I hope you enjoy this blog post.

If you want us to appraise your luxury watch, painting, classic car or jewellery for a loan, click here.

Investing in Rolex Watches – A 2024 Guide (Includes Top 10 Models To Invest In)

Ever wondered “Which Rolex appreciates the most?”, “Which Rolex to buy for investment in 2024”, or “Do Rolex lose value?

“Rolex – “hoROLogical EXcellence” – Never has a brand name denoted such truth. Yet Rolex transcends its position as the superior manufacturer of timepieces and has become the style icon worn by royalty, heads of state, elite sports competitors, and celebrities.

Rolex is simply the world’s most reputable brand. Rolex transcends every other product name, in every industry, sector, and walk of life. And it has been rated so by industry experts for many years, which is why the answer to the often asked question “Does Rolex lose value?” is most often “No”. Of course, when considering which Rolex to buy for investment, you need to be aware that not all Rolexes are created equal.

The Swiss manufacturer of the very finest wristwatches enjoys a peerless position denoting sophistication, prestige, and esteem. However, investing in a Rolex watch can be a shrewd purchase, and you need to really consider what Rolex holds its value the best, and which Rolex appreciates its value the most, if you are to make a return on your investment.

To sum up, although a Rolex watch is a beautiful item to possess, it is as much an investment as it is a timepiece. Whether you opt for a brand new Rolex, or decide to purchase a secondhand option, one of the major advantages of buying the Rolex brand is that it is highly likely to appreciate in value.

The challenge for a person seeking the best Rolex investment is to find the model that’s likely to yield the largest return on investment, at the same time as being an attractive and highly functional watch. Our pawn shop watch experts took a look at some of the general factors to consider when deciding on which Rolex appreciates in value the most as of 2024, as well as selected our top eight picks when it comes to which Rolex to buy for investment in 2024.

THE ROLEX INVESTMENT MARKET OUTLOOK FOR 2024

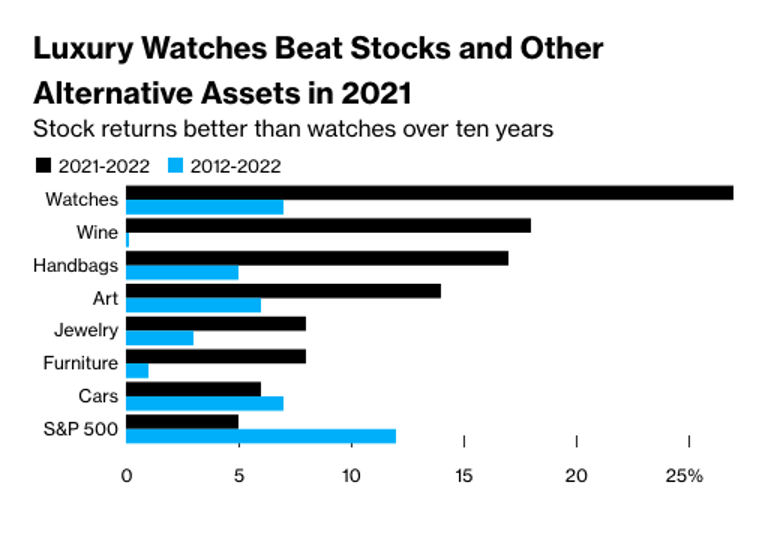

Rolex watches, alongside Patek Phillipe and Audemars Piguet, form part of the “big tree” of collectible timepieces. Between 2018 and 2024, the secondary market for these watches outperformed the S&P 500. Indeed, over the last decade, luxury watches have been a better investment than many other alternative assets, including wine, handbags, art, and jewelry.

Source: BCG Captial.

However, as the old investment mantra goes, “past performance is not indicative of future results.” So, the question remains: are Rolex watches a good investment for 2024?

The first thing that we need to do is to assess the market entering 2024.

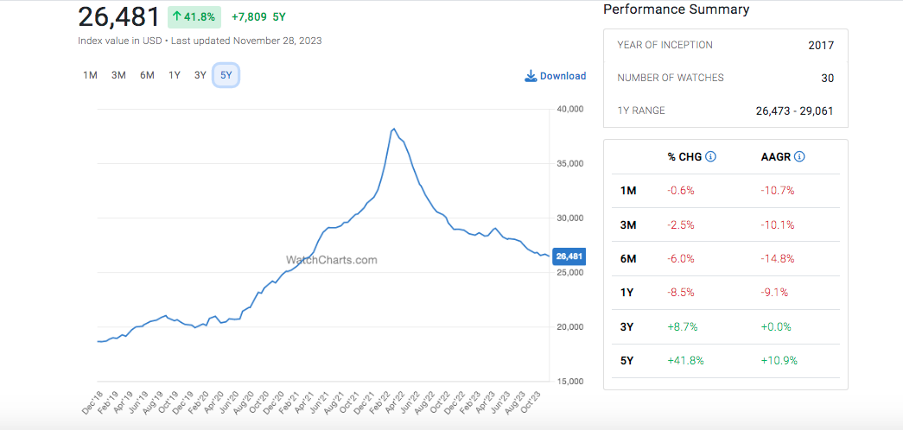

A look at the WatchCharts Rolex Market Index gives us the snapshot of the secondary market we need. Now, here are a few conclusions that we can draw from the chart.

- The secondary market has been in decline since March 2022 (avg. prices have dropped from $38,000 to about $26,000)

- If you look at the 1M, 3M, 6M, and 1Y averages, the decline is slowing down

- The market is up heavily over the last 3 to 5 years, even when accounting for the sharp drop since March 2022.

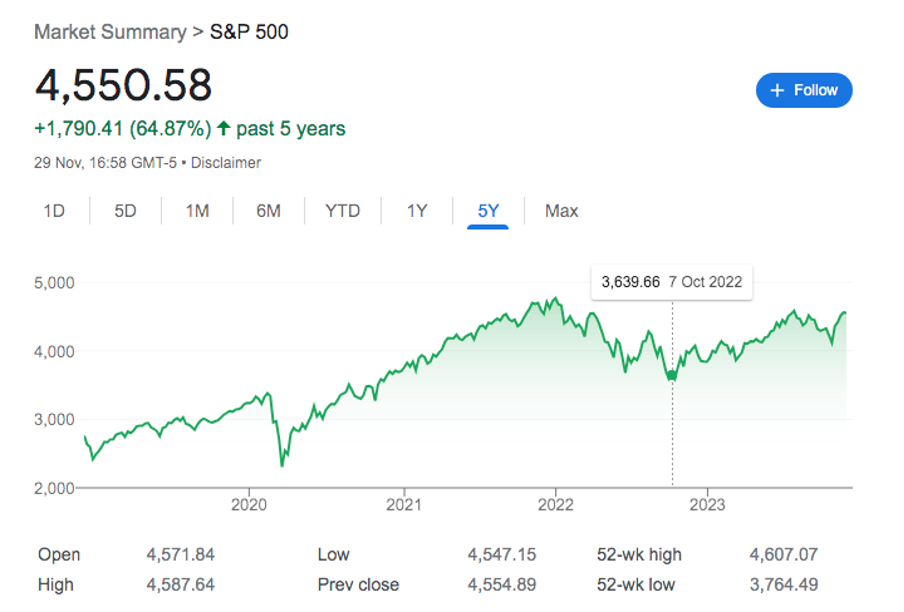

Now, if we take a look at the S&P 500 for the last five years.

The S&P500 also suffered a decline or a correction in the early part of 2022. However, unlike the Rolex index, it has more or less recovered and is close to hitting its peak.

The good news is that the secondhand Rolex market is not tightly correlated to the S&P500, which makes it a good asset if you want to diversify your investments. However, there is no getting away from the fact that the secondhand Rolex market is in a slump compared to the heady days of early 2022.

Any investment needs to be considered over the long term. Zooming out gives you a good idea of the market. In this case, the Rolex secondhand market is up over 40% in the last five years.

Timing markets is notoriously difficult, but there might be an argument that now is the time to buy a Rolex at a discount. When interest rates drop, and the economy heats up again, your investment could swell. However, all that depends on a few different factors that we’ll get into below

FACTORS AFFECTING ROLEX MARKET

PERFORMANCE IN 2024

This is an interesting time for the Rolex market, to say the least. However, whether 2024 will be a fruitful year for watch investments depends on a few criteria that are listed below.

1. Demand

Rolex makes just over 1 million watches each year. However, it’s important to remember that this is an estimate. Unlike other similarly recognizable brands, Rolex is privately operated. As such, we don’t have access to public financial information that could provide us with an exact figure.

Morgan Stanley releases an annual report on the watch industry, and they estimate that the number of Rolex watches produced per year is 1.05 million per annum. Now, compared with other heavyweights like Patek Philipe (which produces around 68,000 per year), you might think that 1 million watches is a lot. But the real thing we need to think about is how that 1 million watches relates to demand. So, how can we think about the demand for Rolex watches?

There are three different ways:

- Marketshare: Rolex has about 30% of the market share of the leading Swiss watch brands

- Waiting lists: The waiting list for a Rolex watch is typically between 1 to 2 years. However, it’s as long as five years for a Daytona

- robust secondary market: Finally, the existence of a robust secondary market is strong evidence that the demand for Rolex watches is on the rise

So, yes, it’s fair to conclude that demand for Rolex watches is high and it’s not going anywhere.

2. Secondary market

Rolex has a robust secondary market for several reasons. Perhaps one of the most significant is that the watches are built to last, and they have earned significant public trust. However, it’s important to think about the long wait times involved in actually getting your hands on one of these watches.

The thing is that the retail price of a Rolex doens’t really matter if the waiting list is extremely long. As such, this creates a secondary market where watches appreciate quickly by virtue of access. In short, collectors are prepared to pay a premium on retail prices to get specific models because they can’t walk into a store and buy them. Unless Rolex alters its business model, this trend will continue to push up the prices of its watches.

3. Public sentiment

Like any investment, Rolex watches are subject to consumer sentiment. It’s fair to say that there was something of a Rolex mania between 2021 and 2022. There were a few factors at play here, including Rolex factories stopping production during the pandemic and a sharp rise in public interest in investment.

In a Morgan Stanley note to investors last year, they suggested that the wild demand of 2021-2022 was over and that there was more than enough demand to sate supply.

Other factors we need to consider are the perception of a recession and the rise in interest rates. With rates at around 5%, taking out a loan on any asset that does not appreciate by 5%+ each year is unwise. With swirling doubt about the economy, fewer investors will be prepared to invest in an asset that could lose money and be hard to liquidate.

NEW VS PREOWNED ROLEX AS AN INVESTMENT?

If you’re investing in Rolex watches, is it better to buy new or from the secondary market? The answer is that it depends on a few different factors, not least of which is the model of watch that you buy.

Now, to be clear, this section is not advice about whether you should personally buy a new or preowned Rolex. That’s a personal choice. Instead, this following is purely about buying new or preowned as an investment.

1. The case for new

Perhaps the most compelling case for buying a new Rolex watch is that you can buy it from an authorized dealer (AD) at the manufacturer’s recommended retail price (MRRP). In short, what that means to you as an investor is that you can instantly sell the watch for a profit because there is a limited amount of new Rolex’s dripped into the market each year. However, it’s not as easy as just flipping an asset.

The waiting list for Rolex watches is long. What’s more, you’ll need to give an AD some business to get an opportunity to buy the watch. Add in the fact that not all Rolex’s appreciate at the same rate, and it’s not exactly a slamdunk investment.

2. The case for preowned/secondary market

Buying on the secondary market, on the other hand, means paying a price premium. In effect, you are purchasing the watch from someone who was on the waitlist, and you’re paying them for the privilege.

Now, from an investment standpoint, the price you pay will likely be the current upper end of the market. For example, MRRP could be $10,000, but you buy on the secondary market for $12,500.

3. So, which is better?

There are two ways to look at this. Take our example of the MMRP of $10,000 and the current secondary premium price of $12,500.

Scenario A:

You go on the waitlist and wait for 24 months. You now have an asset that you paid $10,000 for that you can sell for $12,500. However, you need to think about the money you’ve spent with the AD to get on the list. That said, you have a head start here of $2,500.

Scenario B:

In this scenario, you buy from the secondary market for $12,500. However, you enter a different kind of waiting list: the time it takes for your watch to appreciate. Let’s say it increases by 10% each year; well, then it will be worth $15,125 by the end of year two, giving you a profit of $2,625.

In both scenarios, you wait two years to turn a profit of roughly $2,500.

However, in Scenario A, there is no guarantee that you will get the watch you want; you are subject to the mercy of the AD and all the relationship-building that goes into actually getting your hand on the watch.

In Scenario B, you need to think about the opportunity costs of tying up your $12,500 for 2 or more years. Also you also need more capital to realize a similar profit.

As with every investment, the devil is in the details. A lot depends on the particular watch, the appreciation rate, and how long you’re prepared to wait.

THE FACTORS THAT AFFECT THE

APPRECIATION OF A ROLEX WATCH

Before we share our 2024 list of the best Rolex to buy for investment, we should examine the various factors that affect the rising price of particular models and individual watches.

1. Condition

This won’t come as a huge surprise, but the condition of your Rolex has a huge bearing on the price that others wish to pay for it. If you’re investing in Rolex watches from the secondary market, you need to ensure that it both looks and runs well.

However, there are exceptions to this rule in particular cases. A vintage Rolex watch is expected to have a little wear and tear. For example, a vintage Rolex with a Tropical Dial (i.e., a sun-faded dial) is actually considered desirable. This flaw only exists in pre-1980s models, so it adds an element of rarity that collectors love.

2. Original parts

A vintage watch with its original parts is something to look for when you are investing in Rolex watches. Because these watches are meant to be serviced once every ten years, it’s not unusual for parts to be replaced. However, there is a difference between circa-correct and modern parts.

Watches with circa-correct parts, both visible and within the case, are considered to be more desirable by collectors and investors. Indeed, it’s almost impossible to tell the difference between a replacement and a strictly original part, but if a timepiece has all its factory parts, it’s a good sign that the watch has not been tampered with.

3. Model and rarity

Some Rolex models are incredibly rare, which gives them a great deal of appeal to investors and collectors. For example, the Submariner series are pretty exclusive, so they tend to fetch high sums at resale.

4. Reference

Again, specific references of Rolex watches are more desirable than others. The reference describes certain details, such as colors, bezels, hands, and so on. Again, part of this is about rarity, and the other is about aesthetics. In essence, Rolex models have their own eccentricities that are represented by the reference, which can increase their demand and, subsequently, their value.

5. Original box

If you find a Rolex that you want to invest in, but it doesn’t have the original box or papers, it’s not the end of the world. However, if it does still have these original items, it will likely be worth more at resale.

ALTERNATIVE WAYS TO INVEST

IN ROLEX IN 2024

As mentioned above, Rolex is a private company. As such, you can’t invest in Rolex stock. However, there are other ways to make money from the success of the Swiss brand without directly buying and selling their products.

For example, various fractional investment funds with a focus on Rolex watches have emerged in recent years. Through these organizations, you can buy shares in watches managed by a fund manager. While these financial products are interesting, thorough research and vetting are recommended.

Will Rolex hold its value in 2024?

Rolex watches as a long term investment

If you own a Rolex watch that’s in good condition, its value can only go one way – up. The limited batch sizes that these watches are produced in means that they are rare. Over time, rarity will translate into value. It doesn’t matter what luxury good you’re selling, as a rule of thumb if it’s old, rare, and in good condition, you’ll get a great price for it. Here’s a story that exemplifies this point.

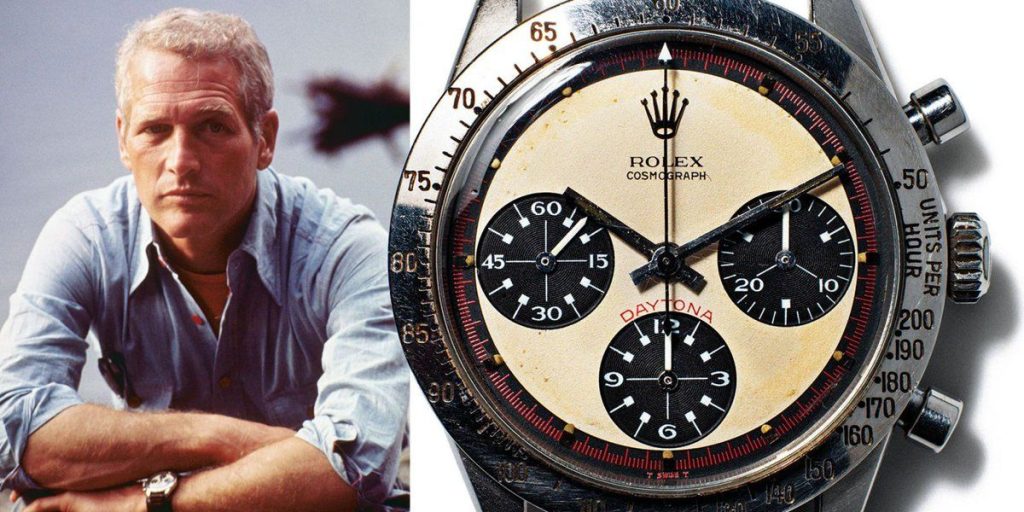

In the 1970s, a US Air Force veteran stationed in Thailand spent a month’s salary ($345) on a new Rolex Daytona that he intended to use for scuba diving. Once the watch arrived, he saw how nice it was, and didn’t feel comfortable wearing it, so he left it in its box with all of its documentation for decades. In 2020, he took it to be valued, over 40 years after he originally bought it. As it turned out, his watch was the exact model that was made famous by Paul Newman and would be worth at least $200,000 at auction.

However, this Rolex investment watch was in near pristine condition, having never been worn, and still had all of its original papers. This bumped the price up to the $700,000 mark. Now, we’re not saying that by investing in it, your Rolex watches will eventually be worth that amount one day. If you’re anything like us, you like to wear your Rolex watches instead of letting them sit around unused, which does have a negative impact on the eventual investment sale price. Additionally, many Rolex owners don’t keep all of the relevant paperwork, which can decrease the investment value further still.

However, even if the seller mentioned above hadn’t kept his watch pristine and kept all of the papers, he still would’ve bagged a cool $200,000 for his small investment in his Rolex. That’s a pretty good return on investment considering that he paid just $345 for it. You need to keep this in mind if you’re thinking about selling your Rolex watches now. Sure, you may bag a profit by selling your Rolex now, but in reality, you’ll make far more money on your Rolex in the long run if you sit on that investment for decades.

If you’re still tempted by the booming market, regardless of the potential long term gains, there is another way to unlock the value of your Rolex watches in the short term, while keeping hold of them for the long term investment. Pawning your fine watch allows you to access the full cash value of it, while not losing the asset outright.

Selling in the short term is a mistake

With this in mind, selling up your Rolex in the short term is not a good idea, despite what others may tell you. Usually, the rationale for selling up quickly goes like this. Rolex watches appreciate in value instantly after they are first bought, so it makes sense to release your investment quickly for a small profit. Then you can reinvest your capital and do the same thing again. This is not an idea without merit, and there are people who make a living doing exactly this. However, you need to sell many Rolex watches over and over again to see any significant profits on your investment.

On the other hand, if you own just one or two Rolex watches and sell them almost instantly, you’re throwing away investments that will have significant earning power in the future. A Rolex watch that will bag you a few hundred pounds in profit today will get you thousands more in 10, 20, or 30 years.

Our point is this – unless you’re going to become a fine watch dealer (and more power to you if you do) – don’t sell your Rolex watches in the short term. I guarantee someone will eagerly take it off your hands as in invetment, and that’s because it will become incredibly valuable in the future. By doing this, you’re only selling yourself short.

So, which Rolex appreciates its value

the most in 2024?

Many of the Rolex models featured in this blog will hold or increase in value – that’s one of the joys of investing in a time-honored brand like Rolex, with proven investment appeal. If you’re puzzling over which Rolex to buy for investment in 2024, there are a couple of perhaps surprising new considerations.

Firstly, it is tempting to steer towards investing in the newest Rolex models. Indications point towards a shift in interest and a re-emergence of potential for older Rolex models, who seem to hold their value best at the time of this writing. A great example of this is the DateJust, a classic of the Rolex brand – and what many Rolex enthusiasts consider as the symbol of Rolex styling.

The Datejust has been continuously available since its inception, and so it exists in a number of forms, giving vast potential and appeal for collectors and Rolex investments. This availability means lower prices, which heightens appeal in the pre-owned market, and the DateJust is a great entry point for anyone new to collecting or seeking that classic Rolex look.

Another established model that’s experiencing a new lease of life is the Oyster Perpetual, another Rolex watch that tends to appreciate its value time and time again. One of the oldest names in the Rolex catalog, this beauty is often overlooked when thinking about what Rolex is the best investment, however, changes to the model in 2020 created enough buzz to steal some of the spotlight from the Submariner.

A new movement, bright dial colours, and a new lease of life have combined to make the Oyster Perpetual one of the liveliest names of 2020/2021, and one of the best Rolex watches to buy for investment in 2024. As ever, this renewed interest is creating a stir around discontinued models too, such as the Oyster Perpetual 39 114300 which is already seeing a strong increase in open market value and a new aspect to the question “how much is my Rolex worth?”

Sources:

https://www.marketplace.org/2020/10/05/pandemic-giving-luxury-watch-market-its-moment/

https://www.bobswatches.com/rolex-blog/buying-guides/pre-owned-rolex-watches-investments.html

https://www.worthy.com/blog/knowledge-center/watches/best-rolex-for-investment/

What Rolex is the best investment?

The Rolex back catalogue is full of classic pieces – many of which simply aren’t made anymore. So what Rolex is the best investment? Do Rolex watches lose value? What Rolex holds its value the best in 2024? Why do Rolex watches hold value? And, which Rolex appreciates in value the most?

These are just some of the many questions we receive on Rolex watches; below, we include some of the Rolexes with an ageless value with the hope to answer these questions.

1. Rolex Milgauss

The Milgauss was developed for doctors, engineers and scientists working in electromagnetic environments. The Milgauss is the only Rolex to feature tinted crystal and its orange lightning bolt secondhand is a unique feature. The Milglauss has a Faraday cage of soft iron construction.

The Milgauss has evolved only slightly in size and shape since its launch in the mid-1950s and it is still used in scientific research and by healthcare professionals working with X-rays. Definitely one of the Rolexes that both hold their value, and appreciate their value best on a consistent basis.

2. Rolex sports watches

Professional Rolex sports watches are among the most popular and also the most historically important timepieces. Vintage sport Rolex watches have proven to be some of the models that are the best for investment purposes.

Originally built for professional athletes to monitor their performances, sports watches have become a style icon in the modern era. The most popular Rolex sports watches are the Submariner, Daytona, Sea-Dweller, GMT-Master (II), the Yacht-Master and the Sky-dweller, and are some of the best Rolexes to buy in 2024.

3. The Daytona

To many, the Datejust is the quintessential Rolex piece. First launched in 1945, the Datejust continues to be a mainstay of the Rolex catalog. With its simple dial displaying time and date, circular Oyster case, and robust self-winding movement, the Perpetual Datejust is a luxury watch that can be worn just about all of the time in any environment.

Rolex has a history of sponsoring great sporting events, and its partnership with the famous Daytona Road Beach Course culminated in the release of the Rolex Daytona in 1963. As official timekeepers, the watch was designed to be worn by racing drivers, with features to match.

The Daytona is a strongly built watch, waterproof, and capable of resisting the g-forces drivers experience when racing at high speed. It’s also capable of measuring speeds of up to 400 kilometers per hour, with three sub-dials within the face for measuring seconds, minutes, and hours. These features command a “Yes” to many of the questions we have started with this article: “Which Rolex appreciates the most?”, “Which Rolex to buy for investment?”, “Do Rolex lose value?”, “What Rolex holds its value the best?”, and probably more.

Since its origins, three distinct generations of the Daytona Rolex have existed. The first came with what’s known as an ‘exotic’ variant dial, while the second series in 1988 included a self-winding movement produced out-of-house. The third and current generation of the Daytona brought that manufacture back in-house, alongside the addition of the popular tachymetric scale and elapsed time displays. While each model is slightly different, overall the Daytona continues to be a distinctive and highly recognizable model across its long lifespan.

Although there are vagaries in the market when it comes to Rolex sales (as there are with any market), usually sports watches tend to do better at auction than Rolex models with a lower technical spec. Obviously the fewer watches of a particular model which were created, the bigger the rarity value and the better that Rolex watches hold and appreciate in value.

It is little surprise that a Daytona Rolex, possibly the only one of its kind, sold for CHF 5,937,000 in 2021. That particular example, called “The Unicorn”, is thought to be the only Rolex Daytona made of white gold, rather than the more common versions made of stainless steel or yellow gold.

Other examples of Daytonas that have an impressive Rolex resale value include: “The Golden Pagoda” (resold for CHF 948,500); “The Bumblebee” (resold for CHF 516,500); and “The Oyster Sotto” (resold for CHF 1,662,500).

Rarer Rolexes will already have an impressive pedigree that will be shared with potential investors prior to an auction. If you have the necessary capital to purchase a Daytona in the first instance, it is highly likely that you will end up with one of the best Rolex to buy as investment material; we have hopefully made a bit of light into the “Which Rolex to buy for investment” question we have started this article with.

4. The GMT Master and GMT Master II

Rolex has a history of designing watches to suit the needs of certain types of people – the Submariner for divers, the Daytona for racing drivers, and the Yacht-Master for sailors. The GMT-Master was designed with pilots and navigators in mind, in conjunction with Pan Am Airways.

One of the most famous features of the GMT-Master is its ability to display two alternate time-zones at the same time, allowing for much easier cross-continental travel. The face has also been designed to be as easy to read as possible, when working in dimly lit cockpits and cabins.

Originally launched way back in 1954, the GMT Master was developed in conjunction with Pan American airlines. It was distributed to crew on long-haul flights, enabling them to easily and quickly set their watch to a fresh time zone as they entered one. Early GMT Masters featured red and blue bakelite on the face, earning the watch the appellation “the Pepsi watch”.

The GMT Master II was launched in the early 1980s. In contrast to the GMT Master, it had an added mechanical feature that enabled the hour hand to be adjusted to the new time zone without the need for minutes and seconds to be also reset.

While the original version of the GMT Master was available in pure stainless steel and designed as a hard-wearing work watch, Rolex has since vastly expanded its range to include steel, gold and precious stone-studded variations of this classic design. The launch of the 50th-anniversary edition in 2005 brought additional technical alterations to bring this distinctive design to the modern-day – such as the use of ceramic on the bezel – which has now been carried over into other present-day designs as of 2007.

Both the GMT Master and GMT Master II are one of the best Rolex for investment if you wondered “which Rolex to buy for investment”, “which Rolex appreciates the most” or “what Rolex holds its value the best”, not least because they are extremely functional and hardwearing watches, as well as bearing the prestigious Rolex branding.

Although it’s possible to pick up a GMT Master for just a few thousand pounds, rarer models can sell for tens or even hundreds of thousands of pounds. Models which feature custom engraving or similar individual touches are likely to fetch a higher price, due to their rarity.

5. The Rolex Sea Dweller (Ref: 16660)

The Rolex Sea Dweller was first introduced in 1967, becoming one of the first watches designed for divers which became available for civilian use. Over the years, a variety of Sea Dweller incarnations were introduced. In each case, the watch benefited from technological improvements or other enhancements making it worthy of being included on our list of Best Rolex to buy as an investment in 2024.

While the Sea Dweller only became part of Rolex’s signature range in 1971, the watch was actually fully developed and ready for release in 1967. This four-year delay was rumored to be down to obtaining the patent for the helium escape valve.

Invented by US Navy diver Robert A. Barth, this valve has long been part of the charm and functionality of the Sea Dweller model, which at its launch was awarded to pioneering deep-sea explorers like Robert Palmer Bradley, the pilot of the famous Deepstar 4000.

The Ref: 16660 model was launched in 1978. Capable of continuing to work accurately to a depth of 4000 feet (1220m), this model featured an enhanced helium escape valve and a sapphire crystal. Because fewer of these models were sold than some of the other models, the Rolex resale value of this model is enhanced due to the rarity of this timepiece.

Arguably one of the best Rolex to buy for investment in 2024, and one of our favorite Rolex to pawn against, prices for the Sea Dweller have been gradually rising as time has gone on, ensuring that this Rolex both held its value and increased in value too. Today, a Ref: 16660 Sea Dweller is likely to command a price of between six to nine thousand pounds, depending on condition…one of the best watch investments under 10000.

6. The Rolex Submariner

A popular choice for amateur and recreational divers, the Submariner was initially launched in 1954. A successor to The Oyster – the first Rolex that benefited from a case that was hermetically sealed – the Submariner’s major selling point is its ability to withstand compression and decompression during a dive. Although the earlier versions can’t be used for deeper dives in the same way as the Sea Dweller, by 1957 the Submariner was guaranteed to depths of 200m.

Widely recognized as a staple classic in any collection, the Submariner is part of the wider Oyster Perpetual line, and another Yes answer to questions like “what Rolex to invest in 2024”, “which Rolex model to buy”, “which Rolex should I get”, “what Rolex to buy”, and many more.

In the very early days of this particular model, the Submariner didn’t come equipped with the new highly distinctive Mercedes or Cathedral hands for which it is known.

Instead, more generic design elements were used, such as pencil hands, and the Submariner name was not featured on the dial. While cosmetic changes have been made over the generations, this watch continues to hold that same pedigree and value to collectors and luxury watch fans alike.

Benefiting from the enviable construction which is one of the hallmarks of a Rolex, the Submariner was popularised as James Bond’s watch of choice, appearing in films that included “Dr No” and “Live and let Die”. Rolex has a strong history with diving and waterproof watches. A specially made Rolex “DeepSea” was attached to the side of the underwater exploration vehicle Trieste during its historical exploration of the Mariana Trench. It kept perfect time on the 11,000 metre dive and the journey back to the surface.

Typical resale prices are anything from £6000 to £10000 +: much more if the watch has rarity value…another candidate for the “best watch investment under 10000” award.

7. Rolex Day-Date

When it comes to the question, “Which Rolex holds its value best?”, the Day-Date is a firm contender. First appearing in 1956, the major difference between it and other models available at the time was a day display in addition to the date. Like other Rolex models, the Day Date is waterproof and self-winding. As time has gone on, the watch has become available in a selection of different finishes and metals.

The most recent version of the Day-Date, the Day-Date 40, was released in 2013. Holding fourteen patents and showcasing arguably the best time-piece technology you will find on the planet, the Day-Date 40 certainly isn’t cheap. That said, although the initial outlay is high, this will almost certainly hold and appreciate noticeably in value as time goes by.

Often referred to as the ‘President Watch’, the Day-Date isn’t a Rolex for the wallflower. Created from precious materials such as gold, rose gold and platinum, it’s well-known as a symbol of power in society, politics, economics, and more. The Day-Dates of the 70s and 80s are particularly sought-after, thanks to the unique and highly collectible Stella dial available in a range of distinctive enamel shades – orange, turquoise, pink and yellow to name but a few.

With many models also including those distinctive diamond index markets, the Day-Date is the epitome of luxury in timepiece form.

8. The Yacht-Master

The Yacht-Master Rolex is primarily, as the name suggests, intended for use by mariners. Benefiting from having the only chronograph which operates with a mechanical memory, the Yacht-Master incorporates some of Rolex’s finest technology. Waterproof and extremely robust, the Yacht-Master was specifically designed for use during regattas and other sailing competitions.

Originally launched in 1992, the aim of the watch is to provide an exceptional tool for sailors. Both the Yacht-Master II and the Yacht-Master 40 are likely to appreciate as time goes on. The current price for a Yacht-Master II is anywhere between £10,000 and £25,000, depending on the metals used in it.

At the time of launch, the Yacht-Master was rumored to be the next evolution of the incredibly popular Submariner model. But whether these rumors weren’t strictly true, or the watch was just too different, is a secret lost to time. The modern Yacht-Master has a highly distinctive appearance and continues to be a distinctive model in the range thanks to the flexibility of its design.

As the only current Oyster Professional model to be available in three different sizes, a tailored experience is clearly a major focus with this elegant and luxurious timepiece, making it one of the best Rolexes to buy for investment in 2024.

The Yacht-Master is a consistent favourite among Rolex lovers because of its striking design, its reliability, and its usability. The face has been designed to be easily read, even in strong storms and adverse weather conditions, making it an excellent choice for an “everyday Rolex”.

9. The Air King

As the name suggests, the Air King was developed along with the GMT Master as a watch for flyers. First released in 1945, it was widely used by air force pilots and other aviators. It is the last of the “Air” series to remain in production. Other “Air” models included the “Air Tiger” and the “Air Giant”. Available in a range of different metals and designs, price is largely dictated by how rare the watch might be and the type of materials used to make it.

The characteristic shape and style of the Air-King are what sets it apart from other Rolexes. While still maintaining those classic 1950s-style sensibilities, the Air-King’s middle case is created from corrosion-resistant and solid Oystersteel. This, combined with a hermetically screwed-down case, plus waterproofing features, makes the Air-King just as practical as it is distinctive, while this model has experienced internal updates and changes.

The rarest Air King watch is the highly prized “double red dial” version. Prices vary enormously, but commonly found Air Kings are like to fetch somewhere around £5000 to £10000, which include this Rolex model on our list of “best watch investment under 10000”.

10. Rolex Explorer

It is hard to decide which Rolex is the best investment in 2024, but the Rolex Explorer is clearly a contender. Designed as a watch for explorers, adventurers and those working in tough environments, the Explorer and Explorer II are rugged watches that are built to last! Features include luminous hands and numbers, allowing night viewing, as well as a stunning construction from Rolex’s 904L steel – a steel specifically designed and manufactured for Rolex watches.

First launched in 1953, during the height of explorations and mountaineering, the Explorer is an adventurer’s watch with a difference. Designed to be instantly legible even in pitch-black environments, the Explorer, and its sibling the Explorer II, have become fast favorites thanks to their hardiness and famous following – both on and off-screen. Don Draper from Mad Men often sported the Explorer II, while James Bond was described as wearing an ‘Oyster Perpetual’ in the novels that were very close in description to the popular Explorer timepiece.

With prices for a used model starting at around £3000, this is one of Rolex’s more modest watches, but one which also has a good chance of appreciating value over time. A good answer to many of the questions we often hear online, like “which Rolex is the best investment”, “what Rolex to invest in”, “which Rolex model to buy”, “which Rolex should I get” or “what is best watch investment under 10000?”.

If you are considering which Rolex to buy for investment in 2024, it’s important to do research on the various options within each model, in order to be clear on what the guide price is and what the potential is for appreciation. Clearly, past performance can’t be an indicator of future price, but it may be helpful to find out how the watch has performed at previous auctions before deciding whether to purchase it for yourself.

Although Rolex watches can make excellent investments, this is by no means always the case. Remember to check the condition of the watch, its rarity, and its authenticity before paying up for it. Fake Rolexes are common, so make sure you have some assurance of the watch’s authenticity before parting with your hard-earned cash to buy it.

It’s also important to buy a watch that you like, even if it’s not the most expensive. That way, you will be happy to hang on to it and cherish it until such time as the market is appropriate for sale. If you want the combination of a top-quality timepiece that is also likely to make you a return on your investment over time, a Rolex could be the perfect solution either for buying or as investment.

Will Rolex prices go down, when, why, and by how much?

The saying “what goes up must come down” applies to most things in life. But rarely to Rolex.

A Rolex watch holds its value over time more consistently than other brands. Rolex is the ultimate in exclusivity. Rolex is a prohibitively expensive investment for many which only serves to enhance the desirability and value of the brand.

To maximize your Rolex investment, it is essential to protect your watch from unnecessary wear and tear and from damage. And some Rolex watches stand a greater chance of increasing in value than others.

1. Protect your investment – maintain a flawless Rolex

When buying a Rolex for investment, it is essential that the piece is kept in excellent condition.

Rolex watches are made of premium hard-wearing materials. The materials that make a Rolex, like Oystersteel, 18 ct gold, crystal, and platinum 950 are designed to last.

But the condition of a pre-owned watch is a key factor in which Rolex to buy for investment, and ultimately which Rolex appreciates the most its value. An unused watch will likely sell for more than a used watch.

Visible wear and tear will take some value off the piece though sometimes a little aging can only add to its appeal, especially if there is a story behind it.

The battle scars of the timepiece worn by a military commander long ago, the wartime pilot, or the 1950s racing driver tell the tale of how Rolex has been at the forefront of human endeavor since the watchmaker was first established in the Edwardian era.

A Rolex with a little wear has patina, and character, and demonstrates that the watch was used just as it was intended. A few minor scratches on a pre-owned Rolex hint at a story that only the watch can tell, and often explain why Rolex watches are worth the price.

The glass on a luxury watch is the area most likely to become damaged. Can Rolex glass scratch? Well, yes, of course, it can. Rolex faces are protected by sapphire crystal glass which is extremely hard-wearing but can shatter under extreme stress. Expert restorers can erase minor scratches or replace the glass. Of course, Rolex watches are built for performance as well as manufactured for style and they most often outlast the arm on which they have been worn.

Rolex gold, platinum, precious stones, and 904L stainless steel do not scratch with day-to-day use. All Rolex wristwatches, with the exception of the Cellini line, are water-resistant to at least 100 meters or 300 feet.

The ceramic bezels used in Rolex lines are impervious to scratches and do not fade in sunlight. Rolex bracelets are designed to keep the watch securely on your wrist and handle the purpose for which they were made.

And of course, Rolex watches are designed to be worn and to be enjoyed. Nothing says prestige like a Rolex watch adorning one’s wrist.

2. When and how often to service Rolex watches

Servicing is the best way to maintain the appearance and functionality of a Rolex watch, and a great way to both hold and appreciate its value over time. Rolex recommends that watches be serviced at least every 10 years. But the frequency should be increased depending on the model, its age, and its real-life usage.

Most Rolex models – especially modern-day models – can be restored back to factory finish by an authorized, trained, and experienced Rolex watchmaker.

During a routine Rolex service, parts including the bezel, crystal, crown, crown tube, and case back are removed, examined, cleaned, and repaired as necessary. Any deep dings or scratches on the watch will most likely be left, but true craftsmen will remove the daily wear surface scratches during regularly scheduled services.

Some Rolex wearers want to keep their scratches of course in order to recount their tales to future generations, but also this often helps to hold and even appreciate the value of their Rolex, as explained in a previous section of this article. Rolex and any approved watchmaker will honor a no-polishing / no-finish restoration at the owner’s request.

There are a number of different variables which can help to determine which watch is going to offer the highest Rolex resale value, which Rolex holds its value best, and which Rolex model goes up in value.

Generally, exclusivity is critical to value: the fewer of a particular model that is produced, the greater the price of the Rolex will appreciate in value. A Rolex which has been custom-built for a celebrity, for example, will have a significantly enhanced resale value compared with one that’s part of a larger batch.

Usually, the closer to a release date a Rolex has been made, the more in-demand it is likely to be. Condition, age, and technical specification also play a role in Rolexes holding their value, as well as the initial price paid. Fortunately, almost any Rolex can appreciate in value given time. Usually, the best Rolex to buy as an investment is one that has a range of innovative and exclusive features that was created as a unique watch, or as part of a small number of similar watches and which is in as near perfect condition as possible.

In conclusion…are Rolex watches a good investment in 2024?

It is important to do your research before considering which Rolex to buy for investment. Like any investment, there may be a risk. Markets move. But less so for Rolex than almost any other brand on the planet – particularly in the world of horology.

An expert jeweler or luxury timepiece specialist is the best place to view, learn about, and buy Rolex watches.

Rolex watches are investments. The value of many Rolex watches has significantly increased over time. Buying the right Rolex watch can prove to be a wise investment – you will wear, enjoy, and ultimately sell it for more than it was bought for.

One simply can’t deny – or indeed put a price on – the absolute sense of confidence, reliability, and dignity that the brand name Rolex communicates. For that reason alone, this most prestigious of timepiece brands will endure for centuries to come.

Pawn your Rolex

If you are ever in need of pawning your luxury watch, do get in touch with the pawn shop team at New Bond Street Pawnbrokers in Central London for a free, no-obligation assessment! Some of the many watch brands we loan against include: A. Lange & Sohne, Breguet, Breitling, Bulgari, Cartier, Chopard, Harry Winston, Hublot, IWC, Jaeger LeCoultre, Omega, Panerai, Piaget, Richard Mille, Roger Dubuis, Tiffany, Ulysse Nardin, Urwerk, Vacheron Constantin, Van Cleef & Arpels, Audemars Piguet, Graff, Patek Philippe, and Rolex

This post is also available in:

Français (French)

Deutsch (German)

Italiano (Italian)

Português (Portuguese (Portugal))

Español (Spanish)

Български (Bulgarian)

简体中文 (Chinese (Simplified))

繁體中文 (Chinese (Traditional))

hrvatski (Croatian)

Čeština (Czech)

Dansk (Danish)

Nederlands (Dutch)

हिन्दी (Hindi)

Magyar (Hungarian)

Latviešu (Latvian)

polski (Polish)

Português (Portuguese (Brazil))

Română (Romanian)

Русский (Russian)

Slovenčina (Slovak)

Slovenščina (Slovenian)

Svenska (Swedish)

Türkçe (Turkish)

Українська (Ukrainian)

Albanian

Հայերեն (Armenian)

Eesti (Estonian)

Suomi (Finnish)

Ελληνικά (Greek)

Íslenska (Icelandic)

Indonesia (Indonesian)

日本語 (Japanese)

한국어 (Korean)

Lietuvių (Lithuanian)

Norsk bokmål (Norwegian Bokmål)

српски (Serbian)

Tamil

Be the first to add a comment!