalique, Cartier, Graff, Chaumet and Bulgari, though there are plenty of other top names that we will accept.

7. Long-lasting investment

In recent years, increasing numbers of diamonds are being sold as investment assets. Part of the reason why it makes sense to invest in precious stones lies in the fact that they are long-lasting.

The near-indestructible properties of certain stones and the financial stability in the market means that increasing numbers of hedge funds are considering diversifying their portfolios with gemstones – with some experts pointing to stability as the main concern, particularly in a world of increasing political and social uncertainty.

8. Find out the provenance

The provenance of a piece of diamond jewelry can have a large bearing on its investment value. There may be marks on the item such as country hallmarks, which will be able to provide an indication of where the jewelry was manufactured. If you hold any of the original paperwork or receipts these could provide useful information about where the piece was purchased and when.

For example, an eagle’s head stamp is a sign of a gold piece manufactured in France, but a dog’s head stamp is used to indicate French platinum. A French item of diamond jewelry will often be high in investment value, particularly if the piece is antique, as some of the most skilled jewelry craftsmen were located in France.

9. Know your stones and pearls

If the diamond jewelry contains a stone or pearl the investment value could vary significantly, so it is important to know what to look for. When it comes to pearls, there is a huge difference in investment not value between natural and cultured pearls. A natural pearl is formed over many years, but cultured pearls are found in farmed oysters.

The shape and lustre will provide an indication, however, accurate valuations can be obtained through an x-ray. A natural pearl necklace could be worth several thousand pounds.

If the item contains a colorless gem, it could be a diamond. Modern items of diamond jewelry contain very precisely cut diamonds, however, antique pieces are likelier to be less precise, hence again the investment price will vary.

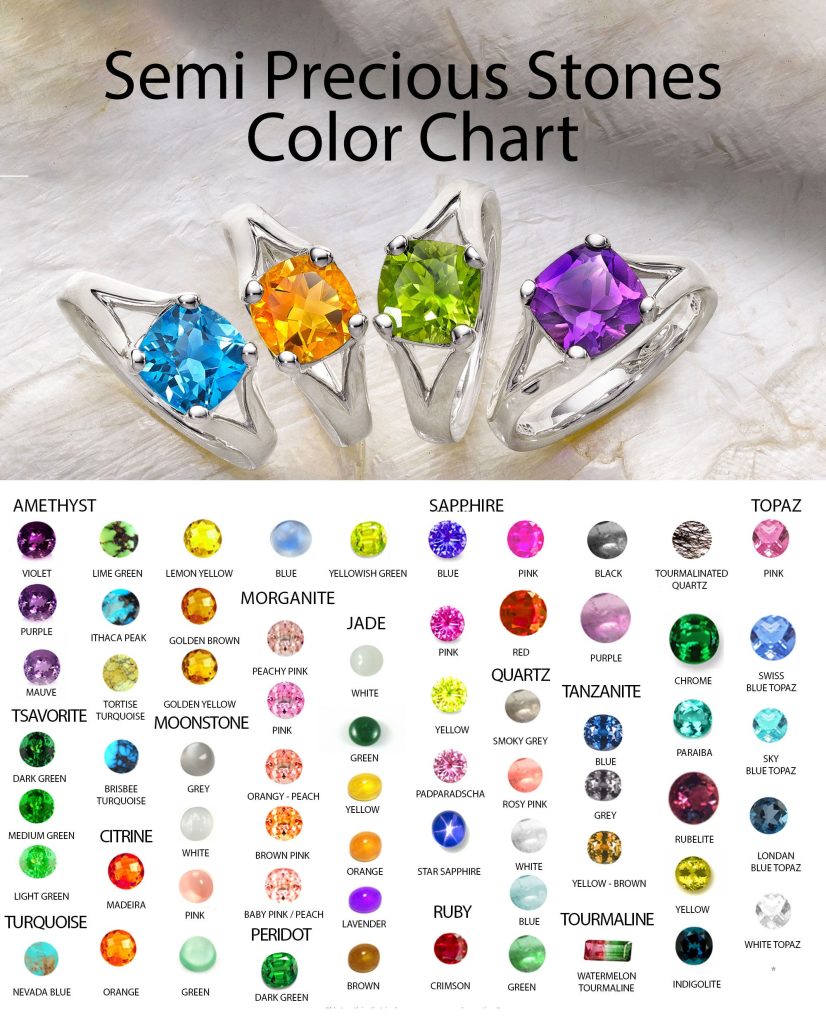

In recent years, the value of colored gems such as sapphires, emeralds, and rubies has increased significantly. The most valuable gems are brightly colored, strong and transparent. The older gems may be untreated and from mines that are now exhausted, so their rarity and demand is higher from an investment perspective.

Gems can be crucial in the value of a piece of jewelry – but they can also hold zero investment value on some occasions. Typically it is determined by the type of gem, how rare it is, and what condition it is in. Different gemstones will hold varying investment values. For example, a diamond is worth more than an amethyst in most situations. A synthetic ruby won’t be worth as much as a natural ruby.

If the gemstone has any chips or abrasions, this may be something that can be removed through repolishing. However, they can sometimes render a gem as being valueless and unappealing. It is therefore important to handle any jewelry with care when looking to sell and recoup your investment in diamonds at a later stage.

Investing in diamonds is fairly popular as they are a type of gemstone that is often seen as classic and timeless.

9. Assess the age

In general, the age of the diamond will position it within a specific age-related category; modern, vintage, or antique. The term antique refers to the oldest category of jewelry and is typically used to describe diamond jewellery pieces that are over 100 years old.

Antique diamond pieces are typically high in investment value, both monetarily and sentimentally, because they were skillfully crafted in an age before mass production. In many cases, they were one-of-a-kind, high-quality diamond pieces owned by the upper class.

If a diamond piece falls into the modern age category it was manufactured in the last 50 years. For an item of diamond jewelry to be considered vintage, it must be over 50 years old. Unlike antique jewelry, there are many vintage pieces that were mass-produced, as technology advanced rapidly from the 1940s.

10. Care for your jewelry…condition is important

Another key question to ask when looking at investing in diamonds or jewelry is what condition the asset is in. This will have the most substantial impact on the investment price your diamond piece can gain. If it is damaged or broken then often it will cost more in restoration costs (unless it is of significant interest and value) and therefore will typically only hold its original, intrinsic worth. In some cases, restoration may be cheap and easy.

However, if it is un-restorable then your diamond jewellery will often going to lose significant investment value and may not even be possible to sell on. Likewise, if your diamond piece is in okay condition physically but looks worn out, then this can have an impact on its cost when investing in it.

It may be possible to bring it back to life with some cleaning, buffing, and professional maintenance. Jewelry and diamonds always look better when they have been cleaned, so do consider this when considering to cash in on your investment. It is therefore imperative that before anything is valued for investment purpuses, it gets cleaned professionally.

In many cases, a jeweller will do this for you for free. You should be careful though; something that isn’t cleaned properly can end up getting damaged or destroyed.

If you aren’t sure how your piece of diamond jewelry should be cared for, it is always better to ask a professional before cashing in on your investment. Ammonia-based cleaning products are often used throughout the industry, but they can be damaging to certain gemstones. A mild soap with a soft toothbrush and warm water can often be all it takes for most investment jewelry, with a rinse afterward. Anything too hard or containing harsh chemicals could cause the metal or gems to become scratched.

Storing your diamond investment pieces in suitable boxes and cleaning gently and carefully before taking the item to be valued will give your jewelry the best chance of getting a high price.

Research the best way to care for specialist items and always use a professional to clean fine jewelry.

11. Consult an expert

Assessing your diamond jewelry collection using the steps above will provide a possible indication of its investment value, but the only guaranteed way to know the true value is to consult a specialist valuer; he/she will discover the true potential of your prized possessions.

It’s best to do your research and find the specialist who’s right for you. Diamond Jewelry investment prices have been rising in recent years, as investors move away from the stock market in search of tangible commodities such as collectible pieces, gemstones, and diamonds.

1. The metal

When looking to invest in diamond jewelry, other considerations include the metal price. This is formulated by the price of the metal at the daily spot price, multiplied by how pure it is. This is known as the true noble metal content – 24 carat is considered pure. Multiply this by the weight, which can either be in grams, ounces, or pennyweights.

A good dealer or diamond jewelry expert will be able to help you calculate this before deciding on you investment.

13. Conduct your own research

If you are given the name of the jewelry manufacturer, some information about the time period it comes from, or any other useful pieces of advice, you may be able to use this to do some research of your own about the diamond piece you are looking to invest in.

By looking online you’ll be able to get a sense of what price other similar pieces are commanding, where they are being sold, how popular they are, and whether there are any bidding wars.

Often if a diamond jewellery piece is deemed ‘rare’, it will be seen as more desirable and therefore will have a higher investment value.

14. Choosing quality

Demand is currently high for the best quality diamonds. These “investment diamonds” are accepted by Rapaport – the world’s leading trading platform for gemstones – only if they meet strict criteria. Diamonds must be ranked with a clarity rating of at least VS2 and a colour grade of at least H.

The cut of the diamond is also important when it comes to investment diamonds – each of which must be certified by the Gemological Institute of America before being accepted by the world’s biggest platform for diamond trading.

Naturally-coloured diamonds command the best prices. At present, larger, natural diamonds are selling for record-breaking sums at auction – smaller pink diamonds can fetch up to £30,000 per carat, for example.

Diamonds treated to appear a certain colour are not quite as valuable, however.

What to avoid when investing in diamonds

Investing in diamonds in 2024 requires finding the best experts to help you make the most of your money. But what about the things you should avoid?

Here are three things to avoid when preparing to invest in diamonds:

1) Paying too much

Do your research so that you know how much to expect to pay. Going to the right place to invest will mean that you are getting the best price for a diamond as investment.

Speak to the specialists you know you can trust and make sure the diamond investment is right for you.

2) Expecting an instant return on your diamond investment

Diamonds are a fantastic way to invest money in 2024, but the process requires patience.

Diamonds offer long-term security and a great way to boost a long-term investment portfolio. They are less likely to instantly gain value and aren’t a ‘get rich quick scheme. Diamonds are for long-term investors, looking for ways to diversify their investment portfolio.

3) Buying the wrong diamond

We’ve already covered the five C’s and it really is important to consider these when choosing which diamond or diamonds to invest in.

It’s also important to decide whether to take a risk on quirkier diamonds, such as coloured diamonds, which can see sudden spikes in value but could be seen as ‘trendier’ rather than classic diamonds. It all depends on the longevity of your investment and how much you have to invest in diamonds.

Always get the advice of a diamond specialist and take your time considering before making your investment.

All in all, diamonds are a wonderful investment resource. They are one of the few ways that you can invest, expect a high return and enjoy the investment at the same time, as you can wear your diamonds as they gain value.

Although investing in diamonds is a multi-faceted way of making money, it is a relatively safe one beyond 2024. Diamonds will always be in demand and if you are willing to wait you can make an impressive return on investment.

Are precious stones worth investing in?

Emeralds, rubies, and sapphires are traditionally known as precious gems. This distinction between these jewels and other semi-precious gems reflects their long-held reputation as elegant and sophisticated jewelry choices, and our diamond pawnbroker experts will further explain.

There are several things you need to consider when purchasing these items. Just as with diamonds, you need to pay particular attention to their grading – done by clarity, size, color, shape, and source.

However, the system for these jewels is slightly different from the famous system used for diamonds. While the white gems are graded on a strict scale (the 4 Cs), emeralds, sapphires, and rubies are graded by eye. This requires both the buyer and the seller to be informed about what makes a quality stone.

The most important factor when choosing any of these three gemstones will often come down to colour. This is a personal preference but usually the deeper the saturation, the higher the value of the stone. For example, one current trend, perhaps inspired by the future Queen of England, Catherine Middleton, is to use bright blue sapphires for engagement rings.

Sapphires

If you have your heart set on a blue sapphire, then there are a number of shapes and styles which may catch your attention. The cut is very important for sapphires, as the depth and style can affect the color of the stone itself, as well as the style of the jewelry. A brilliant-cut stone, for example, will have the effect of slimming the finger due to its elongated teardrop shape.

When it comes to color and clarity, there are also a lot of options out there. The deep royal blue Ceylon sapphires are highly coveted, while Australian blue sapphires also offer glorious saturation – just at a cheaper price.

The source of the sapphires will also affect their value massively – for example, the most expensive sapphires will be those from Kashmir, Burma and Sri Lanka due to their famed bright blue color. For a more unique stone, there are also popular pink varieties of sapphire, or rarer varieties which have a peach tone.

Rubies

Rubies are another vibrant and brilliant color choice if you’re searching for the perfect precious gem. The deeper the color, the greater the value as a general rule, but rubies also find value where there are small inclusions in the stone that create the illusion of stars in their tiny glimmers.

It’s very important to have guarantees of quality and origin when purchasing a ruby – more and more of these stones are being created in the laboratory.

Just as with any other stone, there are particular varieties of ruby that are especially sought after. For example, Myanmar’s “pigeon blood red” stones are in high demand, which means those looking to buy them need to be aware of imitations.

Emeralds

Bright green, forest green, and deep green emeralds are all excellent choices for jewelry and have been increasing in popularity in recent years. They will often have inclusions within the stones and this is an accepted fact which does not significantly affect their value within the trade. They are often treated with an oil or coating to reduce the visibility of these tiny flaws.

The most commonly used cut for emerald stones is, unsurprisingly, the emerald cut. This particular style refers to a stone cut with four different sides, each of which has rectangular facets which are cut to help create stunning visual depths within the stone.

Precious stones for everyday wear

All three of these gems have increased in popularity for everyday wear as they are both beautiful and durable. For example, a sapphire has a rating of 9 on the Moh’s Hardness Scale. This means if you buy a quality gem it should remain polished and beautiful for the lifetime of your jewelry.

Rubies are also known to be resilient – though not as hard as diamonds – and can be worn regularly.

So…do diamonds make for a good investment in 2024?

Diamonds, much like fine jewellery, often gain value with time. By selecting the correct diamonds a savvy investor can make an impressive return on his 2024 investment choice.

Fine jewellery and diamonds investments can be held onto for years, maybe even generations, so that when they are sold they achieve far more than the original investment value paid.

Diamonds are rare and, over the past 10 years, they have rarely been out of the news with some really notable investment prices achieved at auctions across the Globe.

For example, the discovery of a 9.17 carat violet diamond at Australia’s Argyle Mine made headlines worldwide. Now polished down to 2.83 carat, the Argyle Violet is one of only a handful of such gems produced in the last 32 years and is expected to excite unprecedented interest at the 2016 Argyle Pink Diamonds Tender.

But violet is far from the only colour to create a stir in 2024’s diamond investment market.

1. Blue Moon Diamond

This remarkable 12.03 carat diamond was bought at auction by Joseph Lau for a record-breaking £32 million in November 2015. The Hong Kong property magnate promptly renamed the stone, ‘Blue Moon of Josephine’, after his daughter: an endearing provenance, current trends indicate, will only increase the diamond’s value.

2. Graff Pink

Pink diamonds remain the world’s most valuable investment stones as of 2024.

The Graff Pink – sold at Sotheby’s Geneva in 2010 for £29 million – is the most expensive single stone ever bought at auction. It was once owned by celebrity jeweller, Harry Winston, which no doubt contributed to its cachet.

Glamorous connections were also a factor in the remarkable £43 million paid for Elizabeth Taylor’s Bulgari emerald at auction in 2011.

While the record-breaking bid of £962,500 for the Hope Spinel last year, owed much to its origins in the legendary Hope Collection. Rarity, colour or connections?

3. ‘Flawless’ diamond sells for £11m in Hong Kong – A case study of how investment in expensive diamonds pays off

Sotheby’s in Hong Kong has sold a ‘flawless’ 8.41 carat pink diamond for $17.7 million, or £11m at the time, outstripping the $15.5m (£9.65m) top estimate.

Working out at £1.3 million per carat, the sale made this diamond one of the most expensive diamonds per-carat ever sold as of 2024, experts say.

The diamond was the centrepiece of that year’s autumn’s Magnificent Jewels and Jadeite collection. The Sotheby’s website described the stone at the time as the “spotlight” of the year’s autumn sale, as “remarkable,” with an “internally flawless clarity that is virtually unseen,” in diamonds of its kind. In the grading of diamonds listed on Sotheby’s ‘Diamond Clarity Grading,’ internally flawless is the highest grading that can be bestowed on a stone by the auction house.

Naturally pink diamonds are incredibly rare, and those over one carat even more so; in fact, the senior director of Sotheby’s jewellery department for China and South East Asia described it as “one in ten million.”

To exemplify their rarity, of the 75 largest known diamonds, only four are naturally pink; they are a real luxury item, some of the most uncommon and expensive gemstones available, which make them some of the best investment opportunities in 2023.

Consequently, diamonds that are not white are described as being ‘fancy coloured,’ and are automatically placed in a higher investment price bracket due to their rarity.

Finally, separate lists compiled by the World Bank, the International Monetary Fund, and the United Nations all concluded that China has the world’s second strongest economy after the United States of America, and Hong Kong Sotheby’s burgeoning success makes it clear that the country’s richest are no strangers to investing in luxury assets like diamonds, and 2024 makes no exception in terms of appetite for investment in diamonds.

Beyond Diamonds – Diversifying Your

Investment Portfolio with Gems

While diamonds are the big player in the game, there are alternative stones that might be worth a look in 2024 and beyond.

The gemstone market is around half the size of the diamond market. Analysts suggest it is worth around $53 billion per year. However, it has a stronger CAGR than the diamond market, with an impressive growth of 6%.

There are a lot of options when it comes to gemstones, including:

- Ruby

- Emerald

- Sapphire

- Opal

- Tourmaline

Gemstones tend to increase in value in line with inflation. However, just like colored diamond investment, you shouldn’t expect to flip a gemstone too quickly. Indeed, these stones are fairly stable in price, which can make them a store of value, but only if you get them at a good price in the first place.

It should go without saying that buying retail is rarely a good investment strategy.

Investing in Gemstones in 2024 makes sense because:

1. Diamond Investments are a valuable market for businesses

Rough gemstone auctions are typically attended by businesses rather than consumers, who will then cut the stones into shape to be used in a piece of jewellery eventually

Because of this, gemstones go for a much lower price than their cut and polished counterparts, but once attended to they can be a very valuable 2024 investment indeed.

50 companies from countries including the UK, China, and Germany made bids at the auction mentioned above.

2. Ethics

Gemfields and diamonds are remarkable investments in 2024. The sale of the Rhino Ruby is a great example, some of the money from which will help fund an anti-poaching plane. They also operate in a manner so as to remain within the law of the countries they’re in and protect their workers and the environment.

3. Valuable for the consumer too

Gemstones have been a valuable commodity since the dawn of civilised society, thanks to their rarity and aesthetic value. Frequently used in jewellery, rare gemstones investments are the ultimate status symbol.

In 2024 gemstones, like diamonds, are reliable investments because their value is less at the mercy of the economy; if you invest in a rare gemstone or diamond, there’ll always be someone willing to buy it for a good price, recession or no recession.

Diamonds + Jewellery :

Why fine jewellery can be an excellent investment in 2024

Diamonds aren’t necessarily a girl’s best friend, but they may be an important part of her assets and high up in the friendship rankings. If you’re looking for a 2024 investment opportunity slightly off the beaten track, jewellery and diamonds might be one avenue that you haven’t considered.

For many people, their diamonds are often handed down through family with pieces passing from mother to daughter over multiple generations. These family heirlooms are often imbued with historical family legends and carry huge emotional significance. This means many of these amazing investment diamonds may never be sold willingly.

However, when a good diamond does come to market, do you know what you’re looking for and what would be a good investment?

1. Can diamonds increase in value?

Jewellery has a tendency to appreciate in value over time and the savvy investor can turn the unwanted diamonds of another family into something profitable for their investment portfolio. But it comes with a few caveats and it’s important to know what you’re doing when it comes to collecting jewellery.

The first thing to remember is that buying from a high-street store is unwise.

Retailers often impose a 100% markup that doesn’t include the wholesale margin, and VAT is an additional expense passed onto the customer. This means if you buy a piece of diamond jewellery in a shop today for £200, you’d be lucky to be able to sell it for £50 or £60 tomorrow. If you’re looking to make a profit as an diamond investor, you will need to do your research and buy second-hand or low-cost at auctions.

2. The key is to know what you’re looking for…

The price of desirable diamond vintage jewellery has gone up 80% in the last ten years. The best returns on investment have come from two particular design eras: the Art Deco period (1914-1935) and the Belle Epoque period (1870-1914).

Art Deco emerged from France in the mid-twenties and typically incorporates platinum and diamond. Pieces tend to have very strong and striking designs that were inspired by cubism and still look modern and stylish today. Designers like Cartier, Van Cleef and Arpels are all highly sought after by the discerning collector as their pieces are usually of incredibly high quality.

The Belle Epoque (The Beautiful Era) was a period of relative stability across Western Europe between the Franco-Prussian War and the First World War. As European empires extended their tendrils into Africa, the supply of precious gemstones began to increase and designers expanded their ranges.

Competitive designers would try and outdo each other and became experts at working with gold and platinum, frequently setting small diamonds into lacy structures to create timeless pieces that were designed to feel weightless.

They’re not to everyone’s taste and can sometimes look quite fussy to the modern eye, but many diamond pieces have held their investment value and turned good profits.

3. How do you spot fine jewellery?

Often designers would hide their marks discretely inside links. This can make them difficult to spot at first, but finding a designer’s mark can double or even treble the value. These marks are often very well hidden, invisible to the naked eye and will need to be verified by an expert who knows exactly what to look for and where.

The value of diamond jewellery from both these epochs has skyrocketed in recent years and is up almost 90% from almost two decades ago. That is a huge return on any investment and diamond jewellery tends to be unaffected by the ravages of geopolitical problems, unlike stocks and shares which can be tumultuous at best.

Designers that diamond investors love to target include Boucheron, Bulgari, Belperron and Chaumet as well as Chanel, Cartier, Lalique and Tiffany. If you’re thinking about investing in diamonds, researching these designers and their companies would be an excellent starting place.

Fine diamond jewellery is an art form that adds beauty and panache to the everyday world and has the power to make the wearer feel special and even more confident.

Naturally, you need to have a good idea of whether the diamond necklace, cufflinks or rings are actually valuable for investment purpuses. So, what exactly should you be looking for?

4. The desirability of the designers

Diamond Jewellery is a fine craft, one that requires both aesthetic sensibility in the design process and artisanal skills when working with precious metals and gemstones. As such, much like fine art, pieces that are the work of a renowned jeweller, or designer or are part of a sought-after collection are highly desirable and can command higher investment prices than mass-produced items.

Famous design houses such as Bulgari, Tiffany, and Cartier are just a few examples of current companies that produce fine items of diamond jewellery that sell for many thousands, but historic diamond jewellery can be equally as desirable for investing if they were made by a reputed jeweller or designer.

If you believe that your piece of diamond jewellery is from a prestige brand, whether old or new, then checking the piece and any cases or boxes for branding and logos is essential.

Preliminary internet research of unfamiliar names and symbols can help give you an idea of the designer or collection before going on auction.

5. Quality of the materials

With the word ‘jewellery’ itself being derived from the moniker for precious stones, it is no surprise that the investment value of such pieces is dictated hugely by the metals, diamonds and other materials they are composed of.

However, more modestly priced jewellery can often be constructed from materials that emulate the appearance of their more valuable counterparts. Gold flake, cubic zirconia, plated silver – these materials can make your diamond jewellery look far more expensive and valuable than it actually is.

Texture and weight can often give you an initial idea as to whether an item is genuine – metal jewellery that feels incredibly light, or pearls that feel unnaturally smooth, for example, can be an indicator of cheaper materials such as plastic or glass. But if you believe that the diamond jewellery you are looking to invest in is constructed from gold, silver, platinum or contains a precious gemstone, then making sure of the authenticity of these materials is paramount.

Luckily, there is an easy way to find out – and the key lies in the jewellery itself!

The vast majority of any item crafted out of genuine gold will come bearing a hallmark (a small symbol stamped into the metal itself). This will tell you a raft of information as these stamps will have different icons and text depending on the maker, the date and how many karats the item is – although you may need to resort to more internet research to uncover the code.

These hallmarks are not just for gold, however, and almost all precious stones and metals will bear a mark of authenticity, each with its own symbolic conventions.

You yourself do not need to know what the hallmark means, but looking for one is an easy way to estimate whether your diamond piece is as valuable as it appears to be for investment.

6. Provenance

Provenance is the proof of authenticity of diamond jewellery, such as where it was made, purchased, and whether it has ever been repaired or altered. Especially with rare diamonds or collections, having written proof of origin in the form of certificates or documentation can dramatically increase the investment prices and value over time.

Evidence of provenance and purchase of your diamond jewelry is key to securing a potentially high-profit piece when you are cashing in on your investment.

If there is a strong story attached to the original designer or owner, then the diamond jewellery increases in both collectability and potential return on investment. Wherever possible, documentation proving the authenticity of the piece and where it was bought should be obtained. All stories about the jewellery will need to be independently verified.

If you’re forward focussed then you might want to consider looking at contemporary designers. If you have a good eye then you may be able to invest in high-quality designers at the start of their careers. This is obviously more of a gamble, but the designer pieces of today are the collectable historical pieces of the future. Your grandchildren may thank you.

There is one last plus when collecting diamond jewellery for investment. Quite simply, it was designed to be worn and to be appreciated. Whether you have a great-grandmother’s engagement ring or a turn-of-the-century designer necklace, there’s something wonderful about being able to wear your investments as they appreciate in value. You can’t do that with stocks and shares!

The different types of Diamond Jewelry for Investment

You have probably heard the terms estate, vintage and antique applied to diamond jewellery, but what are they and how can you tell what your pieces are and their investment value?

1. Estate jewellery

Estate diamond jewellery is often an umbrella term for any diamond jewellery that has been previously owned, although dealers tend to limit its usage to the last thirty years in order to distinguish between vintage and antique investment pieces.

Although often referring to diamond jewellery handed down after the death of an individual (i.e. that individual’s ‘estate’), estate jewellery is usually any pre-owned collectable and valuable diamond piece.

Imagine you divorced and sold your ten-year-old diamond engagement ring and eight-year-old diamond wedding band. Both pieces, although not very old, would still be valuable and therefore would be what a dealer or investor would consider ‘estate’.

Estate diamond jewellery could refer to an entire collection owned by a member of the aristocracy, in which case it could be worth much more for investment purpyuses. Sometimes pieces are missing from collections from long-deceased Lords and Ladies and often turn up in the hands of descendants of their workforce, having been gifted from mistress to servant.

The investment value of estate diamond jewelry is determined by the manufacturer, the material and the gemstones. It could also be determined by the previous owners of the pieces and their historical, cultural or social appeal.

2. Vintage diamond jewellery

The abundantly used term ‘vintage’ seems to apply to almost anything these days – one can even purchase ‘vintage style’ clothing and cars. However, for a piece of diamond jewellery to be considered ‘vintage’, it has to be over 20-30 years old and is usually part of mass production.

This does not detract from its investment value, however. Think about your grandmother’s diamond engagement ring from the 1940s. It undoubtedly has large set of valuable gemstones such as sapphire or emerald. It is likely to be of heavy yellow gold. It might even have diamond clusters. In brief, your grandmother’s diamond ring might not be too appealing to contemporary tastes, but it still has investment value.

Likewise, some costume diamond jewellery can be highly collectable (and therefore valuable for investment) if it captures the zeitgeist of a particular age. Think 1980s power-dressing clip-on earrings with diamante or 1950s coral stone brooches.

The distinction between vintage and antique can often be blurred. It is highly possible that the 19th-century gold diamond necklace you have coveted was made during the Industrial Revolution when Queen Victoria set the trends and mass production was coming to fruition. In itself, this necklace carries historical significance, even though it is far from one of a kind.

However, many dealers and diamond investors will consider a diamond jewellery piece over 100 years old to be antique, rather than vintage, often just to demonstrate the age of the piece.

Pieces identified as ‘vintage’ can sell from anywhere between £100 and £40,000.

3. Antique diamond jewellery

The term ‘antique’ usually refers to anything that is over a hundred years old. So this could include diamond pieces as late as the turn of the century – maybe some of your great-grandmother’s diamond jewellery could be someone else’s investment opportunity?

‘Antique’ usually has connotations of beauty or rarity. Antique diamond jewellery will often fall within a particular period of manufacture such as Victorian, Georgian, Edwardian or Art Deco. It is unlikely to have been mass-produced and is likely to have been crafted carefully by a prominent designer and craftsperson of the era.

Usually distinguishable by a maker’s mark, antique diamond jewellery carries with it the hallmark of quality. These diamond pieces are often desirable for investment and, for some, collectable. Specific manufacturers at certain times in history can carry more investment value, as can diamond jewellery pieces where there are imperfections that add, rather than detract, from the beauty of the piece.

Antique diamond pieces from abroad can also carry greater investment value than those from the UK – think Indian rubies or African diamonds from colonial times. These were likely to have been hand-extracted from mines and undoubtedly carry their own stories.

Diamond Jewellery investments labeled as ‘antique’ can fetch anything from the thousands to the millions.

4. Belle Epoch

Instantly recognisable due to their ornate and almost ostentatious nature, diamond jewellery from the pre-WW1 era is ornate and bounteous, and well-loved by investors.

Advances in technology and craftsmanship resulted in garlands and weave set in platinum and gold, adorned with diamonds and inset jewels.

Firmly nestled in the Titanic era, the investment appetite for these diamond items continues to grow.

5. Art Deco

Known for combining flashness and angularity, the cubist-inspired diamond items offer the modern market something that is at once antique and very modern. Still selling well today, the jewellery’s glamour and brash confidence fit in perfectly with today’s modern lifestyle.

The tumultuous events of last years on diamonds investment: Ukraine War

The past few years leading to 2024 have been tumultuous for many industries worldwide, and the diamond investment industry is no exception. The diamond market is sensitive to global developments, such as changes in political landscapes and current events.

It’s no surprise then that the diamond investment value was affected by supply chain restrictions and that diamond prices have fluctuated a lot since the start of the 2020s, with many wondering whether diamonds are still a good investment in 2024.

Both the lockdowns enforced in March 2020 due to the novel coronavirus and the recent war in Ukraine have disturbed the diamond supply.

These crises could potentially still affect the diamond investment value in 2024.

THE WAR IN UKRAINE

If you’re considering an investment in diamonds in 2024, the war in Ukraine is a crucial factor to consider.

Russia’s military invasion of Ukraine started in February of 2022 and has also led to some significant supply constraints in the diamond industry. US sanctions on Russian companies have crippled Russia’s mining industry, even though Russia’s mines are responsible for about a third of the world’s diamond production.

Alrosa, the largest public diamond mining company in the world, accounts for 28% of the world’s diamond mining capacity, and this company was subject to debt restraints by sanctions as a prominent government-controlled entity.

Though Alrosa hasn’t explicitly been prohibited from conducting business, restrictions placed on the payment systems of Russia have made trade settlement impossible for any other nations.

These developments have halted the production and sale of most Russian diamonds and led to fear of an unsustainable rise in diamond investment prices due to the supply shortage.

This supply shortage has not yet affected the rest of the world, as many companies stocked up following the 2020 supply shortage. Still, industry experts are scared of an impending price increase once those reserves run out. Now, many jewelry houses are looking for workarounds to recover diamond supply and meet demand, such as setting up alternative payment systems.

The 2022 – 2024 war in Ukraine has not only affected supply but has also influenced public opinion when it comes to diamond investments. Many condemn buying diamonds originating from Russia, and some jewellery companies have even severed ties with Russia completely.

This public outcry could also have a lasting impact on the diamond supply of the future if these trends continue, meaning that you need to consider the best diamond investments in 2024 with care and research.

Bringing everything together

When it comes to accurately valuing your diamond jewellery for investment in 2024, it’s imperative to look for the subtle, almost hidden signs of quality.

Many named brands will have their stamps or insignias hidden away in hard-to-spot areas, such as the base of settings or the underside of links or bandings. With many diamonds appreciating in investment value due to the power of the name alone, these top-tier companies will also have access to the highest quality items, resources and skilled personnel, to make sure that the item’s constituent parts are quality.

Some brand names to look out for include Boucheron, Van Cleef and Arpels, Harry Winston, and Chale.

However, older styles of diamond jewellery are often extremely hard to come by, due to major names buying up their old stock to retain investment value. Companies, such as Cartier, pride themselves on the fact that their diamond assets have never gone on auction for less than the original investment price, a fact that can help drive up the investment value of diamond jewellery that has been in your possession for a long time.

Each of these four factors will make a piece of diamond jewellery valuable for investment on its own, but if your asset has a combination of two or more of these, that’s when you could have a significantly valuable piece on your hands.

A fully certified piece with high-quality gemstones and materials, made by one of the world’s premier jewellery manufacturers could be worth a great deal indeed.

To learn more about our Central London pawnshop and or loans on diamonds and diamonds jewellery, you can visit our diamonds or pawning fine jewelry dedicated webpages. We offer loans against the following types of fine jewellery: diamond earrings, diamond necklaces, diamond rings, and fine brands of diamond jewelery such as Graff, Van Cleef & Arpels, Bulgari, Harry Winston , Tiffany and Cartier to name just a few.

This post is also available in:

Français (French)

Deutsch (German)

Italiano (Italian)

Português (Portuguese (Portugal))

Español (Spanish)

Български (Bulgarian)

简体中文 (Chinese (Simplified))

繁體中文 (Chinese (Traditional))

hrvatski (Croatian)

Čeština (Czech)

Dansk (Danish)

Nederlands (Dutch)

हिन्दी (Hindi)

Magyar (Hungarian)

Latviešu (Latvian)

polski (Polish)

Português (Portuguese (Brazil))

Română (Romanian)

Русский (Russian)

Slovenčina (Slovak)

Slovenščina (Slovenian)

Svenska (Swedish)

Türkçe (Turkish)

Українська (Ukrainian)

Albanian

Հայերեն (Armenian)

Eesti (Estonian)

Suomi (Finnish)

Ελληνικά (Greek)

Íslenska (Icelandic)

Indonesia (Indonesian)

日本語 (Japanese)

한국어 (Korean)

Lietuvių (Lithuanian)

Norsk bokmål (Norwegian Bokmål)

српски (Serbian)

Tamil

Be the first to add a comment!