I hope you enjoy this blog post.

If you want us to appraise your luxury watch, painting, classic car or jewellery for a loan, click here.

The History of Pawnbroking and Collateral Loans

The history of pawnbroking and collateral loans spans a period of more than 3,000 years, with the first pawn shops set up in China to provide access to short-term credit for low paid workers and peasants. Pawn shops were also a familiar sight to citizens in ancient Greece and the Roman Empire; indeed the word pawn is derived from the Latin word “patinum” which means to pledge. Throughout the centuries anybody with a need for fast cash and valuables to act as security has been able to access pawnbroker services to exchange their items of value for cash loan advances, with chargeable interest rates added. Just like today, if clients failed to repay their loans, plus interest, the pawnbroker retained the goods to sell on or auction to another buyer.

Collateral lending – or pawnbroking – is one of the world’s oldest professions, and has been around in some form or another for centuries. From 5th Century China to the modern day, people have been using items as collateral for a loan for centuries. People with items of value to be used for collateral have been able to secure loans against items at their monetary value for centuries. At New Bond Street Pawnbrokers, we are a modern pawn shop based in Mayfair, London, but we make a point of knowing our history. Here is the full history of collateral lending, from the early days all the way up to the present day.

Chinese origins

The world’s first pawnbrokers appeared in Chinese Buddhist monasteries during the 5th Century, owned and operated by monks. Sometimes, these business ventures were set up by wealthy private individuals as a joint venture with monasteries, as monasteries were sometimes exempt from taxes. While these are the earliest recorded examples of pawn shops, it is quite possible that pawnbroking existed in some form or another long before this time.

Pawnbroking in Europe

Pawnbroking reached Europe when the Roman Empire was at the height of its powers. The influence of the Empire on modern day pawnbroking cannot be understated; many of the modern-day laws governing the pawnbroking industry have their roots in ancient Roman laws. That is not to say that the Romans’ laws have been copied verbatim, however. In the Roman Empire there were strict rules on what you could and could not take to a pawnbroker to use as collateral against a loan, that were written into the law. Clothing, furniture and farming equipment were not permitted to be used as collateral. This rule does not apply to the modern pawnbroker, and – indeed – antique furniture tends to be a common choice for people pledging an item to a pawnbroker.

Pawnbroking and religion

In the earliest days of pawnbroking, Jews and Christians were forbidden to lend money and profit from interest repayments. Under Judaism, charging interest on loans is classified as one of the worst sins in the Old Testament Book of Ezekiel. However, the Torah and Talmud both encourage the lending of money and goods to other Jews, just so long as there is no interest charged. Interest-bearing loans by Jews to people who are not Jewish was not forbidden, however. Christians were also forbidden to provide interest-bearing loans and cash advances until the time of the Protestant Reformation, although there were many instances where this biblical prohibition was ignored. Indeed, the Franciscan church was permitted to practise usury in order to give aid to the poor.

Pawnbroking in the Medieval Era

In its original form, “monts de piete” was a form of basic pawnbroking set up by the Roman Popes to lend money to the poor and these loans would not bear any interest and would be covered by the value of pledges, such as clothing or equipment. Obviously, the original establishments cost money to operate and did not make any profit, so it became more common to charge interest on the loans to cover expenses and operational costs. From its humble roots in Italy, the pawn shop charging interest for loans began to spread throughout Europe. By the year 1622 pawn shops were established in Ghent, Amsterdam and Brussels and most major European cities soon followed this trend.

Medieval Italy

The development of collateral lending as we know it today was vastly accelerated in Medieval Italy, where the merchants of the Lombardy region – many of them linked to the wealthy Medici family – helped to spread the practice across Europe. The Lombard merchants are also credited with the creation of the pawnbroking symbol of three golden balls – originally three golden coins – which was hung outside their shops. Today it has evolved into the globally recognised sign of the pawnbroker.

At this time the practice was controversial, but in the 16th Century, Pope Leo X declared that pawnbroking be a legally recognised profession across the entirety of Catholic Europe, and that anyone questioning the legality or morality of it was liable to be excommunicated. This ruling ensured that the practice of pawnbroking became entrenched in the fabric of European financial life for years to come.

The Lombards

The origins of Lombard banking also derive from the original “monts de piete” pawn shop brokers and began in the wealthy Lombardy region of Italy. Pawnbrokers became known as Lombards throughout mainland Europe and the UK and it’s still possible to find Lombard Streets and Lombard Alleys in major cities around the globe, signifying they were once the location for prominent pawn shops. Lombard credit practices are still pertinent today and most major banks will lend against marketable securities using their secured loan procedures. The three golden balls which symbolise pawnbrokers were originally a symbol of the Lombard pawn banks and the Medici family of Florence, but they have now become synonymous with pawnbrokers around the world.

Medieval Britain

The concept of collateral lending arrived in Britain during the Norman invasion of 1066, but it was not until the Lombard merchants arrived later on that the popularity of the practice grew. The Lombard merchants had some high profile clients during Medieval times, including Edward III and Henry V, who both pawned royal artefacts in order to fund their wars with France. The Lombard merchants faced much suspicion from the ruling classes and common folk alike, but their popularity grew and grew throughout this time to the point where they became an established part of London’s financial sector. Indeed, the merchants left such an impact on the City of London that a street was named after them; Lombard Street.

In the UK, pawnbrokers needed to become licensed from the year 1785 and onwards. A pawnbroker’s licence cost £10 in the London area, and £5 in the provinces, with an allowable fixed interest rate of 0.5% monthly and a maximum loan term of a year. The legislation worked well for 75 years, subject to a few amendments to terms and conditions, but was overturned by the Pawnbroker’s Licence Law of 1872, which bought in many of the laws which still govern pawnbroking today.

Present day

In the present day, collateral loans are a widely accepted method that people use to unlock the monetary value of their valuables like fine art or watches. In cities across almost every country in Europe and the Western world, the sign of the pawnbroker is visible on the high street, and signifies a place where customers can get collateral loans against their valuables.

The role in history of pawnbroking to the rich and famous

There are many stories of pawnbroking in history. King Edward III of England regularly used pawnbrokers to finance his rule, famously pawning his jewels in the year 1388 to finance war against France. It is also said that Queen Isabella of Spain pawned her jewellery to fund Christopher Columbus on his expeditions to the New World. Charles I of England set up his own Lombard banking enterprise to fund his war against Oliver Cromwell, while Cromwell dissolved all pawn shop establishments when he became Lord Protector of England. Article 27 of the Royal Charter establishing the Bank of England in 1694 clearly describes a banking system based on the principles of pawning.

In our modern era many pawn shops have become the repositories of history, holding diamonds, valuable antiques, precious gems, jewellery and furnishings which have passed down through generations.

Where does the symbol of the pawnbroker come from?

The resurgence of pawnbroking in the past decade means that the distinctive three gold balls – the universal symbol of the pawnbroker – are a common sight on our high streets once more. The symbol, shown above, is intrinsically linked to the Italian region of Lombardy, as is the pawnbroking industry itself.

Indeed, while pawnbroking has been around in some form for over a thousand years, the rise of Lombard banking in the 15th century would bring the pawnbroker to prominence in every major city across Europe. Such was their influence that many European cities still have a street named after the practice – such as Lombard Street located in the City of London.

Why is the symbol three golden spheres?

Lombard bankers in the Italian region of Lombardy and further afield were known to hang the recognisable symbol outside their premises to mark them out to potential clients. A popular theory is that the symbol was initially three golden coins – a direct reference to their trade – but was later changed to spheres in order to make it easier to see.

The influence of the Medici family

Another theory on the creation of the pawnbrokers’ symbol has been attributed to the Medici family. The family’s influence cannot be understated – some argue they were the wealthiest family in Europe at their peak, and used that wealth to buy political influence. A family who made their fortunes from banking, a number of pawnbrokers in Florence contributed to their wealth.

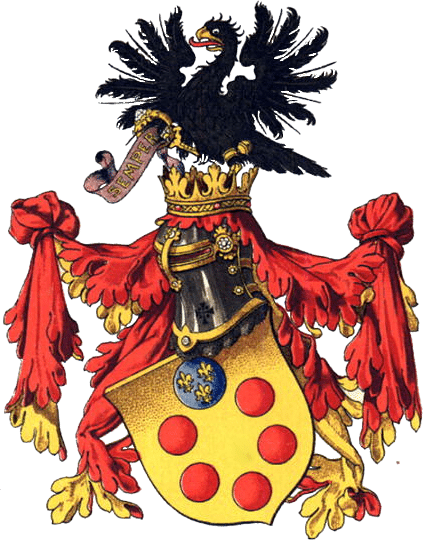

Some claim that the symbol was an adaptation of the crest of House Medici, which contained a number of spheres. The lowest three spheres, which you can see on the crest below, are in the same formation as those in the modern-day pawnbroking symbol.

The argument goes that the influence of the Medicis on banking meant that a portion of their crest became synonymous with the finance industry generally, before becoming associated solely with pawnbroking. It’s a compelling argument, after all House Medici did run the Medici Bank, which for a long time was Europe’s wealthiest and most respected financial institution.

Influential to the modern day

Whatever the truth, the wide-ranging financial influence of the Medici family meant that the symbol used in medieval and Renaissance Italy remains to this day. It’s certainly the case that the symbol’s origins are deeply rooted to the financial history of the wealthy Italian region of Lombardy. Indeed, the region’s affluent history has continued into the modern day – it remains the richest and most populous region of Italy.

Historians have managed to trace the origins of the symbol back to medieval Lombardy, and the Medici family clearly played a large part, but the finer details are more open to discussion. So, basically, the jury’s out.

Modernising the symbol

As with all history, there are different theories as to the origins of the pawnbroking trade. One thing is for certain, though; the industry is currently undergoing a resurgence, and the symbol is evolving along with it.

At New Bond Street Pawnbrokers, we’ve gone for a slightly more minimalist take on the traditional design, clearly advertising that we’re a pawnbroker in a tasteful and discreet way. As the industry evolves, so too does the symbol. Have a look below:

Collateral lending explained

Collateral is an asset that helps a person or business secure a loan against luxury assets like antiques, fine wine, luxury Hermes bags, classic cars, or rare books. When money is borrowed, an agreement is made (often in the fine print) that the lender can take something from the person taking out the loan and sell it in order to recoup their money, if there is a clear failure to make repayments as agreed in the contract. Collateral often increases one’s chances of getting a larger loan, and it also improves one’s chances of approval if getting a loan is proving to be difficult.

A pledge of collateral enables the lender to feel like they are taking less of a risk, and therefore there is likely to be a better rate for the loan. Read on to find out more about collateral lending.

How does collateral lending work?

Collateral is frequently a requirement when the lender needs additional assurance that they won’t lose all their money by granting a loan. If an asset is pledged as collateral, the lender is granted the right to take action if the client fails to keep up with the agreed payments on the loan. The action they take is to seize the asset that was pledged as collateral, sell that asset, and use the proceeds from the sale to pay off the loan in full.

The process generally goes as follows:

1. Choosing an item for collateral

2. Valuation of the assets to be pledged as collateral

3. Loan offer is made based on the valuation

4. Acceptance of loan, whereby a contract is drawn up with all the terms and conditions and collateral is taken into the lender’s care.

5. Loan period, in which you spend the money however you want and follow the repayment schedule agreed in the contract.

6. End of loan period, where your collateral asset will be returned if you have paid off the debt in full. You may want to negotiate a loan extension if necessary.

A collateral loan contrasts with an unsecured loan, in which the only powers a lender will have if you fail to make repayments is against your credit rating and/or bring legal action against you.

First and foremost, lenders will always prefer to recoup their investment when they approve a loan. It is never their desire to force legal proceedings to your doorstep, so they will often try to involve collateral as a safety measure in the event that things go sour. Ideally, they also prefer not to have to go down the route of seizing your collateral – their primary business mechanisms don’t involve the ownership, renting and sale of property – but often that turns out to be the simplest and most convenient asset to protect their investment.

What can be used as collateral?

Any asset that your lender chooses to accept as collateral, and which is permitted by law, can be pledged. As a general rule, lenders will always prefer to accept assets that are simple to value and turn into money if circumstances require it. In this line of thinking, money sitting in a savings account is very appealing as collateral, because its value is definitive and it’s very easy to collect. Some other common forms of collateral include the following:

– Property (including equity in a home)

– Automobiles

– Cash accounts (usually retirement accounts aren’t included in this, but there are exceptions)

– Investments

– Hardware and machinery

– Valuables, collectables and antiques

– Insurance policies

– Future payments from customers, also known as receivables

Even in the case of securing a business loan, an individual might pledge their own personal assets (such as a family home) as part of a personal guarantee with their lender.

Valuation of your assets

Generally, the lender will offer you a loan that is less than the value of the asset you pledge. Some assets might have heavy discounts applied to their value. This is to improve their chances of regaining all of their money in case the asset pledged as collateral declines in value.

When negotiating a loan application, lenders will usually quote an acceptable loan to value (LTV) ratio. This would mean that if you borrow against the value of your house, for example, lenders might specify an LTV up to 80 percent. This would mean that if your property is worth £100,000, you would be able to borrow up to £80,000.

If your pledged assets decline in value, you may have to pledge additional assets to maintain a collateral loan. Similarly, you remain fully liable for the remaining balance of your loan, even if your lender seizes your assets and sells them for an amount smaller than what you owe. The lender can collect any outstanding deficiency by taking legal action, if necessary.

Types of collateral loan

Collateral loans can come from a variety of places. They are used for business loans at least as often as they are used for personal loans. Many new businesses, lacking a proven financial track record, are required to pledge collateral that may include personal assets of the business owners.

Sometimes, you might pledge the thing you buy with a loan as the collateral. This is sometimes the case in premium-financed life insurance cases; the lender and the insurer often collaborate to provide a policy and collateral loan simultaneously.

A home purchased on finance works similarly – the property secures the loan, and the lender can seize the property if the repayment plan fails. There are also some collateral loans designed for people whose credit rating is poor. These loans are often expensive to secure and should be a measure of last resort. They come in many forms and can reap heavy repercussions if you fail to repay.

New Bond Street Pawnbrokers is situated in central Mayfair and provides confidential pawnbroking and collateral loans on a variety of collectables like watches i.e. Rolex, Patek Philippe, Blancpain and others. We help provide financial solutions to our exclusive clientele and have a wealth of experience in providing loans against a range of fine personal assets, such as fine art, precious jewellery and fine wines.

This post is also available in:

Français (French)

Deutsch (German)

Italiano (Italian)

Português (Portuguese (Portugal))

Español (Spanish)

Български (Bulgarian)

简体中文 (Chinese (Simplified))

繁體中文 (Chinese (Traditional))

hrvatski (Croatian)

Čeština (Czech)

Dansk (Danish)

Nederlands (Dutch)

हिन्दी (Hindi)

Magyar (Hungarian)

Latviešu (Latvian)

polski (Polish)

Português (Portuguese (Brazil))

Română (Romanian)

Русский (Russian)

Slovenčina (Slovak)

Slovenščina (Slovenian)

Svenska (Swedish)

Türkçe (Turkish)

Українська (Ukrainian)

Albanian

Հայերեն (Armenian)

Eesti (Estonian)

Suomi (Finnish)

Ελληνικά (Greek)

Íslenska (Icelandic)

Indonesia (Indonesian)

日本語 (Japanese)

한국어 (Korean)

Lietuvių (Lithuanian)

Norsk bokmål (Norwegian Bokmål)

српски (Serbian)

Tamil

Be the first to add a comment!